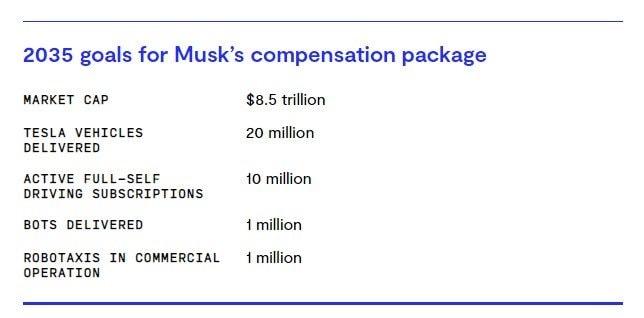

Tesla CEO Elon Musk’s trillion-dollar compensation package, recently approved by shareholders, sets an almost unimaginable goal: the company’s market value must soar to $8.5 trillion, and cumulative vehicle sales must reach 20 million by 2035.

However, amid these ambitious targets, a troubling reality is emerging: Tesla is losing ground in critical growth markets, particularly as Asian competitors rise to prominence.

For instance, in India, Vietnam’s VinFast unexpectedly outpaced Tesla, selling 152 vehicles compared to Tesla’s 109 as of October 2025. VinFast began pre-orders on July 15, 2025, the same day Tesla opened its first showroom in the country.

Warning Signs

Tesla’s sales lag behind VinFast in India isn’t due to consumer preference for Vietnamese over American vehicles, but rather because Tesla has minimal local market presence.

This highlights a broader issue in Tesla’s strategy: the company is falling behind in the world’s fastest-growing markets, from India to Southeast Asia and Latin America, where Chinese competitors and emerging players are rapidly gaining traction.

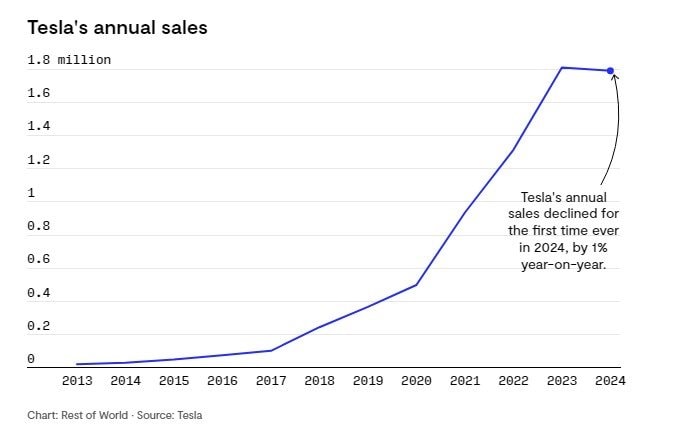

Tesla’s Vehicle Sales (in millions)

India, the world’s third-largest auto market, exemplifies this challenge. Tesla opened its first showroom there only in mid-2025, while VinFast capitalized on its early mover advantage with a market-appropriate sales model.

Losing such early footholds could cost Tesla years to recover, especially as India’s EV race is fueled by policies favoring local production and incentives for new investors.

Meanwhile, Elon Musk needs Tesla to achieve unprecedented growth: selling 20 million vehicles by 2035, which means adding 12 million sales in the next decade—more than the company has sold in its 17-year history.

Yet Tesla’s sales are trending downward. In 2024, the company recorded its first annual sales decline in a decade, followed by its worst revenue drop since 2022.

“These targets are incredibly aggressive, bordering on unrealistic, given Tesla’s global operational challenges and over-reliance on non-U.S. markets,” warns Tu Le, founder and CEO of Sino Auto Insights (Detroit).

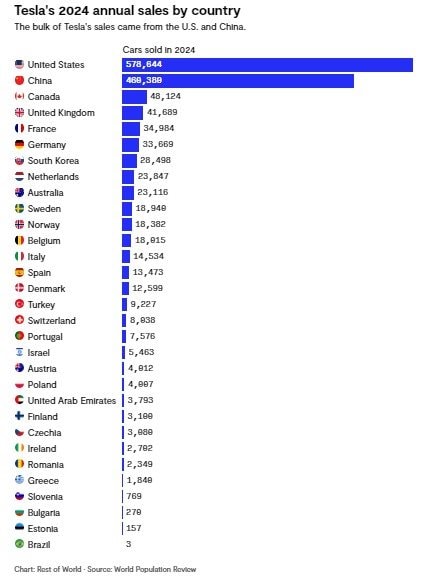

In key battlegrounds like Europe and China, Tesla’s market share continues to erode as competitors like BYD, which sells vehicles in 102 countries—nearly three times Tesla’s reach—gain ground.

