Specifically, VPBank has increased its interest rates by 0.3% per annum compared to the previous month. According to the new rate schedule, over-the-counter savings deposits with terms of 1-5 months for amounts under 10 billion VND are set at 4.2% per annum, and rise to 4.3 – 4.4% per annum for deposits of 10 billion VND or more. KienlongBank has also adjusted its mobilization interest rates, increasing rates by 0.2 percentage points per annum for terms of 1-4 months and by 0.2 percentage points per annum for terms of 6-7 months. Several other commercial banks, including Bac A Bank, SHB, HDBank, NCB, MB, and VCBNeo, have collectively raised their interest rates in November.

Rising Mobilization Interest Rates

According to Dr. Le Duy Binh, Director of Economica Vietnam, the creeping rise in deposit interest rates in the fourth quarter reflects increased capital mobilization to meet the growing credit demand, which typically surges toward the end of the year due to seasonal cycles. This is an inevitable market trend. Data from the State Bank of Vietnam (SBV) shows that as of October 30, the credit balance across the entire system had increased by approximately 15% compared to the end of 2024, and is projected to rise further to 19-20% by year-end.

Another reason, according to the expert, is that deposit interest rates have remained low for an extended period. If banks do not adjust rates upward, funds may shift to alternative investment channels like gold, real estate, and securities, making it challenging for banks to attract capital. Consequently, the ability to meet the borrowing needs of individuals and businesses would be impacted.

Further analyzing interest rate trends, Vietcombank Securities Company suggests that credit is likely to accelerate in the final months of the year as the SBV relaxes targets, compelling banks, particularly joint-stock commercial banks, to intensify capital mobilization efforts. This increases the risk of localized liquidity shortages. Additionally, the overheating of the real estate and financial asset markets boosts credit demand, indirectly driving the adjustment of mobilization interest rates to reasonable levels to control capital flows.

In the October inquiry report submitted to the National Assembly, SBV Governor Nguyen Thi Hong acknowledged that interest rates are under significant pressure, primarily due to factors such as the global interest rate landscape, which, despite a downward trend, still sees the U.S. Federal Reserve maintaining high rates, and the unpredictable global financial market influenced by U.S. trade policies. Meanwhile, credit demand for production, business, and consumption is expected to rise, while capital mobilization across the entire credit institution system may be affected by competition from other investment channels.

Currently, Vietnam’s lending interest rates are lower compared to previous periods and to those of major global economies.

Banks Navigating Challenges

The rise in mobilization interest rates puts upward pressure on lending rates, raising concerns among individuals and businesses about potential increases in capital costs during the year-end season. Dr. Le Duy Binh explains that when input costs rise, output capital costs are unlikely to remain unchanged. The key lies in credit institutions’ efforts to reduce operational costs and adopt new lending methods to maintain lending interest rates at reasonable levels. “Banks are facing the challenge of balancing support for economic growth with securing cost-effective capital for lending,” Dr. Binh emphasizes.

On the other hand, according to Mr. Binh, Vietnam’s current lending interest rates are lower compared to previous periods and to those of major global economies. As of September 30, 2025, the average lending interest rate for new transactions by commercial banks stood at 6.54% per annum, a decrease of 0.4% per annum compared to the end of 2024.

Sharing a similar view, MB General Director Pham Nhu Anh believes that even if interest rates rise slightly by 0.5-1%, they remain low compared to previous periods and global rates. This is not a significant concern and will not substantially impact the economy. Mr. Anh predicts that if conditions are favorable early next year, interest rates may decrease slightly when the Fed lowers rates below 3% and policies stabilize, leading to a return of foreign capital to Vietnam.

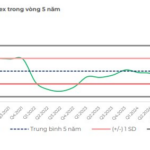

According to Dr. Chau Dinh Linh from Ho Chi Minh City Banking University, localized interest rate increases by a few banks do not influence the entire market. Only when major banks raise rates over an extended period should there be cause for concern. Currently, there are no indications that the SBV needs to intervene strongly in monetary policy, and macroeconomic factors have not shown additional negative fluctuations. Therefore, Dr. Chau Dinh Linh forecasts that from now until the end of 2025, with favorable macroeconomic factors such as a stable international environment, flexible monetary policy, sustained economic growth, and controlled inflation, interest rates are likely to remain stable.

Experts predict that the SBV will maintain current operating interest rates while employing various liquidity support measures to help banks stabilize lending interest rates. Additionally, interest rate reductions by major central banks will create favorable conditions for Vietnam in managing exchange rates and interest rates. If the Fed continues to lower rates, the gap between domestic and foreign interest rates will narrow significantly.

The Business Trend Survey of Credit Institutions for Q4/2025, recently published by the SBV’s Forecasting, Statistics, and Monetary Stability Department, also indicates positive signals for interest rates. Credit institutions forecast that liquidity will continue to improve in Q4/2025 and throughout 2025 compared to 2024. Consequently, from now until year-end, VND mobilization interest rates are expected to remain stable, while VND lending interest rates are anticipated to continue their slight downward trend.

Central Bank’s Latest Move in the Currency Market

The State Bank of Vietnam’s recent move comes amidst persistently high interbank VND interest rates, which have remained above 6% across all tenors.

Interest Rates Show Signs of Rising Despite State Bank’s Net Capital Injection

After a prolonged period of remaining at a low level, deposit interest rates are showing signs of a slight increase in the final months of the year. Despite the system’s ample liquidity, interest rates in both the primary and secondary markets are trending upward, reflecting notable shifts in the balance of capital supply and demand within the system.