According to the plan, Vietcap will offer the aforementioned shares for sale in 2025 and Q1/2026. With 127.5 million shares, equivalent to 17.6446% of the outstanding shares, the company will increase its charter capital from VND 7,226 billion to VND 8,501 billion.

The announced offering price is VND 31,000 per share, 13% lower than the closing market price on November 14th, which was VND 35,750 per share. Vietcap stated that this pricing considers the overall market conditions and other factors affecting the success of the offering, while also providing an opportunity for investors to contribute to the company’s growth.

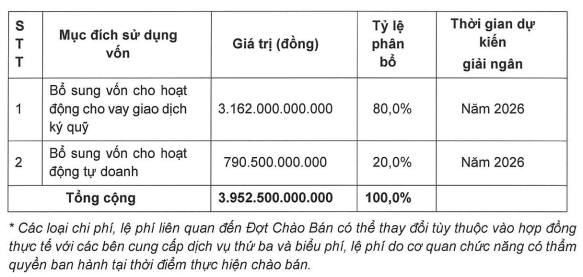

As a result, the company expects to raise nearly VND 3,923 billion, which will be fully disbursed in 2026. Of this amount, 80% will be used to supplement capital for margin activities, and 20% will be allocated for proprietary trading.

|

Vietcap’s Capital Allocation Plan

Source: Vietcap

|

According to the list published by Vietcap, 69 investors are expected to participate in the private placement, including 26 new investors who will become shareholders after the offering. The list also draws attention due to the presence of several prominent domestic and international institutions.

Among them, Darasol Investments Limited is set to purchase the largest number of shares at 12.2 million, nearly 10% of the offering, corresponding to an investment of over VND 378 billion. Following the transaction, this foreign institution will increase its ownership to 1.44%, up from zero previously.

The Dragon Capital group will acquire 10 million shares through its member funds, including Samsung Vietnam Securities Master Investment Trust [Equity], Vietnam Enterprise Investments Limited, Hanoi Investments Holdings Limited, and DC Developing Markets Strategies Public Limited Company. This group will also increase its ownership in Vietcap from 3.1% to 3.83%.

Insurance companies are also participating in the offering, with Manulife (Vietnam) LLC, Prudential Vietnam Life Insurance Company LLC, and its ecosystem member Eastspring Investments purchasing millions of shares.

Other institutions listed include ACB Capital (ACB Fund Management LLC), Red Three Growth Equity Fund (a member fund of Red Capital), G.C Food JSC (UPCoM: GCF), Nanjia Capital Master Fund Limited, and ACM Global Fund VCC.

Among individual investors, Mr. Nguyễn Tấn Minh and Mr. Lê Danh Tài are the largest participants, each purchasing 11.5 million shares, corresponding to an investment of approximately VND 357 billion per person. As a result, Mr. Minh and Mr. Tài will increase their ownership stakes to 2.07% and 2.12%, respectively.

During the recent extraordinary shareholders’ meeting on November 7th, Vietcap’s leaders emphasized the need to promptly increase the company’s charter capital to strengthen its financial resources, support existing business activities, enhance competitiveness, and establish a foundation for sustainable long-term growth.

Regarding the 2025 business outlook, Mr. Đinh Quang Hoàn, Vice Chairman of the Board, stated that the pre-tax profit plan set at the beginning of the year was VND 1,400 billion. Given the favorable market conditions, Vietcap expects to exceed this target by 10% to 20%.

In addition to the capital increase plan, the company has also approved the establishment of a subsidiary in Singapore with an investment of USD 29 million (equivalent to VND 725 billion). The primary activities of this subsidiary will be proprietary indirect investment abroad and providing securities business services in accordance with local laws and regulations. The management stated that the main purpose of this overseas investment is to collaborate with companies within the ASEAN region.

– 6:18 PM, November 14, 2025

Who Remains in the Digital Asset Exchange Race After Vietcap’s Exit?

Vietcap has halted its plans to establish a digital asset trading platform, yet numerous industry giants remain poised to enter this highly promising market, actively preparing their resources for the impending opportunity.

Vietcap Unveils Strategic Plan: Private Placement, Singapore Subsidiary Launch, and Withdrawal from Digital Asset Exchange Project

In 2025, Vietcap is poised to surpass its profit targets by an impressive 10-20%, marking a significant milestone in its financial performance.