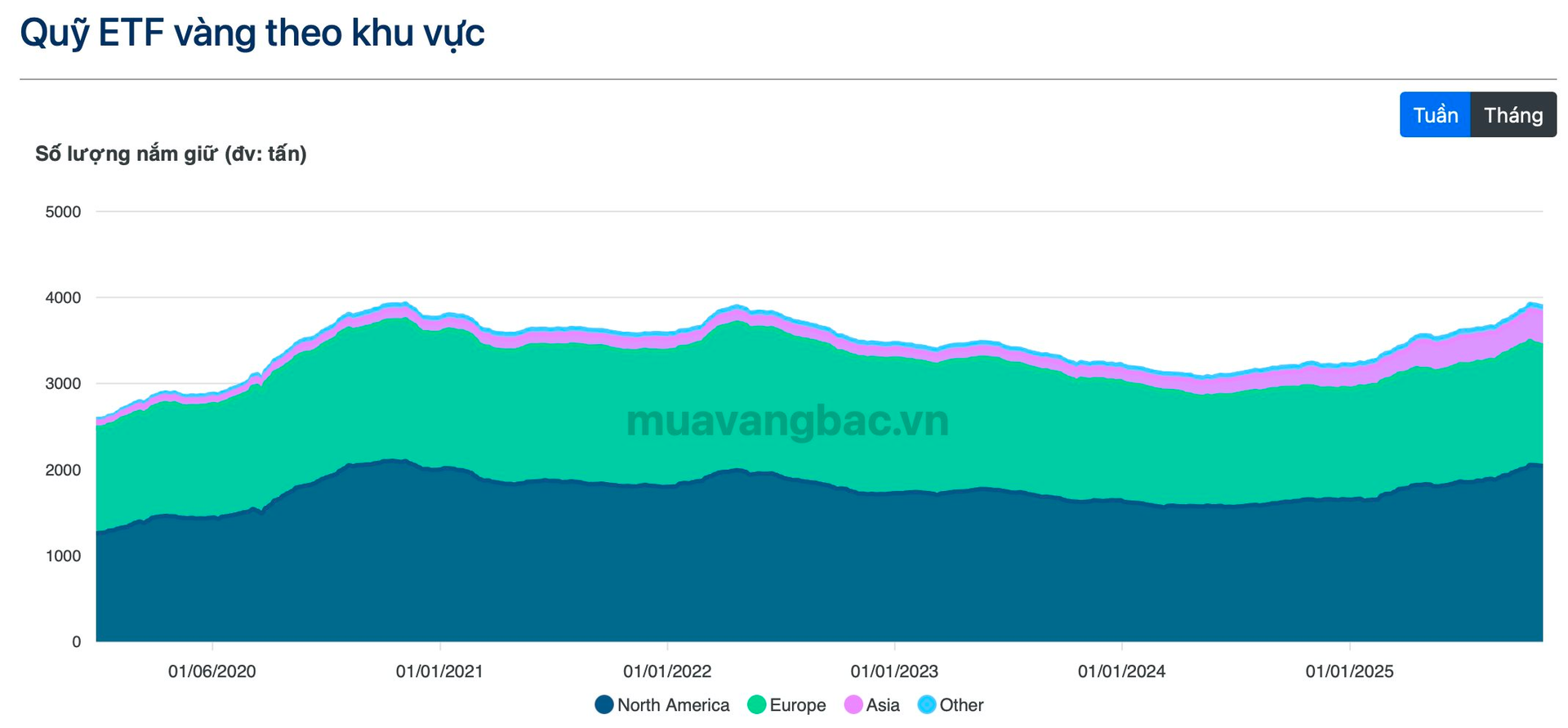

As of October 2025, global gold ETF holdings have surged to nearly 3,900 metric tons, matching the record levels seen in late 2020 and early 2022. The majority of this gold is held by funds based in North America and Europe.

