Record Profits: Industry Giants Report Multi-Fold Earnings Growth

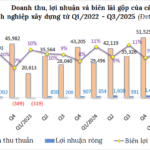

The total revenue from 99 construction companies listed on the stock exchange, as per their Q3/2025 financial reports, reached over VND 44.5 trillion, a 26% increase year-on-year. Net profits hit a record high of nearly VND 5.2 trillion, surging by 422%. The industry’s gross profit margin for the quarter stood at 11%.

Data reveals that 49 out of 99 companies experienced profit growth, with 30 of them reporting multi-fold increases.

This dramatic rise is primarily attributed to the high profits of leading firms, though not from core business operations.

For instance, Vinaconex (HOSE: VCG) achieved a historic net profit of nearly VND 3.3 trillion, accounting for 63% of the industry’s total profit, thanks to its divestment from the Cát Bà Amatina resort project.

In the first nine months, VCG’s profit reached nearly VND 3.8 trillion, a 394% increase year-on-year, surpassing its annual profit target by 215%.

Leading the profit growth chart is Construction and Investment Corporation 40 (HNX: L40), with a record profit of over VND 135 billion, 62 times higher than the previous year. This was driven by the profit from transferring shares in Hà My Complex JSC, the developer of the Hà My Urban Complex in Đà Nẵng. Over nine months, L40’s net profit exceeded VND 139 billion, 30 times higher year-on-year, far surpassing its annual plan.

Hòa Bình Construction Group (UPCoM: HBC) also had a strong quarter with VND 182 billion in profit, 23 times higher, largely due to court-awarded compensation for delayed payments. However, its nine-month profit dropped by 72% to VND 238 billion, equivalent to 72% of its 2025 target.

Meanwhile, Coteccons (HOSE: CTD) started its 2026 fiscal year (July 1 – September 30, 2025) with a net profit of nearly VND 300 billion, over three times higher year-on-year, driven by a 59% increase in construction contracts, fulfilling 40% of its annual plan.

Ten Companies Report Revenues Over One Trillion Dong

In Q3, ten construction companies achieved revenues exceeding one trillion dong. Alongside established leaders like CTD, VCG, CC1, and PC1, FECON (HOSE: FCN) joined with nearly VND 1.143 trillion in revenue, up 53%, and a net profit of nearly VND 15 billion, up 105%.

Đạt Phương Group (HOSE: DPG) recorded revenue of nearly VND 1.176 trillion and a profit of VND 72 billion, increasing by 58% and 265%, respectively. Licogi 13 (HNX: LIG) generated VND 1.231 trillion in revenue, up 76%, but its profit halved to nearly VND 600 million.

“Mixed Fortunes”

While some companies thrived, others continued to face heavy losses.

Đua Fat Group (UPCoM: DFF) extended its losing streak to nine consecutive quarters, with a record loss of over VND 368 billion, bringing cumulative losses to over VND 1.273 trillion and negative equity of over VND 473 billion.

Vietnam Industrial Construction Corporation (VVN) reported its 12th consecutive quarterly loss of VND 106 billion, with cumulative losses nearing VND 3.233 trillion and negative equity of over VND 2.386 billion.

Notably, after 38 consecutive quarters of losses since Q1/2016, Vinaconex 39 (UPCoM: PVV) ended Q3 with a sudden profit of over VND 200 billion, not from core business but from asset transfers to offset bank debt. This reduced PVV’s cumulative losses to over VND 334 billion, though equity remains negative at over VND 12 billion.

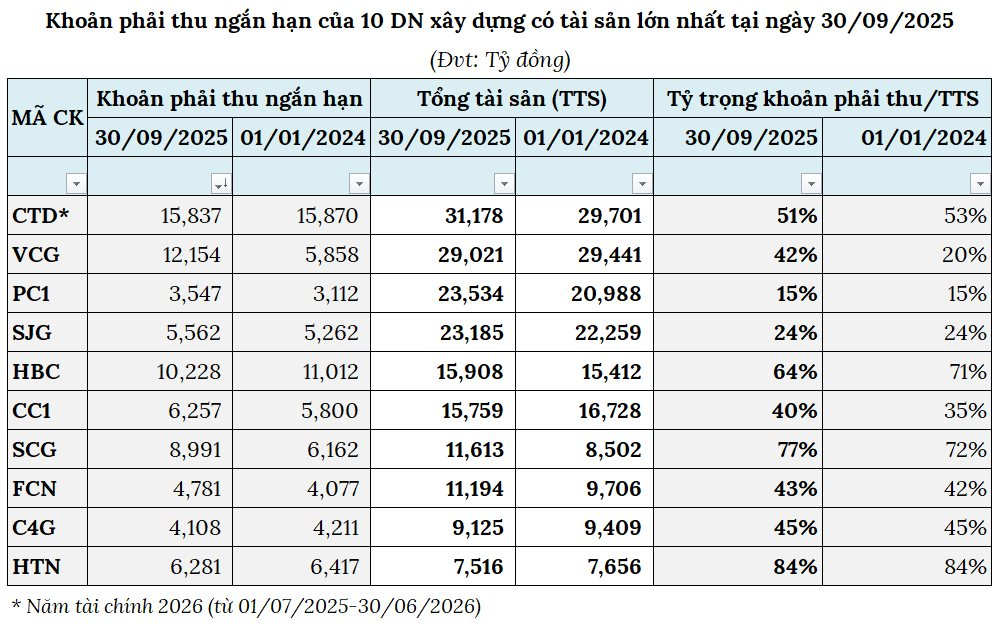

Mounting Receivables

One of the construction industry’s biggest challenges is debt recovery. As of September 30, 2025, short-term receivables, particularly from customers, constitute a significant portion of the top ten companies’ total assets.

Source: VietstockFinance

Hưng Thịnh Incons (HOSE: HTN) has short-term receivables of nearly VND 6.3 trillion, 84% of its total assets, with customer receivables exceeding VND 2.7 trillion.

SCG Construction Group (HNX: SCG) holds short-term receivables of nearly VND 9 trillion, up 46% since the beginning of the year and 77% of its total capital, with customer receivables of nearly VND 3.7 trillion.

In terms of value, CTD has the largest short-term receivables at over VND 15.8 trillion, 51% of its total assets, with 96% from customers and over VND 1.3 trillion in bad debt provisions.

VCG’s short-term receivables surged to nearly VND 12.2 trillion, more than double since the beginning of the year and 42% of its total assets, including VND 6.3 trillion in short-term loans, 9.4 times higher than earlier this year. Bad debt provisions exceed VND 527 billion.

The 2025 Q3 Layoff Wave: 14 Banks Cut Nearly 7,300 Jobs, While Two FPT Subsidiaries Ramp Up Hiring Despite Parent Group’s Reduction

Among companies disclosing workforce figures, FPT Retail (FRT) leads with the highest personnel growth, adding 1,983 employees. FPT Telecom (FOX) follows closely in second place, with an increase of 986 employees.