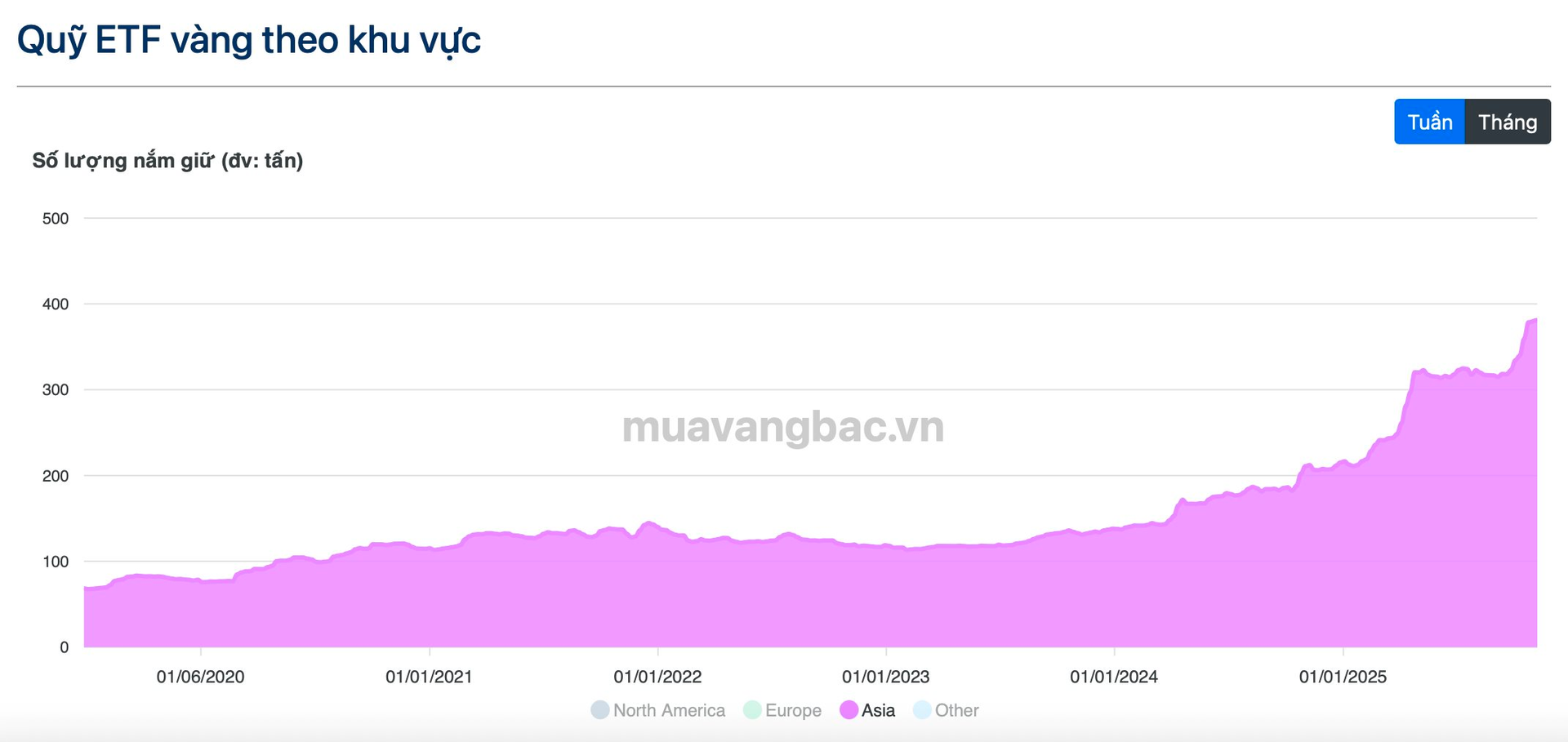

Amid a global surge in gold accumulation by ETFs, Asia is emerging as a formidable new player with astonishing purchasing momentum. In the first ten months of the year, Asian gold funds have attracted over $18 billion in net inflows, acquiring nearly 163 tons of gold—accounting for nearly a quarter of global additions.

This figure even surpasses Europe’s, despite Asia’s smaller holdings. As of October, Asian gold funds held approximately 380 tons of gold valued at around $50 billion, less than a third of Europe’s holdings. Robust capital inflows are propelling Asian gold funds’ growth at an unprecedented pace.

Data from Muavangbac.vn

Asia’s largest gold funds are predominantly from China. Holdings in Huaan Yifu Gold ETF, Bosera Gold Exchange Trade Open-End Fund ETF, E Fund Gold Tradable Open-end Securities Investment Fund, and Guotai Gold ETF have surged by over 50%, even doubling since the year’s start. Indian funds have also aggressively purchased gold this year.

The Economic Times reports, “Asia led inflows in October, outpacing North America and Europe (which saw outflows), reflecting local confidence in gold over traditional assets.”

Asia, particularly China, is experiencing an unprecedented “gold thirst.” Experts from the World Gold Council (WGC) attribute this surge to hedging against domestic economic risks, including slowing growth due to escalating U.S.-China trade tensions and a weakening yuan.

Beyond ETFs, central banks are bolstering gold reserves to reduce USD dependency. Goldman Sachs reports that China, India, and Turkey collectively purchased over 500 tons of gold in 2025. China’s central bank alone has bought gold for 11 consecutive months, pushing national reserves to record highs.

Shaokai Fan, Managing Director of Global Central Banks at the WGC, forecasts that ETF gold accumulation will accelerate globally in Q4, potentially surpassing previous records. This trend is supported by positive factors, including stable demand despite higher gold prices.

The WGC maintains its optimistic outlook, citing strong prospects for China and India. “Expanding demand is a key driver for gold prices. Demand is expected to remain robust, fueled by increased investment in ETFs, bars, and coins, alongside continued central bank purchases,” Fan noted.

Central Banks Hold Gold But Not So Enthusiastically. Demand Remains Low. So What Is Really Driving Gold Prices Higher?

The unprecedented rally in the global gold market has been the talk of the markets for days now. But what’s really driving it and how high will it go? That remains very much up in the air.