I. MARKET ANALYSIS OF THE UNDERLYING STOCK MARKET ON NOVEMBER 13, 2025

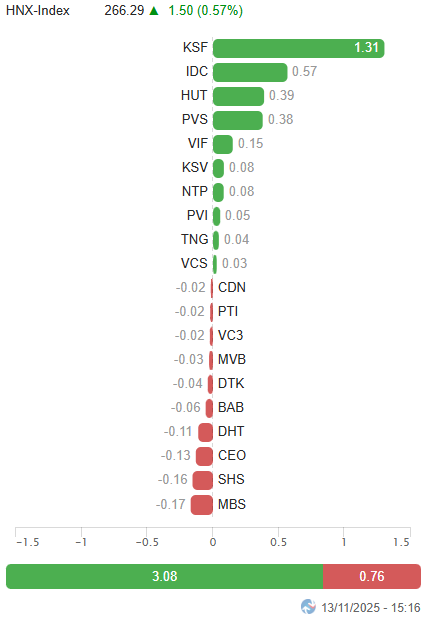

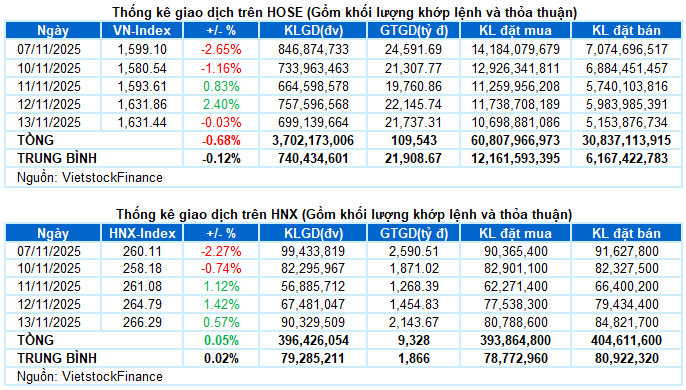

– Key indices showed mixed movements during the November 13 trading session. Specifically, the VN-Index edged down by 0.03%, closing at 1,631.44 points, while the HNX-Index continued its upward trend with a 0.57% increase, reaching 266.29 points.

– Trading volume on the HOSE floor decreased slightly by 7.7%, totaling nearly 630 million units. The HNX floor recorded approximately 71 million matched units, a modest 7.4% increase compared to the previous session.

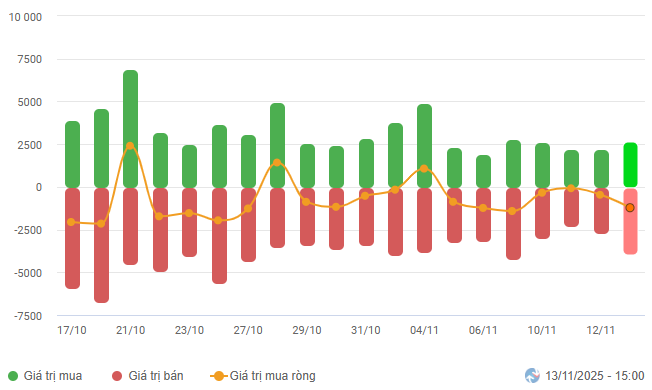

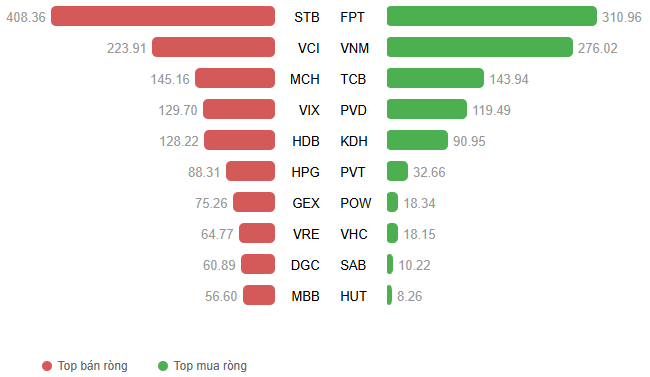

– Foreign investors continued their net selling, with values nearing 972 billion VND on the HOSE and over 34 billion VND on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

