This afternoon, several gold enterprises continued to adjust their prices upward by approximately 700,000 VND per tael compared to the opening, raising the increase from the previous session’s close to an average of 2.5 million VND per tael.

Currently, the price of gold rings at Bao Tin Minh Chau is listed at 151.3 – 154.3 million VND per tael; PNJ at 150 – 153 million VND per tael; SJC at 149.7 – 152.2 million VND per tael; and DOJI at 150.5 – 153.5 million VND per tael. The price of gold bars at these brands also recorded a selling threshold of around 154 million VND per tael, while the buying price is commonly within the range of 152 – 152.5 million VND per tael.

In the global market, at the time of the survey, the spot gold price was at 4,206 USD/ounce, up 17 USD from the opening of the trading session.

Global gold price movements over the past 24 hours. (Source: Kitco News)

—

At the current survey time, domestic gold bars and gold rings have seen a significant increase compared to the previous session’s close.

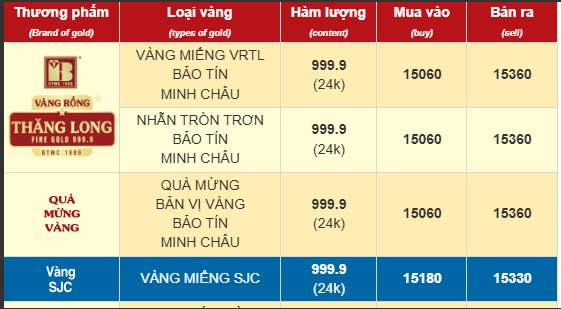

Specifically, at Bao Tin Minh Chau, gold rings are listed at 150.6 – 153.6 million VND per tael, an increase of approximately 1.8 million VND per tael.

Prices of gold rings and gold bars listed at Bao Tin Minh Chau this morning.

SJC Company adjusted more strongly, up to 149 – 151.5 million VND per tael, equivalent to an increase of 2 million VND per tael. At DOJI and PNJ, gold rings are traded around 149.5 – 152.5 million VND per tael, an average increase of 1.5 million VND per tael.

For gold bars, Bao Tin Minh Chau has now listed them at 151.8 – 153.3 million VND per tael. Brands like PNJ, SJC, and DOJI have also uniformly adjusted gold bar prices within the range of 151.3 – 153.3 million VND per tael. Compared to the previous session’s close, gold bar prices have increased uniformly by 1.8 million VND per tael.

–

Opening this morning’s trading session, PNJ adjusted the price of gold rings to 148.4 – 151.2 million VND per tael, an additional increase of 200,000 VND per tael compared to the previous session’s close. SJC Company also raised the price of gold rings to 147.2 – 149.7 million VND per tael, corresponding to an increase of 400,000 VND per tael.

The price of gold bars at these two companies remained unchanged from the previous session’s close, still at 149.5 – 151.5 million VND per tael.

Meanwhile, Mi Hong gold adjusted the price of gold bars and gold rings to 150.7 – 151.5 million VND per tael, respectively increasing by 700,000 VND on the buying side and keeping the selling price unchanged.

In the global market, the spot gold price is currently at 4,190 USD/ounce, down slightly by 4 USD from the previous session.

Gold futures have risen nearly 200 USD in just three sessions, equivalent to an increase of about 5%, bringing the price back above the psychologically important 4,200 USD/ounce level.

Notably, buying interest in the international market indicates that capital continues to accumulate. SPDR Gold Shares – the world’s largest gold ETF – has purchased an additional 170 tons of gold since the beginning of the year, the strongest buying level in 5 years. According to InvestingLive, bottom-fishing forces at the 4,100 USD/ounce area have appeared densely, reinforcing this price range as an important technical support.

However, investor sentiment remains cautious. Gold prices have undergone a strong correction after reaching a peak of 4,381 USD/ounce on October 21, at times falling below 3,900 USD/ounce. The market is awaiting clearer signals to determine if the upward trend has truly returned.

According to analysts, gold will be strongly supported if U.S. economic data continues to reinforce the possibility of the Fed easing policy in the near future. Additionally, escalating geopolitical tensions in many regions, including Asia, continue to enhance gold’s appeal as a safe-haven asset.

Since the beginning of the year, gold has risen by more than 55% and is on track to record its strongest increase since 1979, driven by a combination of defensive capital flows and central bank purchases.

Hebe Chan, an expert at Vantage Markets (Melbourne), noted that the recovery above the 4,100 USD/ounce mark reflects “underlying anxiety” following the 42-day U.S. government shutdown. “The ripple effects from the longest shutdown in U.S. history may still leave traces, maintaining safe-haven demand for gold despite improving market sentiment,” she said.

According to Chan, the resumption of U.S. economic data releases could bolster expectations of the Fed cutting rates sooner, a favorable factor for gold – a non-yielding asset.

Meanwhile, Charu Chanana, Chief Strategist at Saxo Markets (Singapore), believes gold prices may continue to trade sideways before surging again in 2026. “Capital may shift away from overbought assets like gold and AI stocks, moving into less-noticed areas,” she commented.

Afternoon of November 13: Ring Gold and Gold Bar Prices Surge by 2.5 Million VND/tael, Returning to the 154 Million VND/tael Mark

The price of gold rings and gold bars at numerous enterprises continued to rise this afternoon, with further adjustments made to their rates.