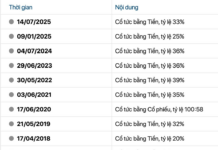

Data Source: Muavangbac.vn

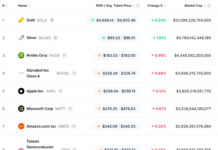

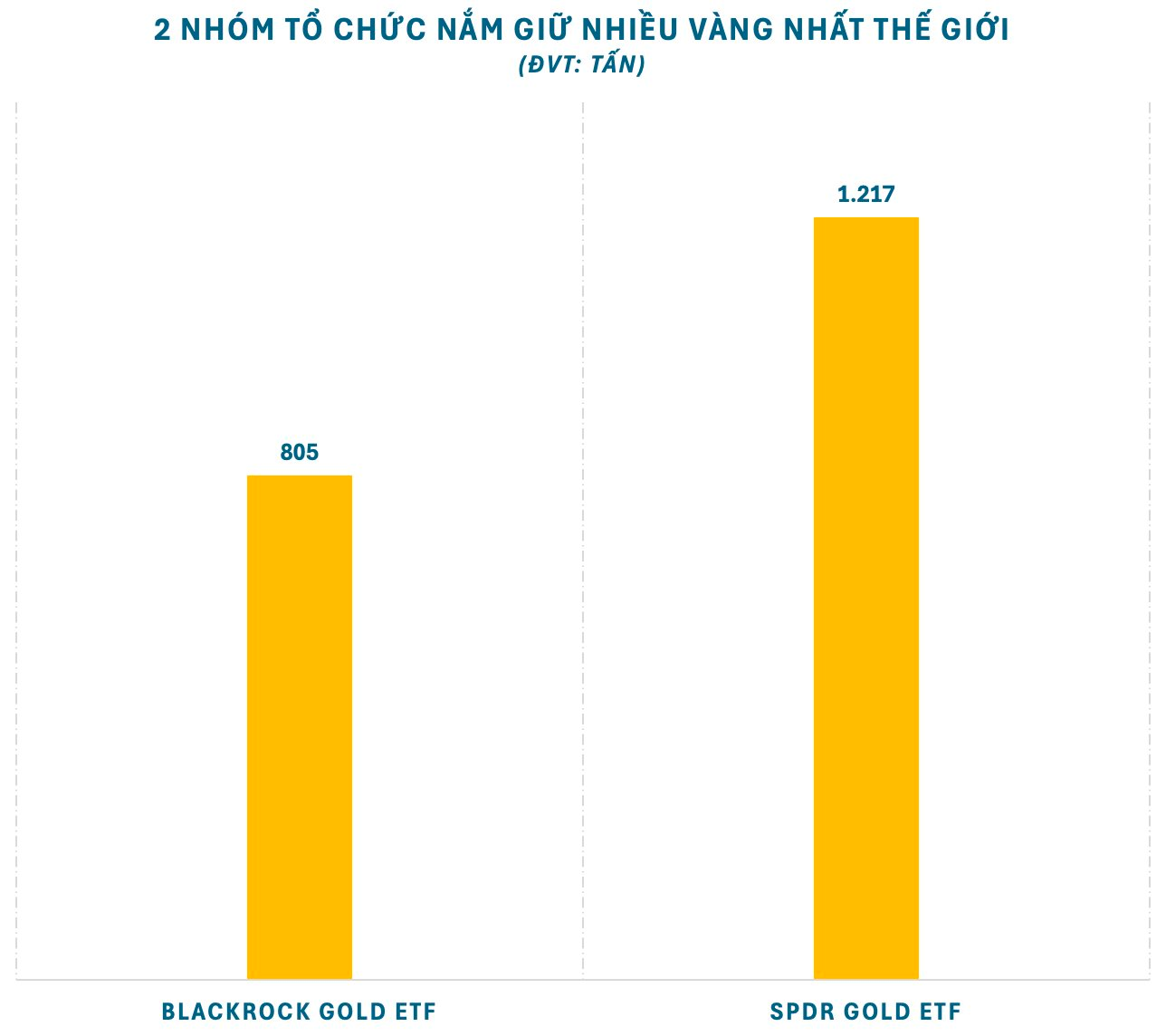

Notably, BlackRock and SPDR funds collectively hold over 2,000 tons of gold, valued at approximately $275 billion. SPDR Gold Shares and SPDR Gold MiniShares Trust alone account for more than 1,200 tons.

Meanwhile, BlackRock’s two largest gold funds, iShares Gold Trust and iShares Physical Gold ETC, hold over 720 tons combined. Smaller BlackRock funds also hold scattered amounts, totaling several dozen tons.

