Ms. Phạm Thị Thanh Hoài – VietinBank Board Member stated that the primary growth drivers stem from credit growth outpacing the industry average, effective cost management, and a robust provisioning buffer enabling the bank to significantly reduce risk provisioning costs.

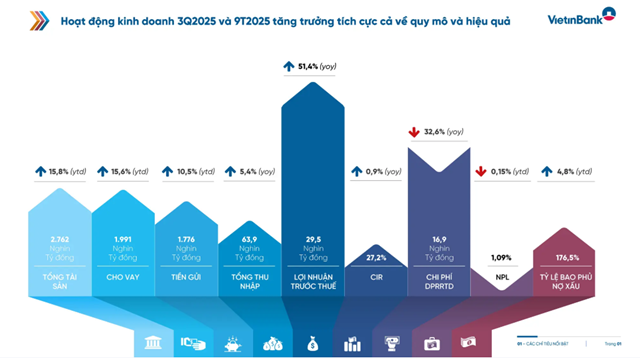

VietinBank’s core financial metrics demonstrate robust and stable growth. As of Q3/2025, total assets reached VND 2,760 trillion, a 15.8% increase compared to year-end 2024. Outstanding loans grew by 15.6% to VND 1,990 trillion, with growth across all customer segments. Customer deposits also rose by 10.5%, reaching VND 1,770 trillion.

CASA (non-term deposits) stood at VND 445.8 trillion, up 11.7% from year-end 2024. Consequently, the CASA ratio improved to 25.1% of total deposits.

A key profit driver was the cumulative nine-month risk provisioning cost of VND 16.9 trillion, a sharp 33% decline year-on-year. Pre-tax profit surged 51.4% to VND 29.5 trillion. The NPL ratio was tightly controlled at 1.09%, down from year-end 2024. This was achieved through proactive debt quality management and early risk identification. NPLs were distributed across corporate (1.15%, primarily transportation BOTs), SME (construction materials, agriculture, real estate), and retail segments (consumer loans, agriculture) at around 1%.

The NPL coverage ratio (LLR) remained high at 176.5%, strengthening the financial provisioning buffer. The cost-to-income ratio (CIR/CIA) was 27.2%. Return on assets (ROA) and return on equity (ROE) were 1.53% and 19.96%, respectively.

In cost management, the nine-month CIR was a low 27.2%. The bank expects the full-year 2025 CIR to be around 30%, due to the concentration of expense recognition in the final quarter.

The nine-month net interest margin (NIM) was 2.57%. Although down from 2024, it remained stable, similar to Q2/2025. The cost of funds (COF) was 3.19%, showing a positive decline from Q2/2025, supporting NIM. The bank anticipates a slight NIM decrease in 2025 compared to 2024. In 2026, NIM may stabilize in the first half and potentially improve in the second half.

Key liquidity metrics remained strong: the loan-to-deposit ratio (LDR) was 83.4%; short-term funding for medium-long term loans was 22.7%; the liquidity coverage ratio (LCR) in Q3 was 16.4%. The capital adequacy ratio (CAR) in Q3 exceeded 9.7%.

Capital increase plans are a current focus. VietinBank is in the final stages of submitting for approval the retention of profits from 2009-2016 and 2021 (totaling approximately VND 24 trillion) to boost capital. The bank is also seeking approval to retain all 2023 profits (around VND 12.565 trillion). VietinBank consistently aims to retain all future profits, prioritizing stock dividends to strengthen financial capacity. A 4.5% cash dividend for 2024 will be paid on November 17, 2025. As of September 30, 2025, the bank’s chartered capital is VND 53.7 trillion.

Target profit of VND 32.5 trillion, digital assets and gold trading to boost fee income

VietinBank aims for 8-10% total asset growth in 2025. Credit growth will align with State Bank of Vietnam (SBV) approvals. Deposit mobilization will match credit growth. The NPL ratio will be kept below 1.8%. The 2025 pre-tax profit target is VND 32.5 trillion.

Looking ahead to 2026, the bank forecasts 16-18% industry-wide credit growth, given Vietnam’s substantial medium-long term credit demand. Globally, growth in the US, Europe, and China is expected to be slow but stable, with recovery. In Vietnam, the government will maintain fiscal and monetary policies to support growth.

However, VietinBank identifies two key 2026 risks. First, the real estate market, where high prices and declining liquidity (especially in the high-end segment) pose cumulative risks. Second, cybersecurity and tech crime risks are rising alongside strong digital transformation.

In credit strategy, the bank will sustain growth through diversified customer portfolios, deeper engagement with existing customers, and new customer acquisition (up 7% in the first nine months of 2025). Retail and SME segments will be 2026 priorities, with a focus on digitalization (online lending) and specialized products (e.g., agricultural loans).

Externally, US export-related loans account for 8.5% of total loans, with minimal impact as these businesses have diversified markets, and no negative NPL effects have been recorded. Q3/2025 storm damage had negligible material impact, with low customer effects due to insurance advice.

VietinBank is accelerating digital transformation, with 45 business initiatives and platforms launched by Q3/2025, focusing on digitalization journeys like online home loans and eKYC for businesses. New business areas are 2026 priorities. For gold trading, VietinBank is finalizing licensing for gold bar production and aims to join the National Gold Exchange. Approximately eight credit institutions, including VietinBank, meet production criteria. The exchange will reduce domestic-global gold price gaps and curb smuggling. For digital assets (crypto), the bank sees significant Vietnamese potential, with the new Digital Asset Law providing a key legal framework for participation.

– 08:47 14/11/2025

Sacombank Honored as “Best FX Bank in Vietnam” by Euromoney for the Third Consecutive Year

Euromoney’s Awards for Excellence stand as one of the most prestigious global accolades in the financial and banking sectors. For over three decades, these awards have celebrated the achievements of more than 600 leading banks and financial institutions worldwide, recognizing their outstanding business performance, exceptional adaptability, and groundbreaking innovation.