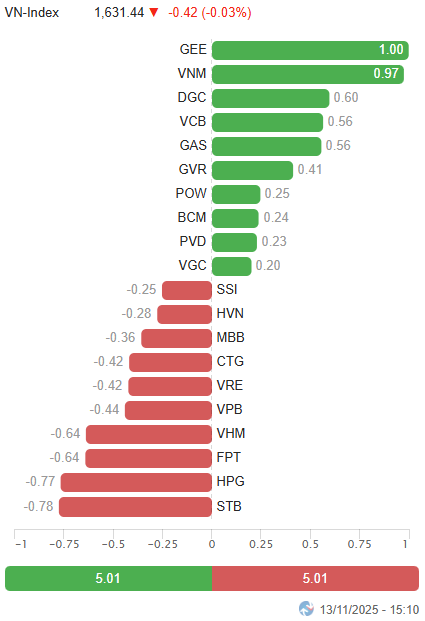

– The market returned to a state of divergence during the November 13 session. The VN-Index primarily fluctuated within a narrow range for most of the trading period. Selling pressure was evident among blue-chip stocks, making it challenging for the index to break through. However, increased buying interest in mid-cap and small-cap stocks, particularly in the energy, chemical, and fertilizer sectors, partially offset the gap created by the weakness in blue-chip stocks, helping the market maintain a relatively balanced trading rhythm. At the close, the VN-Index ended just below the reference level at 1,631.44 points.

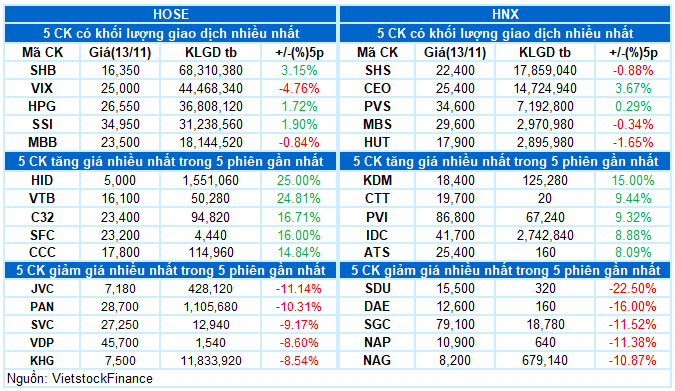

– In terms of influence, the pull and resistance forces were balanced, with the top 10 positively contributing stocks adding 5 points to the VN-Index, while the top 10 negatively impacting stocks subtracted an equivalent number of points. GEE, VNM, and DGC led the positive side, while STB, HPG, and FPT were significant drags on the other end.

Top Stocks Influencing the Index. Unit: Points

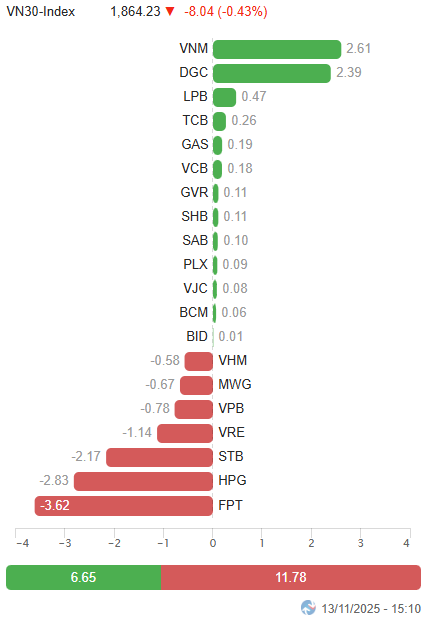

– The VN30-Index declined by 8.04 points (-0.43%), closing at 1,864.23 points. The breadth of the basket was relatively balanced, with 13 gainers, 15 losers, and 2 unchanged stocks. On the positive side, DGC stood out as the most prominent performer, hitting its upper limit right from the opening, followed by VNM with an impressive 3.3% gain. Conversely, STB, VRE, and TPB had a less favorable session, facing adjustment pressures of over 2%.

Sector performance was notably divergent. The energy sector took center stage today, with PVD hitting its ceiling, and PVS (+3.9%), PVT (+5.11%), BSR (+1.58%), PLX (+1.32%), PVC (+4.63%), and OIL (+3.77%) also performing well.

Additionally, chemical and fertilizer stocks within the materials sector attracted significant buying interest, notably DGC reaching its upper limit, CSV (+5.42%), DPM (+1.48%), DCM (+1.17%), GVR (+1.6%), DDV (+1.37%), DPR (+1.99%), and PHR (+1.99%).

Furthermore, the essential consumer and utility sectors recorded gains of over 1%, with standout performers including VNM (+3.34%), MCH (+1.93%), DBC (+2.56%), VHC (+2.8%), ANV (+1.41%); POW (+3.16%), REE (+2.02%), GAS (+1.62%), and GEG (+1.66%).

