Tran Hung Dao Bridge Capital Increase to VND 16,226 Billion

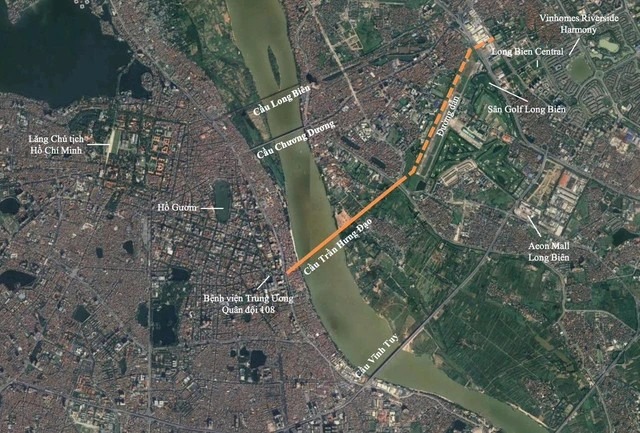

The Tran Hung Dao Bridge groundbreaking ceremony took place on October 9, 2025. After just over a month, the Hanoi People’s Committee approved adjustments to the investment policy for the bridge construction project.

According to Resolution No. 10 dated February 25, 2025, of the Hanoi People’s Council, the Tran Hung Dao Bridge project spans approximately 5.6 km. It starts at the intersection of Tran Hung Dao and Tran Thanh Tong (former Hoan Kiem District) and ends at Vu Duc Thuan Street (former Long Bien District). The total investment is estimated at VND 15,967 billion.

The Hanoi People’s Committee proposed adjusting the project to a total length of approximately 4.18 km.

The starting point is at the intersection of Tran Hung Dao, Tran Thanh Tong, and Le Thanh Tong (Cua Nam Ward, Hai Ba Trung District), and it connects to Nguyen Son Street (Long Bien and Bo De Wards). The preliminary total investment is approximately VND 16,226 billion.

The Hanoi People’s Committee also proposed adjusting the component project allocation plan, including three land clearance projects.

Surrounding Land Prices Surge to Record Highs

The Tran Hung Dao Bridge plays a crucial role in accelerating urban development in the area, paving the way for population decentralization and aligning with Hanoi’s development strategy along the Red River.

Additionally, the bridge connects Hoan Kiem District to Long Bien, creating a powerful catalyst for a new growth cycle in the real estate market of eastern Hanoi.

In Long Bien, with its vast land reserves, improving transportation infrastructure, and strategic location, real estate prices have seen significant changes since the bridge’s groundbreaking.

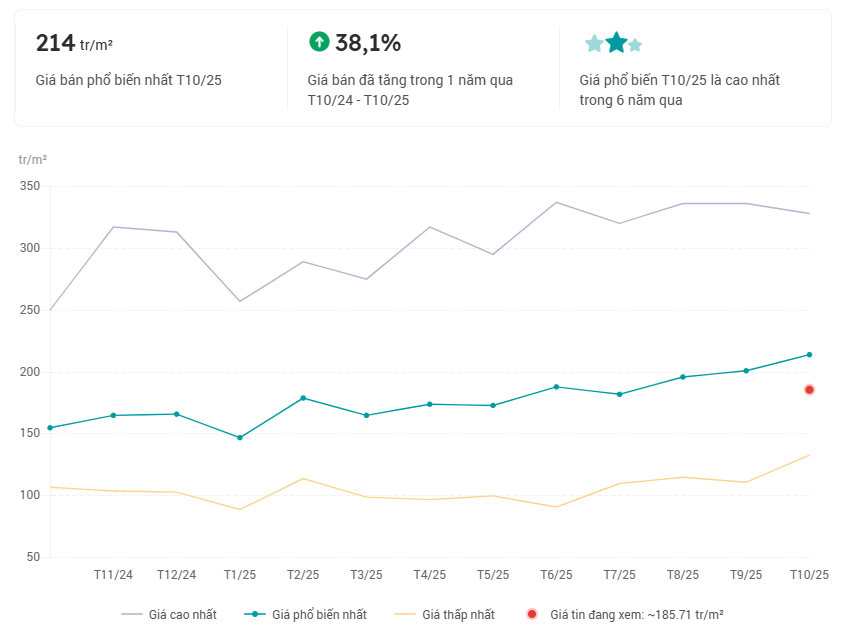

According to Batdongsan.com.vn, land prices in Long Bien District are currently trading at VND 214 million per square meter, a 38% increase over the past year and the highest in six years.

Not only residential land prices but also prices for high-end apartments and condominiums in Long Bien have risen sharply by 30–40% over the past year. Vinhomes Symphony is trading between VND 100–120 million per square meter. Sunshine Green Iconic is priced at nearly VND 100 million per square meter, and Thang Long Investment and Development Corporation’s Platinum project is expected to sell at VND 130 million per square meter. Market reports indicate that Sunshine Group’s upcoming high-rise units are projected to start at VND 160 million per square meter, with low-rise units nearing VND 400 million per square meter.

According to Ms. Do Thu Hang, Director of Research at Savills, market dynamics show that as transportation infrastructure develops, real estate values rise accordingly, especially in areas with convenient connectivity. Therefore, the recent surge in land prices near Red River infrastructure projects is an inevitable trend.

Dr. Nguyen Van Dinh, Chairman of the Vietnam Real Estate Brokerage Association, agrees: “In reality, real estate prices begin to rise as soon as planning information is released, not just when infrastructure projects are implemented or completed. However, the realization of these infrastructure plans remains the key factor driving property price increases.”

Commenting on the apartment market in Long Bien, Dr. Dinh added that Long Bien’s proximity to the city center and its border with Hoan Kiem District, where property values have peaked, position it as a potential new real estate hub with significant growth opportunities.

OneHousing Market Research Center predicts that Long Bien will remain one of Hanoi’s most promising real estate districts in 2025.

DGC’s $190 Million Real Estate Project Approved, Stock Surges to 100,000 VND

Revised Introduction:

Đức Giang Chemical Group JSC (HOSE: DGC) has announced its receipt of the investment approval from the Hanoi People’s Committee for the Đức Giang Public Utility Complex, School, and Residential Project.

Why Sun Group Cau Giay Apartments Are a Magnet for Expatriates?

Sun Feliza Suites Cau Giay stands as a harmonious blend of Vietnamese identity and international sophistication, where investment value, lifestyle excellence, and personal prestige converge. Tailored for foreign professionals seeking long-term rentals or ownership, it epitomizes a refined living experience.

Capital Flow Shifts: Northern Investors’ Quest for Profitable Territories

In the context of the Northern market entering a phase of diminishing profit margins, investment capital is now significantly shifting towards the South, an area recognized for its substantial growth potential and long-term profitability. Savvy investors are increasingly focusing on regions with ample room for yield expansion.

Luxury Real Estate: A Rare Opportunity in Southern Hanoi

The Hanoi market is witnessing a robust surge in the luxury apartment segment, yet the southern part of the capital remains a rare “white spot” on the high-end real estate map—an area poised for a transformative breakthrough.