Vietnam’s e-commerce market has experienced a decade of rapid growth, primarily driven by user base expansion, product diversification, and large-scale promotional campaigns. The “money-burning” phase, characterized by deep discounts, abundant vouchers, and hefty marketing expenditures, once served as the primary catalyst for online shopping behavior. However, according to independent data and analysis from Metric, the market is entering a new development phase, reflecting the maturity of both consumer demands and e-commerce platforms’ business strategies.

With the significant slowdown in new user growth compared to the 2018-2021 period, Vietnam’s e-commerce market is transitioning from rapid growth to quality-focused growth. Key metrics tracked by Metric Analytics, such as Average Unit Price (AUP), conversion rates, and the proportion of sales from official brand stores, all indicate an upward trend. This shift suggests that consumers are increasingly prioritizing product quality, authenticity, and a secure shopping experience over the lowest prices.

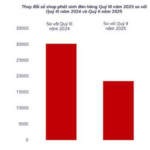

Metric’s H1/2025 market report reveals that over 80,000 sellers exited the market in the first six months of the year due to intense competition, yet the industry’s total revenue still surged by more than 41%. This landscape underscores a restructuring toward efficiency and sustainable growth. E-commerce platforms are moving away from the model of heavy spending for short-term growth, instead focusing on building more resilient models that optimize operations and enhance value for both sellers and buyers.

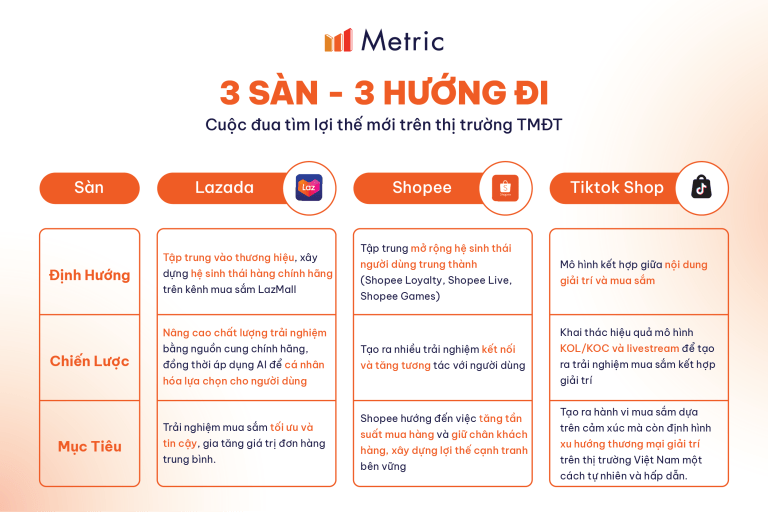

As the market enters a phase of strategic recalibration, the three major e-commerce platforms—Shopee, Lazada, and TikTok Shop—are beginning to showcase distinct strategic directions.

Lazada is focusing on a brand-centric ecosystem through LazMall, prioritizing authentic, tightly controlled supply sources and personalizing the shopping experience with AI. The platform has also expanded its supply network through partnerships with Gmarket and Tmall, thereby increasing the average value of goods sold.

Shopee is strengthening its loyal user ecosystem with programs like Shopee Loyalty, Shopee Live, and Shopee Games. This strategy aims to increase shopping frequency and retain customers by blending entertainment with commerce, fostering high engagement and sustained consumer activity on the platform.

TikTok Shop continues to develop its content-commerce model, leveraging KOL/KOC networks and livestreaming. High-revenue livestreams demonstrate the effectiveness of this entertainment-driven shopping model, where content plays a pivotal role in driving purchasing decisions. The platform has swiftly emerged as a trendsetter in Vietnam’s e-commerce market.

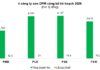

Metric’s data also highlights consumers’ increasing discernment in purchasing decisions. In H1/2025 compared to H1/2024, the average unit price increased across all three platforms. Lazada recorded a 43.4% rise in categories like Household Goods, Toys, and Baby & Toddler Products. Shopee saw a 7.66% increase, driven by high-spending customers and loyalty programs. TikTok Shop achieved a 31% growth, primarily in Fashion and Beauty through livestreaming. The revenue share from official brand stores has also risen across platforms, reflecting consumers’ heightened emphasis on product authenticity and quality.

These shifts indicate that Vietnam’s e-commerce market is entering a mature phase, where platforms compete on efficiency, reputation, and experience rather than short-term spending. The outlook for 2026 predicts continued strategic differentiation among platforms, as each leverages its unique strengths to pursue long-term growth.

Cake Enters the Seamless Payment Race with “Click to Pay”

Statistics reveal that over 20% of online orders are abandoned due to “complicated checkout processes.” This figure is expected to decline as more players, including digital bank Cake, enter the Click to Pay race.

Gobox WMS: The Ultimate Warehouse Management Solution for E-commerce Sellers

In the booming e-commerce landscape, efficient inventory management has become a critical factor for sellers to optimize operations and reduce costs. Gobox WMS emerges as a comprehensive solution, empowering businesses to intelligently control their inventory, minimize errors, and enhance overall business performance.