The spotlight remains on Dragon Capital’s transactions, primarily revolving around two real estate and chemical stocks.

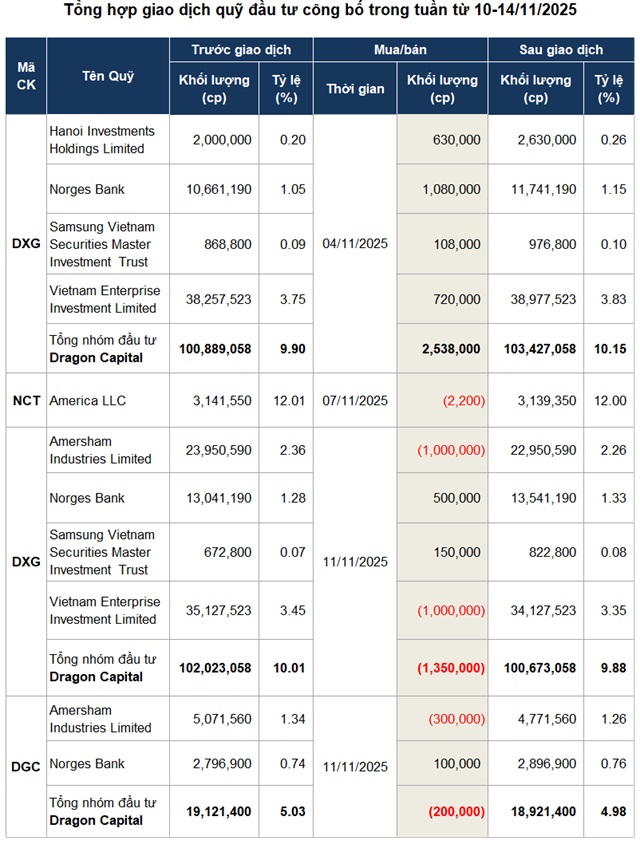

Specifically, on November 11th, Dragon Capital sold 1.35 million shares of DXG (Dat Xanh Group), reducing its ownership from 10.01% to 9.88%, equivalent to 100.7 million shares. Based on the closing price, this transaction is estimated to have brought the fund over 23 billion VND.

A week earlier, on November 4th, Dragon Capital spent approximately 51 billion VND to purchase over 2.5 million DXG shares, increasing its holding from 9.9% to 10.15% (over 104 million shares).

| Price movement of DXG stock from the beginning of 2025 to November 14th |

The quick buy-and-sell activity occurred amidst significant volatility in DXG. On November 4th, the foreign fund bought shares as the stock hit its ceiling price of 20,150 VND/share – the highest level in November. However, after reaching this short-term peak, DXG experienced four consecutive declining sessions, only halting its downward trend on November 11th. From the time the fund bought to when it sold, DXG lost approximately 7%, dropping from 20,150 VND to 18,800 VND/share.

| Price movement of DGC stock from the beginning of 2025 to November 14th |

Similarly, Dragon Capital sold 200,000 shares of DGC (Duc Giang Chemicals Group) on November 11th, ceasing to be a major shareholder as its ownership dropped to 4.98%, equivalent to nearly 19 million shares. Based on the closing price, this transaction yielded approximately 18 billion VND for the fund.

Notably, after the fund’s selling activity, DGC shares saw two consecutive sessions of gains, including a ceiling price increase to 100,000 VND/share on November 13th. This surge is attributed to positive reactions to the Hanoi People’s Committee’s approval of the investment policy for the Duc Giang Public Works, School, and Housing Complex project, with a total capital of over 4.5 trillion VND, fully funded by equity and implemented from 2025 to 2030.

In terms of business results, Duc Giang reported net revenue of over 8.5 trillion VND in the first nine months, a 14% increase year-on-year; after-tax profit reached over 2.4 trillion VND, up 7%. The company has achieved 82% of its revenue target and 84% of its profit goal for the year.

Source: VietstockFinance

|

– 07:28 16/11/2025

Nearly 2,400 Homes in Aqua City Approved for Sale by Dong Nai Province

Novaland’s Aqua City project in Dong Nai has received approval for an additional 204 low-rise houses, bringing the total number of properties eligible for sale to an impressive 2,400 units.

Big Group Holdings: Unlocking 2025 Profits with Three Revolutionary Business Strategies to Boost Stock Valuation

By the end of 2025, Big Group Holdings JSC (UPCoM: BIG) is set to expand its three strategic pillars through its subsidiaries: Big Expo, Big Hotel, and Big Bro. This growth trajectory is projected to drive consolidated revenue above 500 billion VND and post-tax profit exceeding 20 billion VND. These positive developments have fueled a steady rise in BIG’s stock price over recent weeks.

Expert Analysis: Assessing the Current Appeal of Gold, Stocks, Real Estate, and Digital Assets as Investment Channels

On the morning of November 13th, the seminar “The Allure of Asset Classes,” hosted by the Financial and Investment Newspaper, garnered significant attention from experts and investors alike.