A World of Uncertainty

At the Vietstock LIVE program on November 14th, Mr. Vu Duy Khanh remarked that the current global macroeconomic context is at a highly sensitive stage. In the United States, a headache has emerged as the economy develops in a K-shaped model, necessitating support from either fiscal or monetary policy.

This creates an uncertain development model, making financial markets extremely fragile. Investors oscillate between excessive optimism, fueled by stimulus packages or hopes of rate cuts, and deep pessimism. A prime example is the 700-point drop in the U.S. stock market when the probability of a Fed rate cut fell from 80% to 50%, highlighting extreme sensitivity.

The neutral interest rate in the U.S. is trending downward, making monetary policy less effective as there’s limited room for rate cuts during crises. Previously, a QE package was equivalent to a 3% rate cut, but with the neutral rate declining, the stimulatory effect of QE is no longer as potent.

Investment in technology, particularly AI, is also noteworthy. Some compare the current phase to the dotcom bubble, though it’s important to note that AI-related CAPEX as a percentage of GDP is only around 1%, compared to 3-4% during the dotcom era. However, risks remain, as evidenced by companies engaging in cross-shareholding.

Additionally, AI companies have extended asset depreciation periods from 3 to 4-5 years, boosting accounting profits and raising concerns about “technical” profitability.

Another factor is that U.S. consumer spending has increased partly because 50% of mortgage debt is locked in at fixed rates of around 3%, allowing households to save and spend more.

In essence, the U.S. economy is in uncharted territory, facing issues not covered in textbooks.

Regarding inflation, there are suggestions for the Fed to raise its target to 3% from 2%, as trade wars and new-generation trade agreements may render the old target obsolete.

Another emerging trend is de-dollarization, though the USD remains the dominant reserve and settlement currency. Notably, Russia and China are trading oil in CNY; Russia is preparing to issue CNY-denominated bonds; major Australian mining companies accept 30% of payments in CNY; and China’s M2 money supply has surpassed that of the U.S. for the first time.

The USD’s role over the next 10-30 years may gradually diminish. Meanwhile, gold could become the ultimate safe-haven asset, replacing U.S. Treasury bonds.

Overall, the global economy continues to grow but faces significant uncertainties, with the international trade and payment order being reshaped.

Mr. Vu Duy Khanh speaking at the Vietstock LIVE program on November 14th

|

Aiming for 10% GDP Growth: Can Pressure Create Diamonds?

For Vietnam’s economy, the National Assembly has set an ambitious 10% growth target. Mr. Khanh believes this pace is crucial, as Vietnam lagged during the 2011-2015 crisis when the government cut public investment. Infrastructure originally slated for completion by 2025 is now only in Phase 1, with Phase 2 expected to finish by 2030. Without rapid growth, escaping the middle-income trap will be challenging.

Escaping the middle-income trap is fundamentally simple: the key is fostering globally competitive enterprises. East Asian countries like Japan, South Korea, Taiwan, and China have achieved this, while Thailand in Southeast Asia remains trapped due to a lack of global companies.

“If Vietnam doesn’t set high goals to create ‘miracle’ companies, the gap with the world will widen, and competitiveness will decline,” Mr. Khanh noted.

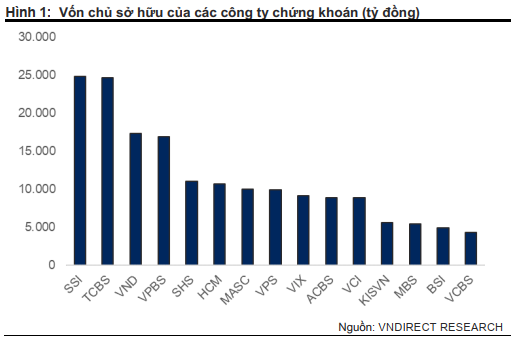

However, 10% growth presents challenges. Credit pressure is a major concern, with studies suggesting credit must grow 20-25% to support this target. Vietnam’s credit-to-GDP ratio already stands at a risky 130%. Without robust development of stock and bond markets to share the capital burden, the system will face immense strain.

Institutional reforms must also accelerate to sustain growth. Positively, by 2026, legal frameworks across sectors and financial-accounting systems will align more closely with international standards than ever before. This is a significant step, bolstering foreign investor confidence.

Another challenge is capital balancing. The State Bank prioritizes exchange rate stability, but Vietnam’s resources pale in comparison to China’s ability to manage a similar model. In recent years, Vietnam has struggled to control exchange rates, even creating policy conflicts while attempting to lower interest rates to stimulate growth.

The core issue lies in the depletion of foreign exchange reserves, now below three weeks of import cover. Secondly, the financial account surplus previously relied on carry trade inflows, but these have faced significant outflows, especially as Fed rate hikes drew capital back to the U.S. (U.S. money market funds grew from $3 trillion to $7.5 trillion in just a few years). Despite trade surpluses, rising remittances, and steady FDI disbursements, the exchange rate remains under intense pressure.

– 11:36 15/11/2025