The Era of “Virtual Waves” is Over

According to experts, the era of “virtual waves” in real estate has passed. Projects relying on planning rumors, lacking legal foundations, and with inconsistent infrastructure are virtually illiquid. Conversely, projects with clear legal frameworks, completed infrastructure, and catering to genuine housing needs continue to attract buyers.

Ms. Minh Huệ, a long-time real estate investor in Hanoi, shared that previously, real estate investors could profit simply by entering the market. Now, the market is highly segmented. Those with a long-term vision, choosing projects with solid legal frameworks and potential locations, still have profit opportunities. However, those with a “deposit today, flip tomorrow” mindset are likely to “sink their capital.” Investors are also avoiding financial leverage due to concerns about fluctuating interest rates when properties remain unsold.

Mr. Đinh Minh Tuấn, Director of PropertyGuru Vietnam, stated: “The market has just gone through a challenging period with reduced liquidity, price declines, and cautious buying sentiment, which has significantly reduced speculative flipping.”

According to Mr. Tuấn, investors are shifting toward long-term, stable investment strategies. Additionally, the limited supply over the past 2-3 years, coupled with steady demand growth, has led to an increase in buyers seeking actual residence or rental income, reducing the prevalence of speculative flipping.

Furthermore, the November report by the Vietnam Association of Realtors (VARS) highlights that over the past three years, the housing supply has surged, but the supply structure remains imbalanced. Most new supply is concentrated in high-end projects catering to investment needs, including speculative demand.

The real estate market has moved beyond “virtual waves.”

Even in suburban areas, expected to offer affordable housing, prices remain significantly higher than average incomes, only slightly lower than central areas. Meanwhile, the market’s greatest demand is for affordable housing.

“The supply-demand mismatch has driven housing prices, particularly in the apartment segment, to surge in major cities, establishing new price levels far exceeding income growth. This narrows access to housing for most citizens and increases the risk of a price bubble,” VARS emphasized, affirming that the era of real estate flipping is over.

The Market Enters a Restructuring Phase

Experts assess that Vietnam’s real estate market is entering its most comprehensive restructuring cycle in years.

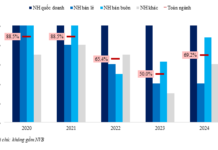

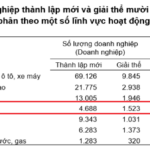

According to VARS’s 2025 nine-month report, 4,090 new real estate companies were established, an 18.7% increase from 2024; total registered capital reached 334 trillion VND, up over 60%. However, over 3,700 companies suspended operations, and 1,260 dissolved.

These contrasting figures, VARS notes, vividly reflect the market’s comprehensive restructuring. Weak enterprises are forced out, making way for those with genuine capabilities.

Dr. Nguyễn Văn Đính, VARS Chairman, commented: “Companies with strong legal, financial, and long-term development strategies will endure. Conversely, those lacking transparency and reliant on short-term capital will exit. This is a necessary jolt for a healthier market.”

According to VARS, this polarization is an inevitable consequence of the post-crisis period of 2022-2023. While the first filtering cycle occurred when the market “hit bottom,” faced credit tightening, and bond crises, the second cycle is now beginning—harsher but more stable and long-term—as credit eases, rules change, and the market recovers.

VARS identifies three primary drivers of the current robust restructuring wave: capital pressure, overlapping legal frameworks, and changes in the new institutional framework.

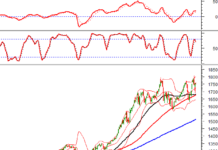

Market Pulse November 14: Striving to Hold the 1,630-Point Threshold

At the mid-session break, the VN-Index dipped slightly by 0.82 points (-0.05%), closing at 1,630.62 points, while the HNX-Index hovered near the reference mark at 266.33 points. Market breadth remained balanced, with 346 decliners, 322 gainers, and 934 unchanged stocks.

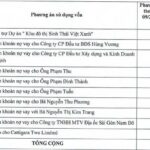

Landmark $200 Million Duc Giang Chemical Real Estate Project Approved After 5-Year Wait

Nestled in the heart of Viet Hung Ward, Hanoi, this expansive 47,470 m² development at 18, Alley 44, Duc Giang Street, offers a harmonious blend of modern living and convenience. Featuring 60 elegant townhouses, a high-rise residential complex with 880 apartments, a 1.1-hectare school, and a comprehensive array of commercial, sports, and recreational facilities, it’s designed to elevate your lifestyle.

Where is the Money Flowing as Real Estate Prices Surge?

Capital flows are noticeably shifting away from the outskirts of Hanoi and Ho Chi Minh City, as apartment prices in the central areas of these two cities remain high and continue to surge.