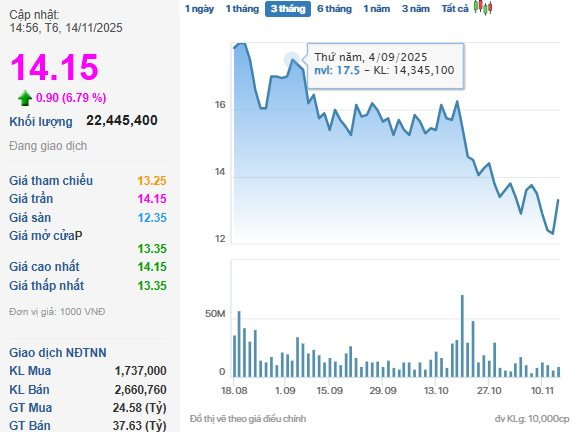

While the market trades cautiously, Novaland Group’s NVL stock stands out as a bright spot, surging to its ceiling price of VND 14,150 per share. The buy order at the ceiling price nearly reaches 3 million units, with no sell orders in sight.

This marks the third consecutive session of strong gains, including two sessions hitting the ceiling price. Liquidity also soared, reaching over 22 million shares, significantly higher than recent averages.

This movement is seen as a positive market reaction to a series of favorable legal signals for Novaland’s key projects.

Recently, the Dong Nai Department of Construction issued Document 2620/SXD-QLN&TTBĐS, confirming that 204 low-rise houses in the Ever Green 1 subdivision of the Aqua City mega-project (Long Hung Ward, Bien Hoa City) are eligible for sale.

According to the department, these products fully meet legal requirements for land, infrastructure, and the adjusted 1/500 detailed planning. As of October 2025, Aqua City has nearly 2,400 products approved for sales contracts.

Previously, the Dong Nai Department of Construction also approved 874 units in River Park 2, 576 units in Sun Harbor 2, 561 units in Sun Harbor 3, and 171 units in Ever Green 1 for sale.

Alongside resolving legal issues, Novaland is accelerating the issuance of pink books. The company has completed over 550 pink books for residents of The Sun Avenue (Thu Duc City), with thousands more in progress and expected to be delivered by year-end. Novaland plans to issue pink books for thousands of products in 2025 to ensure customer rights and enhance market liquidity.

According to Vietcap, Novaland (NVL) is expected to prioritize resolving legal hurdles and accelerate construction progress, thereby speeding up product deliveries in the remaining months of 2025.

Vietcap forecasts that NVL’s sales revenue for 2026–2027 could reach approximately VND 42.6 trillion, primarily driven by the resumption of new sales at Aqua City, NovaWorld Phan Thiet, and NovaWorld Ho Tram.

Although financial leverage is projected to remain high until 2027, debt pressure is manageable due to expected improvements in cash collection from 2027 and a clearer corporate restructuring outlook.

BSC Securities shares this view, noting that legal issues for major projects are showing positive developments, facilitating NVL’s restructuring process. At Aqua City, Dong Nai has approved the 1/5000 zoning plan for the C4 area, and detailed 1/500 plans for sub-projects may be approved in June–July 2025.

For NovaWorld Phan Thiet, Binh Thuan is urgently addressing the final two legal hurdles related to investment policy adjustments and land use methods. BSC expects these critical legal issues to be resolved in 2025, helping NVL reduce debt pressure from 2026 through continued project development, wholesale sales, or debt swaps.

NVL’s restructuring has been accelerated since late 2024 to early 2025, evidenced by reduced ownership in projects like Thanh My Loi, Aqua City, and NovaHill Mui Ne, generating significant cash flow to settle VND 6.66 trillion in bonds in Q1/2025. This move not only improves liquidity but also demonstrates proactive collaboration with capable partners.

Regarding valuation, BSC believes NVL’s stock is attractively priced, with a ttm P/B of around 0.73 and an adjusted P/B of approximately 0.64, benefiting from the reversal of provisions at Lakeview under Resolution 15/QH/2024. Improved legal status and cash flow provide a basis for expecting NVL’s market revaluation.

In terms of business results, Novaland recorded nearly VND 5.4 trillion in net revenue in the first nine months of 2025, a 26% increase year-on-year. However, the company reported a post-tax loss of VND 1.82 trillion due to a sharp decline in financial revenue amid high financing costs.

Aqua City by Novaland: Over 2,400 Units Eligible for Transfer

The Department of Construction of Dong Nai Province has confirmed that the residential units within the Aqua City project fully comply with legal requirements, land regulations, technical infrastructure standards, and the adjusted 1/500 detailed planning. As of October 2025, nearly 2,400 properties at Novaland’s Aqua City are authorized for sales contract signing.

Over 2,300 Properties at Aqua City Project Authorized for Sales Contract Signing

The Department of Construction of Dong Nai Province has recently confirmed that 204 low-rise residential units, located in parts of Subdivision 6 and Subdivision 7 of the Aqua City project, meet the criteria for future real estate properties and are eligible for commercial transactions.

Real Estate Chairpersons and CEOs See Significant Income Surge

In the first nine months of this year, Novaland’s Chairman, Mr. Bui Thanh Nhon, received a remuneration of VND 900 million, equivalent to VND 100 million per month. Novaland’s CEO, Mr. Duong Van Bac, earned VND 3.6 billion, approximately VND 400 million per month. Meanwhile, Mr. Bui Ngoc Duc, CEO of Dat Xanh Group, accounted for nearly half of the senior management’s remuneration at his company, with VND 4.1 billion, or roughly VND 455 million per month.

Novaland Secures VND 3.5 Trillion Loan Guarantee for Subsidiary

Novaland has recently approved the use of its assets as collateral for two significant loans: a VND 2,000 billion loan for NVL JSC and a VND 1,500 billion loan for Gia Duc Real Estate, both secured through a leading bank.