According to VietstockFinance, 18 out of 18 listed seafood companies reported profit growth in Q3/2025. The industry’s total revenue reached VND 17.8 trillion, up 5.7%, while net profit soared to VND 1.2 trillion, nearly tripling year-on-year.

Pangasius Leads the Recovery

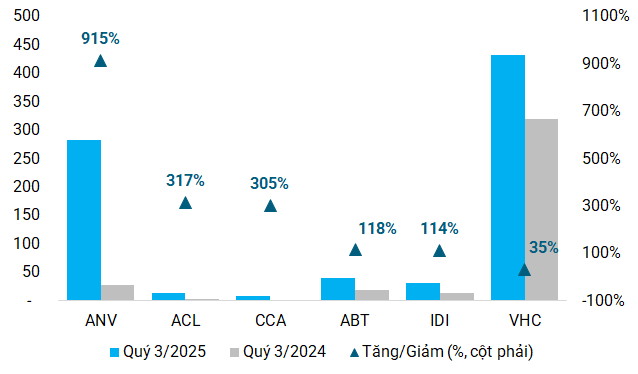

Pangasius exporters remained in the spotlight with impressive results. Nam Viet (HOSE: ANV) posted a VND 283 billion profit, 10 times higher than last year, thanks to a 50% revenue surge to VND 2 trillion, an all-time high. Ben Tre Seafood Import-Export (HOSE: ABT) achieved record revenue of VND 193 billion, up 27%, with net profit doubling to VND 40 billion, just below Q2’s peak.

Cuu Long Fish Import-Export (HOSE: ACL) had its best quarter in three years with a VND 14 billion profit, up 316%.

Despite flat revenue, Vinh Hoan (HOSE: VHC) earned VND 433 billion, up 35%, due to provision reversals and forex gains. IDI (HOSE: IDI) reported VND 32 billion in profit, double last year, mainly from cost cuts despite slightly lower revenue. Can Tho Seafood Import-Export (UPCoM: CCA) saw profits quadruple to VND 8.4 billion, thanks to reduced selling expenses.

|

Pangasius exporters’ Q3 profits surge (Unit: VND billion)

Source: Author’s compilation

|

Shrimp Sector Also Shines

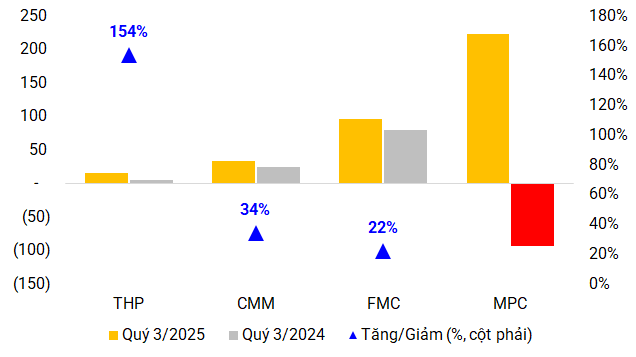

Minh Phu Seafood (UPCoM: MPC) turned a VND 94 billion loss into a VND 223 billion profit, its highest in three years, despite a 13% revenue drop to VND 3.8 trillion. Lower production costs were the key driver.

Sao Ta Food (HOSE: FMC) hit record revenue of nearly VND 3 trillion, with gross profit rising to VND 418 billion. However, net profit was VND 97 billion, up 22%, after VND 350 billion in tax expenses.

Camimex (UPCoM: CMM) earned VND 34 billion, up double digits, despite high interest costs, thanks to 42% revenue growth to VND 645 billion. Thuan Phuoc Seafood (UPCoM: THP) reached new highs with VND 944 billion in revenue, up 19%, and VND 15 billion in net profit, 2.5 times higher year-on-year, driven by strong European demand.

|

Shrimp sector also shows positive signs (Unit: VND billion)

