According to the Vietnam Securities Depository and Clearing Corporation (VSDC), Military Commercial Joint Stock Bank (MB) plans to repurchase the MBBL2330012 bond series (MBB12303) ahead of schedule.

Specifically, MB intends to repurchase all 150 MBB12303 bonds at a price of approximately VND 1.065 billion per bond, totaling nearly VND 160 billion.

The repurchase payment date is set for December 29, 2025. On this date, MB will exercise its right to repurchase all bonds before maturity as requested by the issuer. Bondholders are obligated to sell their entire holdings back to the issuer and receive the repurchase amount. All repurchased bonds will be canceled.

Illustrative image

As disclosed on the Hanoi Stock Exchange (HNX), the MBBL2330012 series was issued on December 29, 2023, with a face value of VND 150 billion, a 7-year term, and an original maturity date of December 29, 2030. MB has the option (but not the obligation) to repurchase all bonds on the second interest payment date (December 29, 2025). Thus, MB aims to settle this bond series as soon as the repurchase option becomes available.

Additionally, MB plans to repurchase all 199 MBB12302 bonds at a price of approximately VND 1.065 billion per bond, totaling nearly VND 212 billion.

The repurchase payment date for this series is also December 29, 2025. The MBBL2330011 series was issued on December 29, 2023, with a face value of VND 199 billion, a 7-year term, and an original maturity date of December 29, 2030.

In terms of business performance, MB’s Q3/2025 consolidated financial report shows total operating income reached VND 15,597 billion, a 23% increase year-on-year. Operating expenses rose 21% to VND 4,545 billion. As a result, net profit from operations grew 23.5% to VND 11,051 billion.

Risk provisioning costs surged 132% to VND 3,802 billion, eroding MB’s quarterly profit. Pre-tax profit in Q3/2025 slightly declined by 0.8% year-on-year to VND 7,250 billion.

For the first nine months of the year, MB recorded total operating income of VND 48,165 billion, up 24% year-on-year, with pre-tax profit reaching VND 23,139 billion, a 11.6% increase, completing approximately 73% of the annual plan.

As of September 30, 2025, MB’s total assets stood at VND 1,329 trillion, an 18% increase since the beginning of the year.

Customer loans reached VND 931,498 billion, up 20% year-to-date, while customer deposits hit VND 788 trillion, a 10.3% increase.

Regarding asset quality, MB’s total non-performing loans (NPLs) as of September 30, 2025, were VND 17,423 billion, a 38.4% increase in the first nine months. The NPL ratio rose from 1.6% to 1.87%.

Substandard loans increased 42.5% to nearly VND 4,818 billion, doubtful loans surged 55% to VND 7,126 billion, and loss-potential loans rose 19% to VND 5,479 billion.

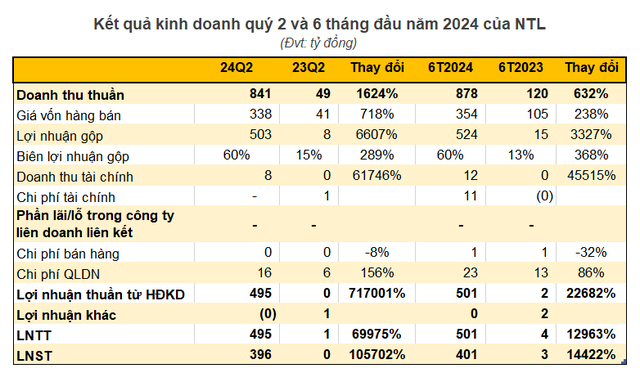

How Indebted is Novaland’s Subsidiary?

August 15th marked the deadline for principal and interest payments on the NTDCH2227001 bond issuance, totaling over 2 trillion VND. However, No Va Thảo Điền has only managed to settle a mere 200 million VND through alternative assets.

Hoà Bình Securities Under Special Control

The State Securities Commission (SSC) has issued a decision placing Hoang Binh Securities Corporation under special control, halting its margin lending activities. The company’s stocks are also subject to trading restrictions.