Illustrative Image

According to Rabobank, global tilapia production is projected to surpass 7 million tons by 2025, driven by robust recovery in major producing countries such as China, Indonesia, Egypt, Bangladesh, and Vietnam. Among these, Vietnam is emerging as a potential supplier in the global tilapia supply chain, leveraging market fluctuations to expand production and exports.

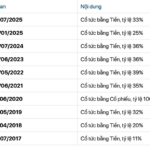

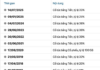

Data from the Vietnam Association of Seafood Exporters and Producers (VASEP) reveals that in the first nine months of 2025, Vietnam’s tilapia exports reached USD 57.3 million, a staggering 332% increase compared to the same period in 2024 (USD 13.26 million). August alone recorded the highest growth, nearing USD 10 million, reflecting Vietnamese enterprises’ agility and adaptability in a volatile market. Vietnamese tilapia products are now present in multiple markets, with the U.S. being a key destination, accounting for a significant share of total exports.

However, growth is expected to slow in Q4 due to temporarily high inventory levels in the U.S. following strong imports in Q2 and Q3. This underscores the need for Vietnam to shift from exploiting short-term opportunities to developing long-term strategies, focusing on product quality enhancement, market diversification, and building a sustainable tilapia brand.

China, the world’s largest tilapia producer (1.6 million tons/year), faces a 55% tariff on exports to the U.S., leading to reduced orders and canceled contracts. While prices have risen slightly, soaring production costs have resulted in record-high inventory and losses for businesses. Brazil, once expected to replace China, also faced a 50% U.S. tariff starting in August, stalling its exports. Many companies have raised prices, eroding their competitive edge.

Both countries have turned to domestic markets, but low prices fail to offset high production costs, leaving small and medium-sized enterprises vulnerable to price competition. Overall, China and Brazil’s tilapia industries face dual challenges: sluggish exports, declining prices, and weakened market sentiment.

The experiences of China and Brazil highlight the risks of relying on a single market or product, making the seafood industry susceptible to policy shifts. When the U.S. imposed tariffs, both nations struggled to redirect orders and maintain exports, resulting in market share losses.

For Vietnam, this is the moment to transform short-term opportunities into long-term strategies. The tilapia sector should proactively diversify markets, expanding into Europe, the Middle East, and South America, while developing value-added products like breaded tilapia, ready-to-eat options, and convenient packaging. Investing in advanced breeding, farming technologies, and deep processing will enhance productivity, reduce costs, and meet sustainability standards.

With Rabobank’s forecast of continued global tilapia production growth and the rising consumer preference for eco-friendly products, Vietnam has the opportunity to establish its own tilapia brand, solidifying its position in the global supply chain. This goes beyond filling temporary gaps, aiming to become a strategic, sustainable, and high-value supplier.

China Halts 24% Tariff, but U.S. Soybeans Still Lose Ground to a Global Agri-Giant Dominating Vietnam’s Market

This nation’s soybeans are gaining global popularity for their affordability, with Vietnam being one of the many countries embracing this trend.