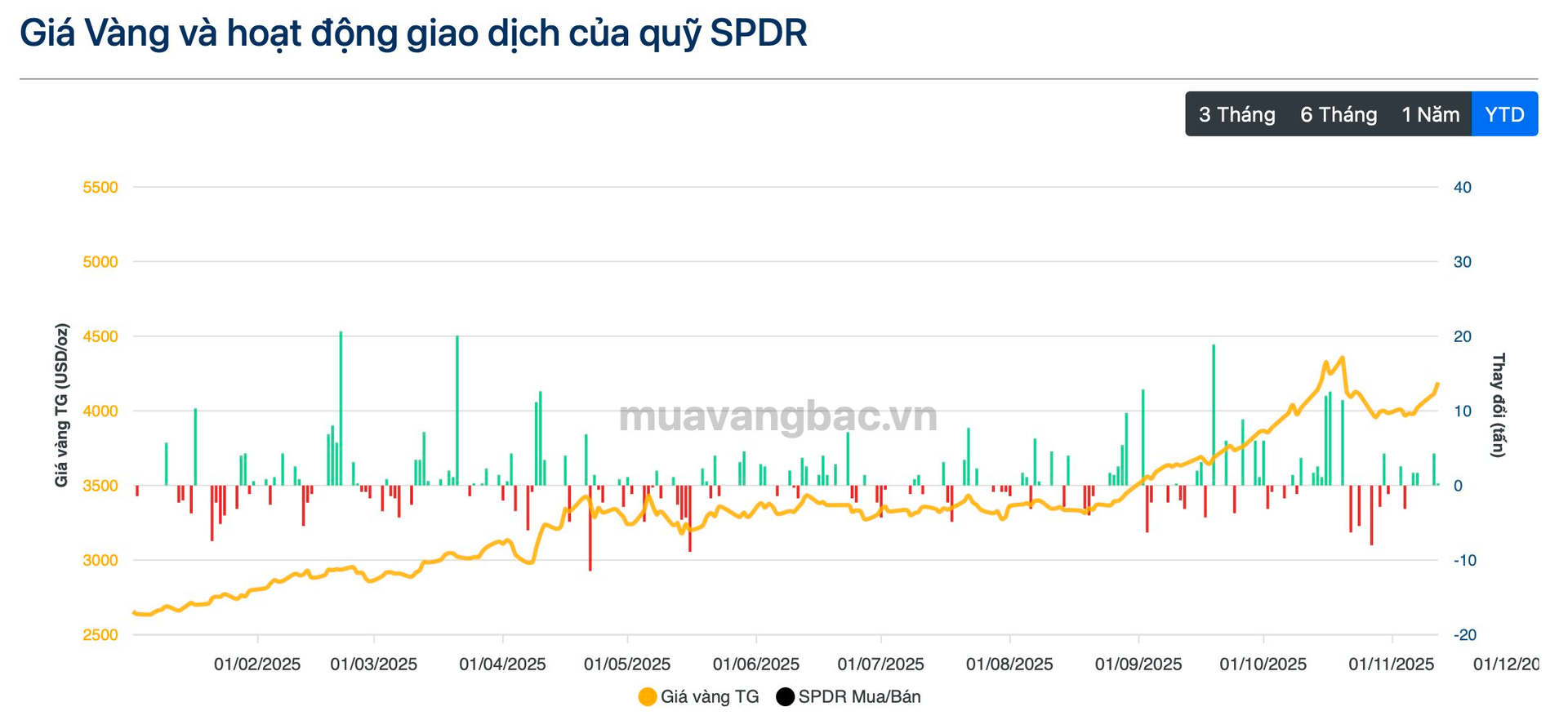

Since the beginning of the year, gold ETFs have seen robust inflows, with the world’s largest fund, SPDR Gold Shares, attracting $10 billion to purchase an additional 170 tons—the highest since 2020. This trend underscores investors’ confidence in gold as a safe-haven asset amid global uncertainty.

Beyond ETFs, central banks worldwide have significantly boosted gold reserves, with China, India, and Turkey purchasing over 500 tons in 2025 to diversify reserves and reduce USD dependency, according to Goldman Sachs.

Geopolitical tensions, global trade instability, U.S. economic uncertainty, and a weakening USD have further fueled gold demand. Since January, gold prices have surged 60%, reaching a record high of $4,200 per ounce.

Data Source: Muavangbac.vn

Shaokai Fan, Global Central Bank Lead at the World Gold Council (WGC), predicts a sharp increase in ETF gold accumulation in Q4, potentially surpassing previous highs. This momentum is supported by sustained buying activity despite elevated prices.

WGC maintains its optimistic outlook, citing strong demand from ETFs, physical gold, and central banks. Fan highlights, “Expanding demand remains a key driver, with investment flows into ETFs, bars, and coins expected to stay robust. Central bank purchases will continue to underpin gold demand.”

Gold Ring and Gold Bar Prices Surge by Up to 2 Million VND per Tael on November 11th

At the close of today’s trading session, Bao Tin Minh Chau listed the selling price of gold rings at 152.3 million VND per tael, while gold bars also reached the threshold of 152 million VND per tael.