According to the 2024 What Vietnamese Workers Want survey by Reeracoen Vietnam, a staggering 64% of businesses in Vietnam admit to struggling with recruitment and employee retention. Meanwhile, Michael Page’s Talent Trends 2024 report highlights that “meeting welfare expectations” ranks among the top three challenges faced by Vietnamese enterprises.

These statistics underscore a stark reality: the battle for talent has entered an unprecedentedly fierce phase, where salaries and bonuses alone are no longer sufficient to retain top performers. In key positions, employees increasingly value feeling appreciated, protected, and aligned with the organization’s future. Recognizing this shift, many companies are pivoting their HR strategies—from “retaining talent through rewards” to “retaining talent through trust,” leveraging long-term benefits as the cornerstone of sustainable growth and engagement.

“Top performers may join for opportunities, but they stay only when they feel valued,” shares Ms. Nguyễn Mai Anh, HR Director at a Hanoi-based tech firm. “To me, benefits aren’t expenses; they’re how a company communicates its genuine care for its people.”

Guided by this insight, BIDV MetLife has developed the “Future Gift” solution—a single-premium Universal Life Insurance product tailored for businesses seeking to establish long-term welfare policies and retain key personnel.

“Future Gift” is a tailored solution for businesses aiming to build long-term welfare strategies.

For businesses, “Future Gift” transcends traditional benefits, serving as a long-term investment in workforce stability. The single-premium structure simplifies budget planning, cost control, and policy flexibility, while ensuring multi-year insurance coverage. This mutually beneficial relationship—where companies proactively demonstrate commitment and employees feel valued—forges a bond stronger than any short-term incentive.

For key employees, “Future Gift” is a dual-value offering designed for long-term loyalty. It provides comprehensive protection against death and permanent total disability, offering peace of mind for both employees and their families. Additionally, the contract value grows steadily through the Universal Life Fund, earning periodic interest and a 10-year contract maintenance bonus, creating a transparent, reliable long-term financial plan.

This benefit structure positions “Future Gift” as a powerful retention tool. When employees remain with the company long-term, they receive the full accumulated value, investment returns, and maintenance bonuses as a reward for their dedication. In the event of unforeseen risks, their families remain financially secure, fostering greater trust and commitment to the organization.

“Future Gift” is a dual-value offering designed for senior executives.

Employees can also flexibly designate beneficiaries, with benefits transferred directly without complex inheritance procedures. For senior executives, this serves as a profound acknowledgment of their long-term contributions, reflecting the company’s deep appreciation.

In today’s volatile talent landscape, retaining top performers is no longer a budget race but a trust race. When companies genuinely invest in their employees’ futures, they earn unwavering loyalty and dedication. “Future Gift” embodies this ethos: a commitment to building a sustainable journey where individuals are protected, valued, and empowered to grow alongside the organization.

VPBank Partners with VTV2 to Launch “Caution 247”

In response to the increasingly sophisticated high-tech financial fraud, the program “Cảnh giác 247” officially launched on VTV2, with the companionship of Vietnam Prosperity Joint Stock Commercial Bank (VPBank), carries the mission of building a “community shield” to protect customers in the digital age.

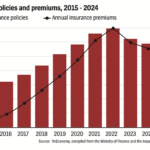

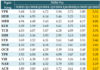

Sustainable Growth for the Life Insurance Industry

The Vietnamese life insurance market has a new legal instrument in place to govern products and benefits. This move aims to revive a struggling industry that has faced challenges with premium costs and policy uptake. With this new regulation, the industry hopes to turn a corner and enter a new era of growth and stability.

“Compensation is Key, But It’s Not Just About the Salary”

“Money matters, but it’s not everything”: This was the key message from Ingrid Christensen, Director of the International Labor Organization (ILO) in Vietnam, as she addressed a recent workshop. Christensen emphasized that while salary and benefits are crucial factors for workers, offering higher wages alone is not a sustainable solution for retaining talent.

The Lucky 13: A Business Offers a Full 13th-Month Bonus to New Recruits

“Typically, the 13th-month salary is calculated based on the number of months worked during the year. However, in a competitive move, this forward-thinking enterprise is offering to waive that requirement. They are eager to ensure that new employees can still receive this bonus in full, an enticing incentive for prospective talent.”