(Illustrative Image: Int)

New Issuance: Momentum from the Real Estate Sector

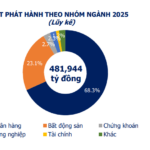

According to the latest report by VIS Rating, October 2025 marked the sixth consecutive month of growth for the corporate bond market, with total new issuance reaching VND 66 trillion, a 30% increase compared to September. The cumulative issuance value since the beginning of the year has reached VND 491 trillion (up 39% year-on-year), and the total outstanding bond value across the market stands at VND 1,406 trillion (up 2.5% month-on-month), reinforcing investment demand and market stability.

Residential real estate led the growth, with five major transactions valued between VND 3.8 trillion and VND 7.65 trillion. The largest issuances in October included IHP12501 (VND 7.65 trillion) and NTJ12501 (VND 5.55 trillion).

Conversely, the banking sector saw a slowdown in issuance, declining by 15% compared to the previous month.

Public Issuance Activity Rebounds

Public issuance activity also recovered, with a total value of VND 2.3 trillion. The primary issuers were Loc Phat Commercial Joint Stock Bank (LPB, A+ Stable) and Viet A Commercial Joint Stock Bank (VAB, A- Stable).

Both LPB and VAB issued Tier 2 unsecured bonds with a 7-year term, offering initial interest rates of 7.03% and 7.6%, respectively. The 57 basis point spread between these rates highlights the market’s increasing sensitivity to credit ratings, reflecting a growing trend in pricing credit risk.

The secondary market remained stable, with liquidity in October 2025 assessed as steady.

The average daily trading value reached VND 4.9 trillion, nearly matching the year-to-date average.

Ho Chi Minh City Development Commercial Joint Stock Bank (HDB) continued to lead in bond trading volume since the beginning of 2025, with cumulative trading value reaching VND 121 trillion. In October, the most actively traded issuers were Vinhomes JSC (VND 14.64 trillion) and HDB (VND 13.7 trillion).

Principal and Interest Delays & Debt Resolution Trends

October 2025 recorded three new cases of principal and interest delays, totaling VND 2 trillion in face value. Since the beginning of 2025, there have been 30 such cases, bringing the delay rate for the first ten months to 1.2%.

New delays in October included interest delays by Sai Gon – Lam Vinh Tourism Investment JSC (SLTCH2328001 – VND 1.607 trillion) and principal delays by UNITY Real Estate Investment LLC (UNICH2124001 – VND 377 billion) and HBC (HBCH2225002 – VND 12 billion).

Debt resolution efforts showed positive signs in October. The overall recovery rate for delayed payments increased to 38.6% by the end of October 2025, up from 37.5% at the end of September.

Notably, the residential real estate sector saw a recovery rate of 45.33%, indicating significant progress in resolving delayed bond payments.

In October 2025, several companies successfully resolved principal debts, including Dragon Village Real Estate JSC (VND 500 billion, remaining debt: 0) and The Century Real Estate JSC (VND 353.5 billion, remaining debt: 0).

HBC Event: Liquidity Risk Spotlight

The delay by Hoa Binh Construction Group JSC (HBC) in paying VND 12.4 billion in principal for the HBCH2225002 bond on October 31, 2025, was a significant event, underscoring the need for stricter liquidity risk monitoring.

Despite HBC reporting profits and maintaining a substantial cash balance (approximately VND 300 billion) at the end of Q3/2025, the company failed to settle this minor debt, revealing a notable liquidity gap.

According to VIS Rating, accounting profits or cash balances on financial statements do not fully reflect a company’s actual payment capacity.

HBC’s high liquidity pressure stems from the fact that, while the company announced plans for substantial project volumes, most new projects only commenced in Q3-Q4/2025. This limited short-term cash inflows while maintaining high liquidity demands.

Capital Inflows Surge into Insurance and Oil & Gas Sectors

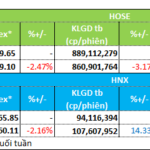

Liquidity diverged across two listed exchanges during the week of November 3rd – 7th. Cash flow exhibited polarization across various sectors. Nonetheless, certain sectors demonstrated robust capital inflows.

Stock Market Week 03-07/11/2025: VN-Index Plunges Below 1,600 Points – Is the Downtrend Far from Over?

The VN-Index plummeted sharply, shattering its August 2025 lows and breaching the psychological 1,600-point threshold in the final session of the week, extending its losing streak into the fourth consecutive week. Short-term risks are escalating amid weak liquidity and a lack of clear market catalysts.