Recently, a sales report for several Chinese car brands in the Vietnamese market surfaced on social media. According to various sources, while not entirely accurate, the data provides valuable insights into the performance of these brands in the domestic market.

| Brand | Sales for the First 10 Months |

|---|---|

| MG | 7,037 |

| BYD | 2,907 |

| Omoda & Jacoo | 1,641 |

| Geely | 639 |

| Wuling | 551 |

| Lynk & Co | 494 |

| GAC | 226 |

| Haval | 79 |

| DongFeng (October Sales Only) | 5 |

With Less Than 5% Market Share, Sales Show Disparity

If the leaked information is accurate, Chinese car brands sold approximately 13,579 vehicles in Vietnam during the first 10 months of 2025. MG leads with over 7,000 units, followed by BYD with nearly 3,000. Other brands recorded modest sales, including Omoda & Jacoo with over 1,600 units.

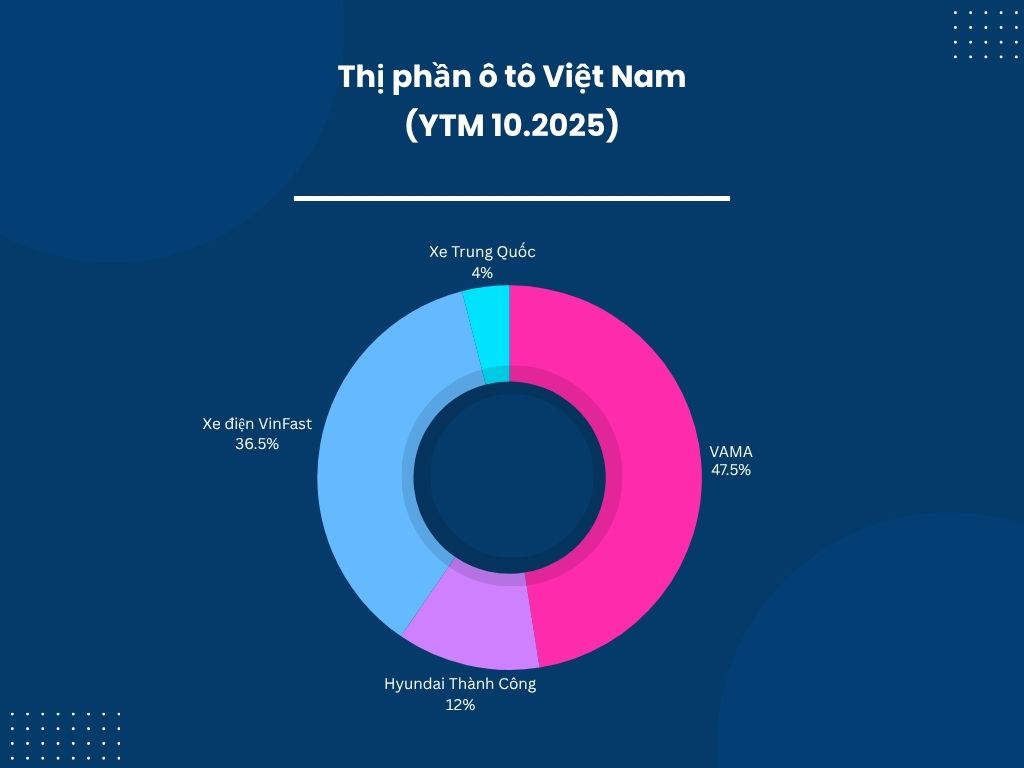

When combined with the sales figures from VAMA, Hyundai Thanh Cong, and VinFast, Chinese cars currently hold around 4% of the market share. In comparison, VAMA brands hold 47.5%, Hyundai Thanh Cong 12%, and VinFast 36.5%.

While this cannot be considered a resounding success given the aggressive market entry of Chinese manufacturers, it does indicate that the market is gradually accepting Chinese car models, albeit with varying degrees of success among brands.

MG is leading among Chinese brands, with sales approaching those of Isuzu (over 9,000 units) and surpassing Suzuki (over 5,000 units). One key factor in MG’s success is its highly competitive pricing for several flagship models.

For instance, the MG HS, a C-segment SUV, starts at just 699 million VND, comparable to many B-segment SUVs. This pricing aligns with the budget-conscious preferences of most Vietnamese buyers. The MG5 sedan is even more impressive, with service versions priced around 300 million VND at times.

In addition to competitive pricing, MG boasts a robust dealership and after-sales service network. With over 40 dealerships, MG ensures convenient access for customers, efficient vehicle supply, and comprehensive after-sales support.

The BYD M6 is expected to boost the brand’s sales.

Despite being a newcomer compared to established brands in Vietnam, BYD is showing a steady increase in sales. Firstly, BYD has built a global reputation in the electric vehicle (EV) sector, making it appealing to tech-savvy consumers.

Secondly, BYD has strategically introduced a diverse range of models in Vietnam, including those targeting the service market. The M6, for example, is aimed at taxi and ride-hailing services. BYD’s introduction of hybrid models also provides consumers with more options, addressing concerns about EV charging infrastructure. Additionally, BYD is expanding its dealership network with a clear roadmap to increase its market presence.

Omoda and Jaecoo, though new, have already launched two flagship models (Omoda C5 and Jaecoo J7) and achieved a combined sales figure of 1,641 units, which is encouraging compared to competitors. Notably, they are the first Chinese manufacturers to announce the construction of a factory in Vietnam with a clear timeline.

Brands like Geely, Lynk & Co, and GAC have smaller sales figures, despite their strong corporate backing. In Vietnam, they have yet to translate their potential into significant sales.

