HDBank’s Leadership at the Q3/2025 Investor Conference

At the conference, HDBank’s leadership reported robust business performance in the first nine months of the year, with several key metrics surpassing targets: credit growth of 22.6%, pre-tax profit of VND 14,803 billion (+17%), non-interest income of VND 5,366 billion (+178.6%), ROE of 25.2%, ROA of 2.1%, and CIR of 25.7%—among the lowest in the industry. HDBank now serves over 20 million customers, achieving sustainable growth backed by a strong financial foundation and Moody’s highest credit rating in the sector.

Subsidiary companies also delivered strong results in the first nine months: HD SAISON posted a profit of VND 1,100 billion (ROE 24.4%); HD Securities earned VND 614 billion (+30%, leading the industry in ROE); and Vikki Bank turned profitable after seven months of transformation, attracting over 1.3 million new customers.

Shareholders approved HDBank’s plan to relocate its headquarters to Saigon Marina IFC, a new symbol of Ho Chi Minh City’s international financial hub. They also endorsed a 30% dividend and bonus share plan (25% dividend, 5% bonus), maintaining a consistent high payout policy.

Addressing investors, HDBank’s leadership expressed confidence in accelerating growth in Q4, driven by two key factors: peak-season credit demand and improved asset quality amid a favorable macro environment. Strong credit growth is expected to offset margin pressures, ensuring full-year 2025 profit targets are met.

However, credit costs and non-performing loans (NPLs) require further improvement. While Q3/2025 results suggest a slight downward adjustment in profit forecasts, the overall growth outlook for 2025 remains positive and on track to exceed targets.

During the Q&A session, HDBank’s leadership provided insights into credit growth prospects. In the first nine months, the bank sold over VND 37 trillion in debt to another bank under the State Bank’s restructuring program. Leadership aims for 35% credit growth in 2025.

This growth is fueled by capital demand from FDI, exports, housing programs, and construction during the peak season, alongside a significant uptick in retail lending for mortgages and consumer loans. HDBank has secured a credit limit from the State Bank, aligned with its financial capacity and growth strategy, enabling robust credit expansion in Q4.

Regarding net interest margin (NIM), HDBank targets 4.8-5.0% for 2025, slightly below the 5.09% achieved in the first nine months, reflecting higher deposit costs. Liquidity remains strong, with a loan-to-deposit ratio (LDR) of 71.3%, well below the 85% cap, and a short-term funding for long-term loans ratio of 22.3%. The bank has also secured over USD 500 million in foreign capital at competitive rates, with potential Fed rate cuts further reducing USD funding costs.

Non-interest income continues to grow, driven by payment fees, bancassurance, and debt recovery. Since mid-October 2025, new collateral enforcement regulations have enabled faster debt resolution and improved cash flow recovery.

HDBank’s leadership anticipates NPLs to improve significantly from late 2025 to early 2026, supported by a stable macro environment, recovering real estate liquidity, and streamlined collateral processing. The bank aims to reduce NPLs to around 2% by year-end.

Looking ahead, HDBank targets 2025 profits exceeding VND 21 trillion, with a 25-30% CAGR in profit growth from 2025 to 2030. Subsidiaries also have ambitious plans: HD SAISON aims for 15-16% loan growth and VND 1,500 billion in profit, while HD Securities targets VND 1,000 billion in profit, maintaining industry-leading ROE.

With a solid financial base, strong funding capacity, and improving asset quality, HDBank is well-positioned to accelerate growth in Q4/2025. Its strategy focuses on efficient growth, risk management, digital transformation, and retail customer expansion, remaining a priority through 2030.

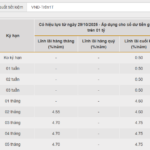

Savings Interest Rates Hit Central Bank’s Ceiling as Multiple Banks Raise Rates

The race to mobilize capital has intensified in Q4 2025, as banks are compelled to ramp up their funding sources to ensure liquidity and meet the surging credit demands typical of year-end periods.

HGM Announces Additional Cash Dividend of VND 8,500 per Share

Hà Giang Mechanical and Mineral JSC (HNX: HGM) has announced the record date for its second cash dividend payment of 2025, offering an impressive 85% payout ratio (equivalent to VND 8,500 per share). The ex-dividend date is set for November 24th, with the payment expected to be distributed from December 18th.

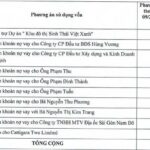

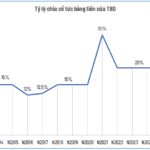

“TBD Sustains 3 Consecutive Years of 20% Cash Dividend Payouts”

Dong Anh Electrical Equipment Corporation – JSC (UPCoM: TBD) announces the finalization of its shareholder list for the 2024 cash dividend distribution. Shareholders will receive a 20% dividend, equivalent to VND 2,000 per share. The ex-dividend date is set for November 21st, with payments expected to commence on December 24th.