In contrast, red dominated large-cap sectors such as finance and real estate, posing challenges for the index. Notable decliners with significant trading volumes included STB, VIX, SSI, VCI, SHS, TPB, EIB, CEO, DIG, VRE, TCH, and KHG.

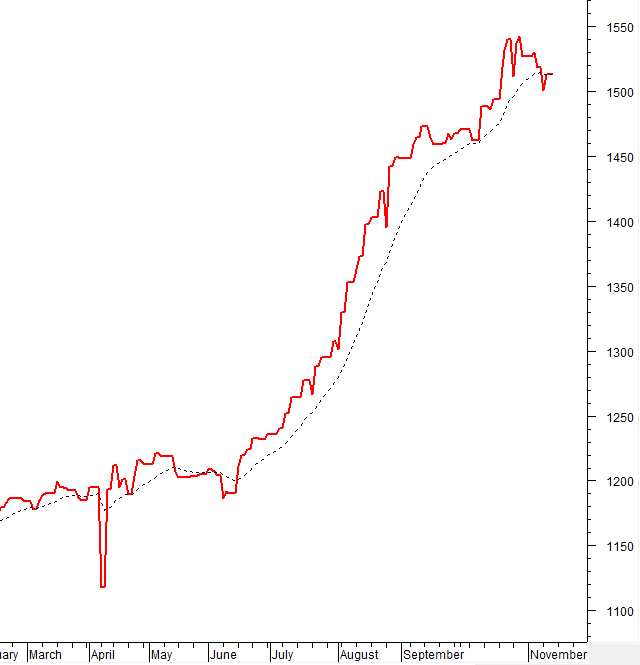

The VN-Index experienced a slight adjustment with a small-bodied candlestick pattern, accompanied by trading volume remaining below the 20-day average, indicating investor hesitation. The Stochastic Oscillator has given a buy signal in the oversold region. If this buy signal continues and exits this region in the upcoming sessions, the short-term outlook will be more positive.

II. TREND AND PRICE VOLATILITY ANALYSIS

VN-Index – Stochastic Oscillator Gives Buy Signal

The VN-Index experienced a slight adjustment with a small-bodied candlestick pattern, accompanied by trading volume remaining below the 20-day average, indicating investor hesitation.

The Stochastic Oscillator has given a buy signal in the oversold region. If this buy signal continues and exits this region in the upcoming sessions, the short-term outlook will be more positive.

The 100-day SMA has held firm during the recent correction and is expected to continue providing support in the near term.

HNX-Index – Breaks Above the Middle Band of Bollinger Bands

The HNX-Index recovered for the third consecutive session, breaking above the Middle Band of the Bollinger Bands.

Currently, the MACD indicator has given a buy signal. If the Stochastic Oscillator also provides a similar signal in the upcoming sessions, the situation will become even more positive.

Cash Flow Analysis

Smart Money Flow: The Negative Volume Index of the VN-Index has crossed below the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) may increase.

Foreign Investor Cash Flow: Foreign investors continued their net selling during the November 13, 2025 trading session. If foreign investors maintain this action in the upcoming sessions, market volatility may emerge.

III. MARKET STATISTICS FOR NOVEMBER 13, 2025

Economic Analysis & Market Strategy Department, Vietstock Consulting Division

– 16:34 November 13, 2025

Newcomer in the Plastics Industry Surges 300% Following 7-Session Limit-Up Streak

In just over a week since its listing, Binh Thuan High-Quality Plastics JSC (UPCoM: BQP) has seen a remarkable streak of consecutive ceiling price increases, surging close to 32,000 VND per share. The company’s recently released explanation confirms that it has taken no actions to manipulate the stock price, and its business operations remain stable.

Dragon Capital: The Paradox of “Hunting Bargains” vs. “Panic Selling” During Market Corrections

Why do we eagerly chase a 50% discount on a shirt, yet panic-sell stocks at a mere 5% drop? Dragon Capital highlights this paradox, challenging our instincts in the face of market fluctuations.

Which Blue-Chip Stocks Are Fueling Positive Market Sentiment?

Amidst recent market turbulence, numerous large-cap stocks have plummeted by 15–25% in just weeks, casting a shadow of caution over investor sentiment. Yet, amidst this volatility, select billion-dollar stocks have demonstrated remarkable resilience, rebounding sooner than the broader market. These stalwarts have emerged as critical pillars of stability, offering a glimmer of hope as markets retreat into sensitive territory.

Stock Market Update November 12: Strategic Investment Opportunities as Stocks Begin to Rally

After a prolonged downturn, Vietnam’s stock market is showing signs of recovery. Investors can now consider strategically allocating funds into promising stocks that are beginning to rebound.