Wuling, Haval, and DongFeng are at the bottom of the sales chart, with DongFeng selling only 5 units in October. Their limited dealership networks indicate ongoing sales challenges.

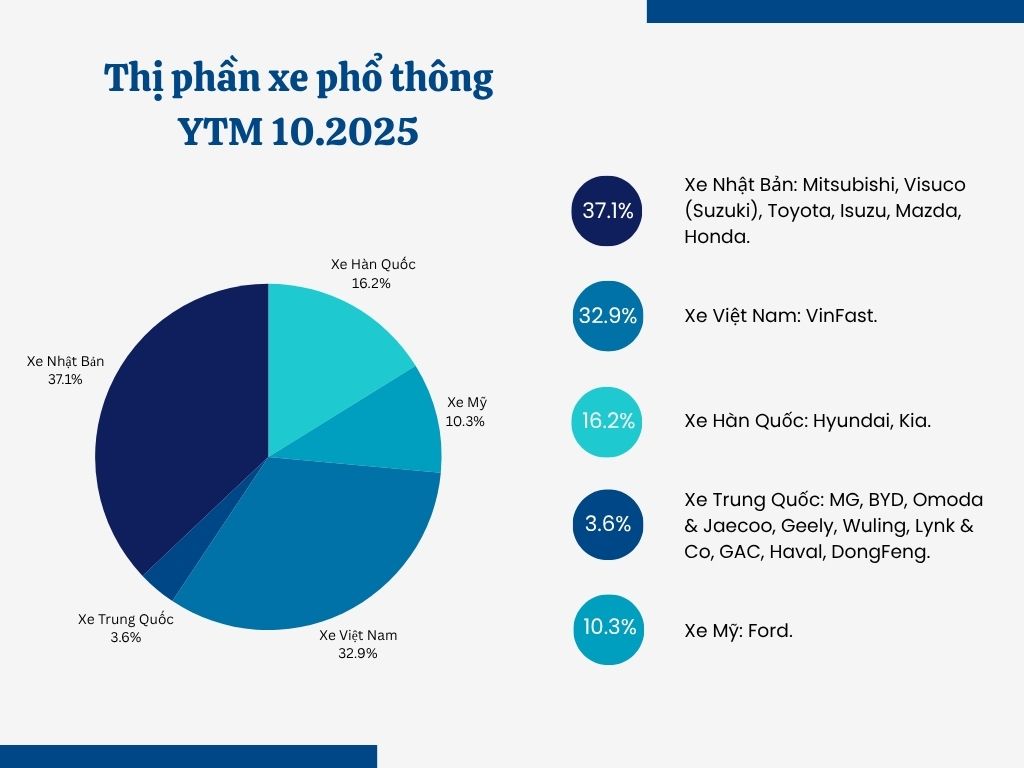

Among affordable cars from various countries sold in Vietnam, Chinese cars hold only 3.6% of the market share.

Based on sales figures and dealership networks, Chinese car brands in Vietnam can be categorized into three groups.

The first group includes MG and BYD, which have achieved significant sales and established distribution networks. The second group comprises brands with potential but yet to fully break through, such as Omoda, Jaecoo, Geely, and Lynk & Co. The third group consists of brands with low sales and limited networks, like Haval, GAC, and DongFeng, which are vulnerable to market fluctuations.

Will Any Brand Exit the Market?

Based on current trends, several scenarios can be projected for the remainder of 2025 and into 2026.

If the shift towards electrification and hybridization continues to influence consumer decisions, especially in urban areas, brands with established EV/hybrid product lines and distribution networks will have an advantage.

The Lynk & Co 08, a plug-in hybrid SUV, was recently launched in Vietnam.

BYD, with its diverse product range and clear dealership expansion plan, is likely to maintain its growth trajectory. MG, with its competitive pricing and extensive after-sales network, is also expected to retain its market share. Brands with smaller sales but active dealership expansion and marketing efforts still have significant opportunities if their strategies are consistently executed.

However, brands with very low sales face significant risks. Thin dealership networks and high operational costs make short-term sales improvement challenging, leading to potential long-term financial losses.

This raises the question of whether some Chinese brands might exit the Vietnamese market.

Recent history suggests this is possible. AION, for example, initially launched with much fanfare but withdrew after poor sales.

AION struggled with poor sales and quietly exited the Vietnamese market.

In Vietnam, buyers value not only price and features but also durability, resale value, and after-sales service quality. Chinese brands aiming to succeed must demonstrate strength in product quality, after-sales service networks, and long-term commitment.

The market remains open to new manufacturers, but only those willing to invest systematically and build customer trust will thrive, rather than those relying on short-lived launch campaigns.

Hybrid Sedan Upgrade Launches in China: Hanoi to Ca Mau on a Single Tank, Priced at Just $13,000

This model is set to rival established contenders like the Honda Civic and Mazda 3 upon its domestic release.

OPPEIN: Global Journey from 8,700 Showrooms to Vietnam’s Shores

On June 28, 2025, OPPEIN proudly unveiled its flagship store in Ho Chi Minh City, marking a milestone in its three-decade journey of innovation and design excellence. With cutting-edge technology and a philosophy that has captivated over 45 million households worldwide, OPPEIN continues to redefine the art of living.

Tineco Unveils S7 Stretch Steam Floor Cleaner, Teasing Smart Cooking Devices for Vietnam Market

Tineco introduces the S7 Stretch Steam to Vietnam, a revolutionary steam mop featuring HyperSteam technology that delivers 140℃ steam for superior cleaning. Alongside this launch, Tineco announces its strategic expansion into diverse home appliance categories.