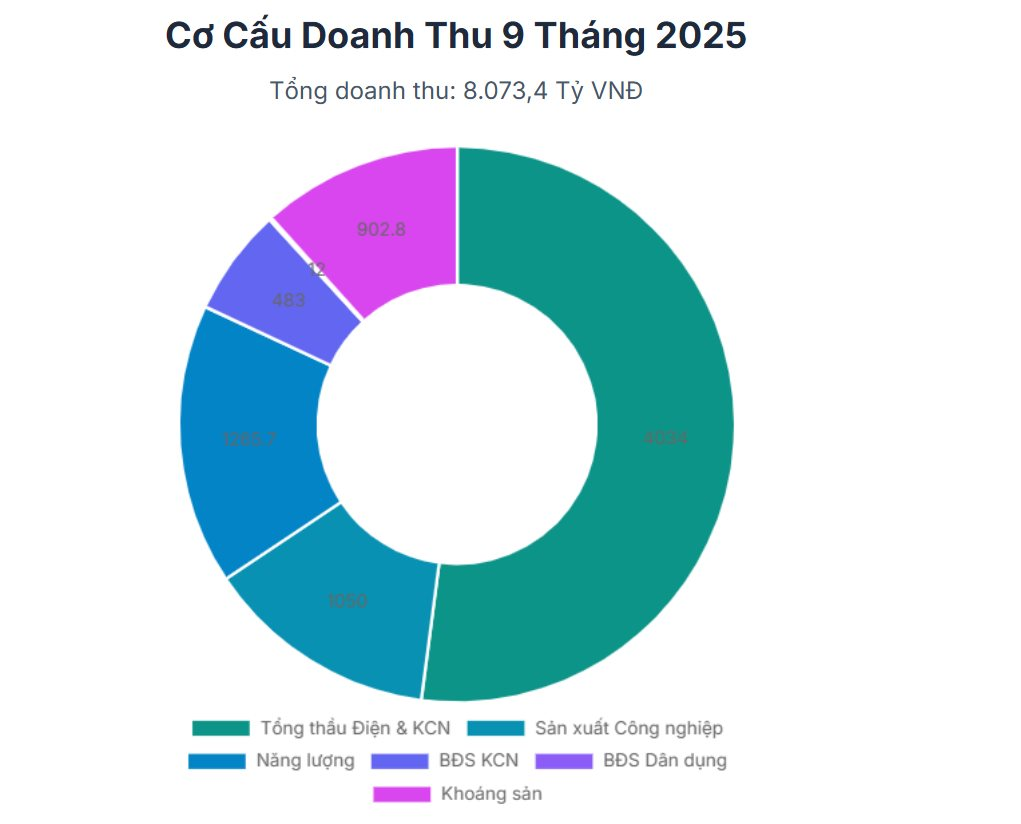

PC1 Group Joint Stock Company (stock code: PC1) has released its Q3/2025 report. In the first nine months of the year, the Group recorded net revenue of VND 8,073 billion and post-tax profit of VND 704 billion, representing a 7% and 22% year-on-year growth, respectively.

Nearly half of PC1’s revenue in the first nine months came from power and industrial park general contracting, with industrial production revenue at VND 1,050 billion, energy segment revenue at VND 1,266 billion, and mineral segment revenue at nearly VND 903 billion.

The Power & Industrial Park General Contracting Division saw a 64.18% revenue growth compared to the same period last year. The backlog reached VND 8,000 billion, matching the record level of Q2, including several large-scale domestic and international EPC contracts for LNG power plants. Planned revenue for Q4 is estimated at VND 2,300 billion.

The Industrial Production Division (steel structures, power poles, etc.) has a backlog of VND 490 billion. The Phase 1 steel pipe pole manufacturing plant in Thai Nguyen has signed a land lease agreement and commenced construction. It is expected to begin production in July 2026. Planned revenue for Q4 is estimated at VND 600 billion.

The Energy Division benefited from favorable weather conditions, ensuring stable operation and strong output across power plants. Gross profit margin remained high and stable at 55.7% in the first nine months of 2025.

PC1 is on track with the construction of the Bao Lac A and Thuong Ha hydropower projects, with commercial operation expected in Q4/2026. The company is also conducting a feasibility study for a 50 MW solar power project on the Trung Thu hydropower reservoir and actively seeking new projects in Vietnam and Laos through partnerships with other developers.

In the Real Estate Division, the NHIZ Japan-Hai Phong Industrial Park (NHIZ) operated smoothly, generating VND 483 billion in revenue for the first nine months. The Nomura 2 Industrial Park (Hai Phong) is progressing according to the site clearance and design plan, with construction expected to start in December 2025.

For residential real estate, PC1 anticipates handing over and recognizing revenue of approximately VND 1,400 billion from the Thap Vang project in 2025. Projects in Hanoi (Bac Tu Liem, Gia Lam, Vinh Hung, Dinh Cong) are in the process of preparing investment proposal dossiers.

The Mineral Division achieved VND 902.8 billion in revenue for the first nine months of 2025, with a significant gross profit margin increase to 40.6%. In Q3, the company successfully exported two shipments with revenue exceeding VND 440 billion.

In Q4, PC1 plans to export an additional shipment, bringing the total annual revenue to over VND 1,100 billion.

PC1 currently holds a 57.27% stake in Tan Phat Mineral Joint Stock Company, the investor of the Nickel-Copper Open-Pit Mining Project in Quang Trung commune, Hoa An district, Cao Bang province.

Nickel is an essential component in high-performance lithium-ion batteries, earning it the nickname “white gold” in the electric vehicle industry.

PC1 Group Leader Successfully Acquires 8 Million Registered Shares

Mr. Phan Ngoc Hieu, Vice Chairman of the Board of Directors at PC1 Group, has successfully acquired 8 million PC1 shares as planned, boosting his ownership stake from 0% to 2.24%.