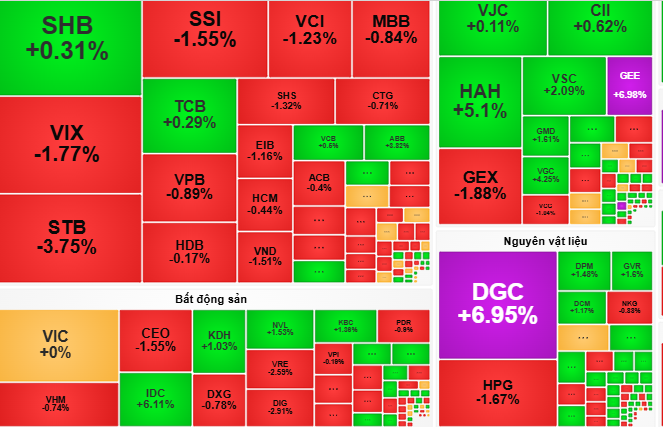

Closing the session on November 13, the VN-Index ended at 1,631 points, down 0.42 points (-0.03%)

The morning session on November 13 started on a positive note, with the VN-Index rising slightly by 2.63 points (0.16%) due to strong demand for key stocks such as VIC, MSN, and MWG. However, the upward momentum soon stalled, and the index fluctuated within a narrow range of +/-5 points.

In the afternoon session, selling pressure intensified from banking stocks (SHB, TCB), Vingroup real estate, and securities, pushing the VN-Index below the 1,630-point mark within the first 30 minutes. Fortunately, buying interest resurged toward the end of the session, focusing on stocks like SHB, VIC, and TCB, helping the market narrow its losses.

By the close, the VN-Index settled at 1,631 points, down 0.42 points (-0.03%), marking the third consecutive session of narrow trading.

According to Rong Viet Securities, liquidity on November 13 decreased slightly, indicating that supply pressure remains moderate. Investors are likely to adopt a cautious trading approach in the next session. If buying support continues and absorbs the supply, the market could generate a new upward wave.

However, VCBS Securities notes that the VN-Index is in a tug-of-war phase, retesting supply-demand dynamics around the 1,630-1,650 point range. Money flow is clearly divided, concentrating on stock groups that have not seen significant gains recently, such as energy, agriculture, and maritime transport.

Given the current situation, VCBS Securities recommends that investors prioritize short-term trading, selecting stocks with increasing demand signals and gradually investing during market fluctuations. Notable sectors include construction, energy, and chemicals.

Unlocking Vietnam’s Stock Market Potential: Key Drivers Fueling Continued Growth

According to the analysis team, the market’s potential is bolstered by its attractively priced valuation compared to many regional markets, particularly as profit growth rates and ROE remain consistently high.

“Profit Accumulation, Loss Mitigation: Embracing a New Investment Mindset”

The topic of ‘profit accumulation and loss deduction’ coupled with the spirit of self-reliance in investment continues to captivate strong attention from the online community. Not only are numerous investors engaged, but several financial experts and a comprehensive digital securities company from South Korea have also joined in sharing insights on this subject.

Market Pulse 14/11: Divergent Trends as Foreign Investors Net Sell VN30 Stocks

At the close of trading, the VN-Index rose 4.02 points (+0.25%) to 1,635.46, while the HNX-Index gained 1.32 points (+0.5%) to 267.61. Market breadth favored the bulls, with 357 advancing stocks versus 342 decliners. Similarly, the VN30 basket saw a slight green tilt, with 11 gainers, 13 losers, and 6 unchanged.

Stock Market Week 10-14/11/2025: Balanced Supply and Demand, Market Polarization Persists

The VN-Index edged higher in the final session of the week, capping a notably positive recovery week following an extended period of adjustment. Amid balanced supply and demand dynamics, with investor participation remaining subdued, the market’s low-liquidity divergence is likely to persist. Next week, the VN-Index faces a critical test at the Middle line of the Bollinger Bands.