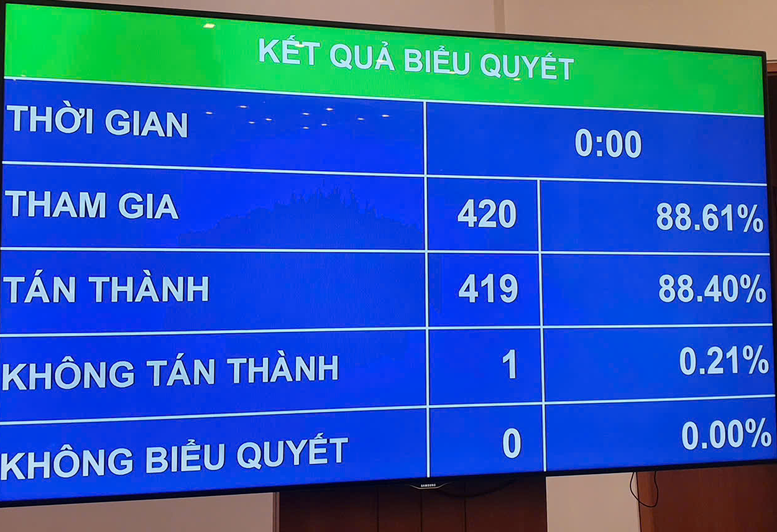

Voting results for the adoption of the 2026 State Budget Resolution – Photo: VGP/Nguyễn Hoàng

The resolution adopts the 2026 State Budget Estimate with a total revenue of VND 2,529,467 billion.

Utilizing VND 23,839 billion from the remaining local budget’s salary reform fund by the end of 2025 to allocate for the 2026 local budget estimate, ensuring a base salary of VND 2.34 million per month.

Total state budget expenditure is set at VND 3,159,106 billion.

The budget deficit is VND 605,800 billion, equivalent to 4.2% of the Gross Domestic Product (GDP).

The resolution mandates the Government to review the utilization of central budget funds allocated to ministries, central agencies, and localities for implementing policies and regimes for officials, civil servants, public employees, workers, and the armed forces. Any unspent funds by the end of 2025 from the salary reform accumulation of the central budget must be recovered and returned.

Allowing the use of 2025 state budget savings from regular expenditures (including 10% savings from the 2025 state budget’s regular expenditures allocated at the beginning of the year, increased compared to the 2024 initial estimate; and an additional 10% savings from the last 7 months of 2025) to construct primary and lower secondary boarding schools in border communes. The Prime Minister is authorized to allocate this capital once conditions are met as per legal regulations.

Permitting the transfer of surplus central budget revenue from 2024 and 2025 state budget savings from regular expenditures to construct primary and lower secondary boarding schools in border communes, unutilized in 2025, to continue implementation in 2026.

Regarding salary policy and social welfare implementation, the resolution requires ministries, central agencies, and localities to continue executing solutions to generate resources for salary policy reforms as stipulated.

In 2026, certain revenue items will be excluded when calculating the increase in local budget revenue compared to the estimate for salary policy reforms, including: one-time land rental payments advanced by investors for compensation, support, and resettlement; revenue from the handling of public assets at agencies, organizations, and units designated by competent authorities for investment spending; revenue from the protection and development of rice land; fees for visiting relic sites and world heritage; fees for using infrastructure, service facilities, and public utilities in border gate areas; environmental protection fees for wastewater; revenue from public utility land funds, profits, and public assets at communes; and revenue from leasing and selling state-owned houses.

Expanding the use of the central budget’s salary reform accumulation fund to adjust pensions, social insurance allowances, monthly allowances, preferential allowances for beneficiaries, and workforce streamlining; allowing the use of local budget’s salary reform funds to implement social welfare policies issued by the central government and workforce streamlining.

Assigning the Government to review savings from regular expenditure support (salary and operational expenses as per legal regulations) due to workforce streamlining and the reorganization of local government structures into a two-tier model; permitting localities to use these savings to supplement local budget salary reform funds.

From 2026 onwards, the Government is authorized to proactively use the salary reform accumulation fund to ensure the implementation of salary regimes, allowances, and income as prescribed.

The 2026 State Budget Resolution directs the Government to proactively manage fiscal policy, coordinating it harmoniously and effectively with monetary policy and other policies, to promptly respond to complex domestic and international developments. This aims to maintain macroeconomic stability, ensure major economic balances, and resolutely achieve socio-economic development goals and state budget financial tasks.

Vigorously implementing solutions to strengthen revenue management, restructuring revenue sources to ensure sustainability; expanding the revenue base; combating tax evasion, transfer pricing, and commercial fraud, especially in digital platform-based activities; urging the recovery of tax arrears; accelerating administrative procedure reforms in taxation; and strictly enforcing legal regulations on the transfer and lease of public assets, land allocation, and land leasing.

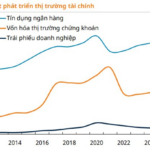

Unlocking Vietnam’s Stock Market Potential: Key Drivers Fueling Continued Growth

According to the analysis team, the market’s potential is bolstered by its attractively priced valuation compared to many regional markets, particularly as profit growth rates and ROE remain consistently high.