According to the latest report from BSC Securities, the market entered a phase of limited information in October, prompting investors to trade cautiously and actively take profits on stocks that had surged in previous periods.

Positive macroeconomic news provided support during the month, notably FTSE Russell’s announcement to upgrade Vietnam’s stock market from Frontier to Secondary Emerging status. The upgrade will officially take effect on September 21, 2026, contingent on the outcome of the March 2026 review.

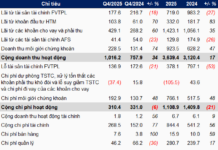

Additional momentum stemmed from robust macroeconomic indicators and strong Q3/2025 corporate earnings. Net profit after tax (NPAT) for VN-Index constituents grew by 27.6% year-on-year, while the overall market’s NPAT increased by over 35.1%.

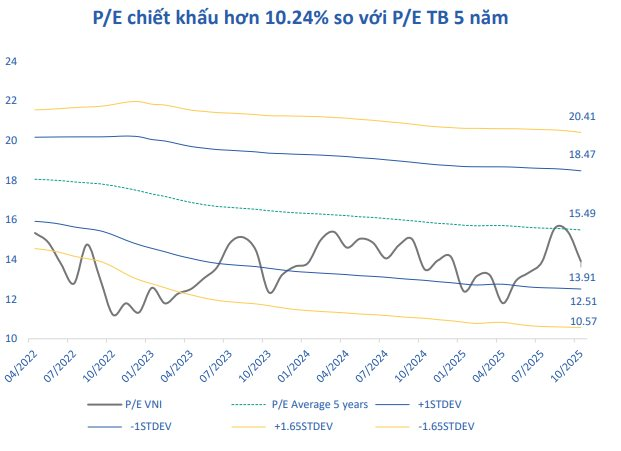

In October, the VN-Index’s P/E ratio fluctuated between 15 and 16.5 before declining sharply, closing the month at 13.91 on October 31, 2025—a nearly 10% drop from the previous month. The P/E ratio is trading more than 10% below its 5-year average and remains above the -1 standard deviation threshold.

Meanwhile, the VN-Index’s P/B ratio reached 1.96, down 4.29% month-on-month. “Current valuations of the VN-Index are considered attractive in the medium to long term, supported by expectations of a market upgrade and the return of foreign investor capital,” the report stated.

The P/E ratio could expand to a range of 13.5-15.x under a positive scenario, with the VN-Index trading between 1,550 and 1,770, continuing its upward trend in the medium to long term.

However, BSC warns of potential risks, including: (1) a persistently high USD/VND exchange rate; (2) rising domestic and global gold prices; (3) increasing deposit interest rates; and (4) net selling pressure from foreign investors.

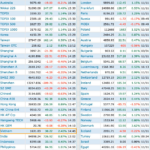

Foreign investors continued to reduce their net selling in October, with total net outflows across all three exchanges exceeding VND 24,150 billion—a 10.4% decrease from September. Net selling trends persisted in other Asian markets, with significant outflows in Thailand (-$71.9 million), Taiwan (-$3.8 million), and South Korea (-$5.2 million).

BSC attributes foreign capital outflows to: (1) escalating global macroeconomic tensions, particularly renewed U.S.-China trade conflicts; (2) persistent exchange rate risks, despite easing, with the USD/VND rate remaining above 26,000; and (3) rising deposit interest rates.

These factors have driven foreign investors toward safer investment havens. Nonetheless, the medium to long-term outlook for attracting foreign capital remains positive, supported by expectations of a market upgrade and the upcoming third wave of IPOs from promising enterprises.

Market Pulse 14/11: Divergent Trends as Foreign Investors Net Sell VN30 Stocks

At the close of trading, the VN-Index rose 4.02 points (+0.25%) to 1,635.46, while the HNX-Index gained 1.32 points (+0.5%) to 267.61. Market breadth favored the bulls, with 357 advancing stocks versus 342 decliners. Similarly, the VN30 basket saw a slight green tilt, with 11 gainers, 13 losers, and 6 unchanged.

Stock Market Week 10-14/11/2025: Balanced Supply and Demand, Market Polarization Persists

The VN-Index edged higher in the final session of the week, capping a notably positive recovery week following an extended period of adjustment. Amid balanced supply and demand dynamics, with investor participation remaining subdued, the market’s low-liquidity divergence is likely to persist. Next week, the VN-Index faces a critical test at the Middle line of the Bollinger Bands.

Market Pulse November 14: Striving to Hold the 1,630-Point Threshold

At the mid-session break, the VN-Index dipped slightly by 0.82 points (-0.05%), closing at 1,630.62 points, while the HNX-Index hovered near the reference mark at 266.33 points. Market breadth remained balanced, with 346 decliners, 322 gainers, and 934 unchanged stocks.