Markets where Tesla hasn’t invested in local production become “open territories” for rivals to dominate.

In Thailand, BYD sold nearly 22,000 vehicles in the first five months of 2025, while Tesla remains absent. In Latin America, BYD controls 90% of Brazil’s EV market, with Tesla present only in Chile.

Tesla’s Sales by Market

Consequences of a ‘Capital-Light’ Strategy

The contrast between Tesla and its competitors is stark in their investment strategies. Tesla maintains a “capital-light” model, relying on three gigafactories in California, Shanghai, and Berlin to export globally.

In contrast, Chinese automakers have invested over $143 billion in local supply chains and production across multiple countries, reducing costs, leveraging tax incentives, and connecting with local consumers. The gap in market presence is widening to Tesla’s disadvantage.

“BYD and Chinese brands succeed by localizing production, supply chains, and distribution. Unless Tesla shifts its approach and invests in regional manufacturing, it will struggle to compete in fast-growing emerging markets,” says Bill Russo, CEO of Automobility Limited (Shanghai).

Even Tesla’s rare expansion plans have faltered. A $3 billion factory planned for India was quietly scrapped, and a Morocco facility remains little more than a name on paper.

Meanwhile, BYD continues to launch factories in Thailand, Indonesia, Brazil, and Mexico. As competitors view local production as essential, Tesla’s export-focused model appears increasingly outdated in a tightening geopolitical and trade landscape.

Even in core markets like the U.S. and China, where Tesla retains a strong position, signals are mixed. U.S. sales are slowing as consumers shift to cheaper EV options, while China’s growth relies heavily on market-specific models like the 6-seat Model Y.

Analysts like Bill Russo warn that shareholder confidence in Musk’s trillion-dollar payout seems rooted in faith in his “long-term vision”—robotaxis, AI, and humanoid robots—rather than current EV sales data.

“Tesla’s growth has stalled outside the U.S., and it’s losing market share in China and Europe amid intensifying competition. The shareholder vote reflects belief in Musk’s long-term vision, not short-term metrics,” Russo notes.

Ironically, while Musk bets big on robotaxis and humanoid robots to boost Tesla’s valuation, Chinese companies are equally aggressive in these areas, if not more so.

Analysts suggest Musk’s trillion-dollar payout hinges on Tesla’s ability to regain momentum in international markets, especially China, where it’s both a pioneer and a laggard.

According to Dmitriy Pozdnyakov of Freedom Broker, Tesla only needs to maintain its current market share in the U.S. and China to reach 20 million sales in six years. Current sales stand at around 1.8 million annually.

“The U.S. EV market still has significant growth potential in the new vehicle segment,” Pozdnyakov adds.

Targets Elon Musk Must Achieve for His Trillion-Dollar Payout

VinFast’s temporary lead over Tesla in India is a small but telling sign of a larger reality: Tesla is no longer the top choice in emerging markets. While Tesla struggles to establish itself, competitors are securing market share, building supply chains, winning incentives, and shaping consumer habits.

Without a shift in strategy, regional production investment, and aggressive engagement in the fastest-growing markets, Elon Musk’s trillion-dollar dream risks becoming an unattainable ambition.

Sources: RoT, Fortune, BI

Vietnamese Billionaire Pham Nhat Vuong Closes the Gap with Elon Musk in Brain-Computer Interface Race

With the imminent establishment of VinSpace, a space technology venture, striking parallels emerge between the ecosystems of companies founded by Vietnamese billionaire Pham Nhat Vuong and the world’s richest individual, Elon Musk.

Tesla Unveils Affordable Versions of Model 3 and Model Y: Starting at Just $42,000, Poised to Compete with Chinese EVs

Discover the all-new Standard versions of the Model 3 and Model Y, now available at unbeatable prices. Starting at just $36,990 for the Model 3 and $39,990 for the Model Y, these cutting-edge vehicles offer exceptional value without compromising on performance or style. Experience the future of driving today.

The Electric Revolution: Vietnam’s Automotive Market Lights Up with Exciting New EV Models

The automotive industry in the domestic market has witnessed an influx of new electric vehicle models during the third quarter, spanning across various segments from affordable to luxury options. Among these introductions, the VinFast Limo Green, Lac Hong 900 LX, and Ford Mustang Mach-E stand out as notable additions to the electric vehicle landscape in the country.

Elon Musk and President Trump: A Crypto Alliance Behind the Grand Plan?

After former US President Donald Trump announced his plans for a national digital asset reserve, the spotlight has once again fallen on Elon Musk. With Trump’s ambitious financial agenda, could a potential alliance with the tech billionaire shape the future of global finance?