Market Insights: Gold, Stocks, and Real Estate Forecast

Forecasting Market Volatility in Gold, Stocks, and Real Estate

Experts at the seminar highlighted Vietnam’s emergence as a “rising star” in Asia, boasting a nearly $500 billion economy, macroeconomic stability, and impressive growth momentum, despite global uncertainties stemming from geopolitical tensions and the US-China trade war.

The National Assembly has set a 2026 GDP target of 10% or higher, with per capita GDP reaching $5,400-$5,500. However, achieving this goal requires a 20% credit injection—double the economic growth rate—posing risks of capital inflows into secondary markets like stocks and gold, potentially creating bubbles.

Dr. Nguyen Tri Hieu, Director of the Global Financial and Real Estate Market Research Institute, predicts global gold prices could surge to $5,000/ounce next year, driven by persistent global instability and accommodative monetary policies. Trinh Ha from Exness Investment Bank concurs, noting the historically low gold-to-S&P 500 ratio, though gold may enter a 5-10 year correction cycle if equities rebound strongly.

Event Overview

Regarding real estate, experts express concern over high prices (24-30 times income in Hanoi) and credit levels at 30% of GDP, mirroring China’s 2015-2016 situation. While growth is expected in 2026, significant risks loom by late 2026 or 2027. Government intervention is needed to lower prices and regulate future property sales.

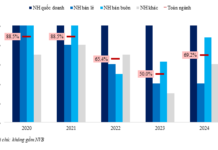

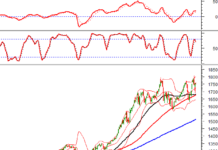

The stock market is viewed positively, with capitalization exceeding 100% of GDP and high liquidity. Prospects are bright, fueled by potential Fed rate cuts in 2026 (projected 0.25% in Dec 2025), boosting US markets and global spillovers. Upgrading from frontier to emerging market status could attract tens of billions in capital, but investors must select portfolios wisely to avoid losses despite overall market gains.

Digital Assets and Credit Upgrades: New Capital Opportunities

The seminar also emphasized the rise of digital assets as a “new frontier,” following Resolution 05/2025/NQ-CP recognizing cryptocurrencies and enabling pilot projects to manage $200 billion in transactions, attracting international capital.

Nguyen Minh Hoang from the Vietnam Blockchain Association noted that Vietnam has approximately 17 million crypto accounts, peaking at 20 million. From July 2024 to June 2025, crypto transactions surpassed $200 billion.

Resolution 05 pursues dual objectives, reflecting government foresight. Regulators aim to bring the market out of the gray area, enhancing oversight and investor protection while curbing fraud and money laundering. Simultaneously, the resolution enables Vietnamese firms to issue new tokens—blockchain-based digital certificates—to attract foreign investment.

This innovative funding channel complements traditional methods like equity or bond issuance, connecting Vietnamese businesses with global capital swiftly and efficiently.

Giap Van Dai, CEO of Nami Foundation, remarked, “Blockchain fosters a freedom economy, where transparency and equality empower users, businesses, and regulators alike. With trust ‘programmed,’ financial activities become more transparent, supply chains verifiable, and corporate governance sustainable.”

Experts also highlighted the significance of upgrading Vietnam’s credit rating to Investment Grade, potentially reducing capital costs by 1.5-2% and attracting $250-$280 billion annually for 2025-2030 infrastructure.

Vu Viet Linh from Maybank Investment Bank predicts Vietnam (currently BB+) could achieve this by 2028 (optimistic) or 2030 with institutional reforms (via Resolutions 66, 68), strengthened banking, and forex reserves. Lessons from Indonesia and the Philippines suggest stock markets surge 2 years before/after upgrades, indicating Vietnam’s current bull run may be halfway through.

Despite optimism, experts caution against risks from a US recession, high inflation, USD volatility, and stablecoins. Digital assets may fluctuate sharply, necessitating licensed exchange trading to mitigate legal and security risks.

Diversified asset allocation strategies are recommended to balance yield and safety. Market volatility across stocks, gold, real estate, and digital assets underscores the need for informed portfolio adjustments. Experts advise investors to diversify, monitor Fed and State Bank policies, and stay updated on regulatory changes.