Source: Author’s compilation

|

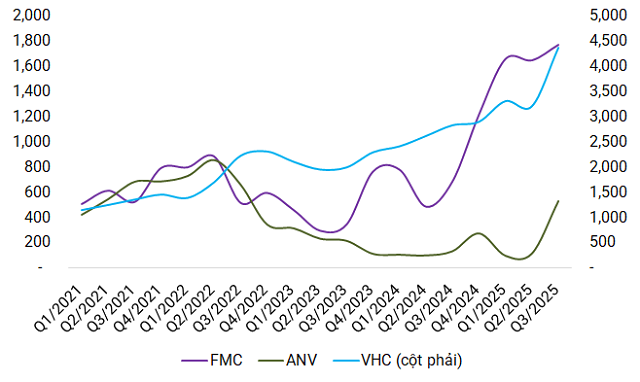

Bank Deposits Hit Record Highs

Seafood companies’ cash reserves surged in Q3. VHC ended the period with VND 4.4 trillion in bank deposits, up VND 1.5 trillion since year-start. FMC also doubled its deposits to VND 1.7 trillion year-on-year.

AAM deposited VND 42 billion for over three months, raising total deposits to VND 139 billion, an all-time high. ABT increased term deposits to VND 340 billion, with total deposits hitting a record VND 357 billion.

ACL added VND 20 billion in term deposits, reaching nearly VND 150 billion, far exceeding previous years. ANV raised three-month deposits to VND 363 billion, with total cash and deposits at VND 532 billion, the highest in three years.

|

Many companies’ deposits hit record highs (Unit: VND billion)

Source: Author’s compilation

|

Stocks Rebound Strongly

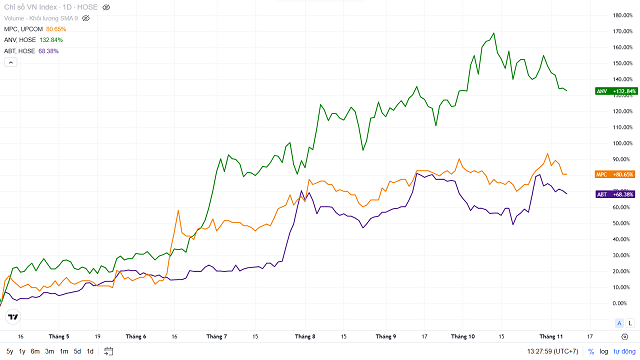

Seafood stocks rallied on strong earnings, recovering from April’s slump caused by US tariff concerns.

ANV led the surge, jumping 176% to VND 32,000 per share, surpassing its 2020 peak of VND 28,000. Q3 trading volume averaged 5.7 million shares daily, 3-4 times pre-slump levels.

MPC also rebounded strongly to VND 18,000, nearly double April’s low. ABT, though less affected, rose 100% in seven months to a record VND 76,000.

Many seafood stocks rebounded strongly after April’s slump

|

Shrimp Exports Grow at Three-Year High

Shrimp companies’ Q3 performance was driven by exports. In the first nine months of 2025, shrimp exports reached USD 3.4 billion, up 22% year-on-year, the strongest growth in three years. Recovery in China, the US, EU, and CPTPP markets sustained orders despite US tariffs.

China and Hong Kong led with USD 966 million, up 65%, while the EU reached USD 434 million, up 21%, driven by demand for ASC-certified, organic, and low-carbon products.

Pangasius exports shifted to CPTPP, Brazil, and Thailand, reducing reliance on traditional markets like China-Hong Kong and the US. This diversification helps mitigate risks and expand opportunities.

VASEP forecasts Q4 shrimp exports may slow due to rising Chinese inventories and US challenges. However, opportunities arise as Indonesia restricts US exports and Ecuador focuses on China, supporting higher prices.

In 2026, competition is expected to intensify, requiring companies to focus on green transformation, supply chain digitalization, and value-added products to maintain profitability.

For pangasius, VASEP expects Q4 recovery driven by year-end demand and Tet 2026 orders. However, rising input costs may squeeze margins, requiring continued cost optimization and quality control.

– 09:00 15/11/2025

Q3: Natural Rubber Surges, Tire Industry Faces Challenges

Most rubber industry businesses saw a rise in net profit during Q3 2025. However, the narrative diverges significantly between the natural rubber and tire segments.

Top 15 Profit-Soaring Companies in Q3 2025: Minimum 540% Growth, with One Firm Skyrocketing 5,700%—Real Estate Dominates the List

The top-performing businesses in the first nine months of 2025 showcase remarkable growth, with the real estate sector leading the charge and boasting the highest number of representatives. Notably, several companies have turned their fortunes around, transitioning from losses to impressive profits.