Over the past month and a half, a trend of increasing deposit interest rates has emerged across numerous commercial banks. According to economic experts, while deposit rates are rising, lending rates must remain stable to support businesses and economic growth.

Deposit Rates Across Multiple Terms Rise Simultaneously

On November 13th, Cake by VPBank (Cake) announced a deposit interest rate promotion. Customers opening savings accounts not only receive additional interest but also have a chance to win an iPhone and receive direct cash bonuses into their accounts. First-time customers opening a savings account with a term of 6 months or more will receive an additional 0.6% interest. Existing customers opening new deposits will receive an additional 0.2% to 0.6% interest.

According to the latest interest rate schedule, Cake offers 6.3% per annum for savings deposits of 6 months or more. The highest interest rate at this bank is 6.5% per annum for terms of 12 months or longer.

A report by MBS Securities shows that in October 2025, six commercial banks increased their deposit interest rates. In November, several more banks joined this wave of rate hikes. The latest banks to adjust deposit rates are LPBank and Kienlongbank, with increases of 0.1% to 0.3% compared to previous rates.

Not only have banks raised savings deposit rates at counters and online channels, but some have also intensified capital mobilization through certificate of deposit channels, offering higher interest rates than traditional savings deposits. For instance, Ban Viet Bank (BVBank) is issuing online certificates of deposit with high interest rates and flexible terms ranging from 6 to 15 months. The final interest rate for a 6-month term is 5.8% per annum, reaching up to 6.3% per annum for a 15-month term.

Asia Commercial Bank (ACB) also began issuing certificates of deposit from late October 2025, with fixed interest rates of up to 6% per annum, calculated based on the actual holding period. Customers purchasing certificates can sell them before maturity if needed while still earning the corresponding yield. According to ACB’s CEO Tu Tien Phat, the purpose of issuing certificates of deposit is to diversify investment solutions for customers.

The rise in deposit interest rates across various terms at year-end has raised concerns that lending rates might increase as well, particularly for businesses needing capital for production, business operations, and meeting year-end export demands.

Speaking with a reporter from Nguoi Lao Dong Newspaper, Dr. Can Van Luc, an economic expert, stated that the increase in deposit interest rates by commercial banks is entirely normal and cyclical. At year-end, businesses’ capital needs rise, prompting banks to increase their capital mobilization. When banks aim to attract more deposits, they raise interest rates.

From another perspective, Associate Professor Dr. Pham The Anh from the National Economics University assessed that the current interest rate hikes by domestic banks align with the global high-interest-rate context and rising exchange rate pressures. The current increase in deposit interest rates remains beneficial for the economy, helping stabilize the macroeconomy, prevent capital flows into speculative asset sectors, and maintain exchange rate stability. However, it’s essential to control the increase in deposit interest rates to prevent them from rising too high.

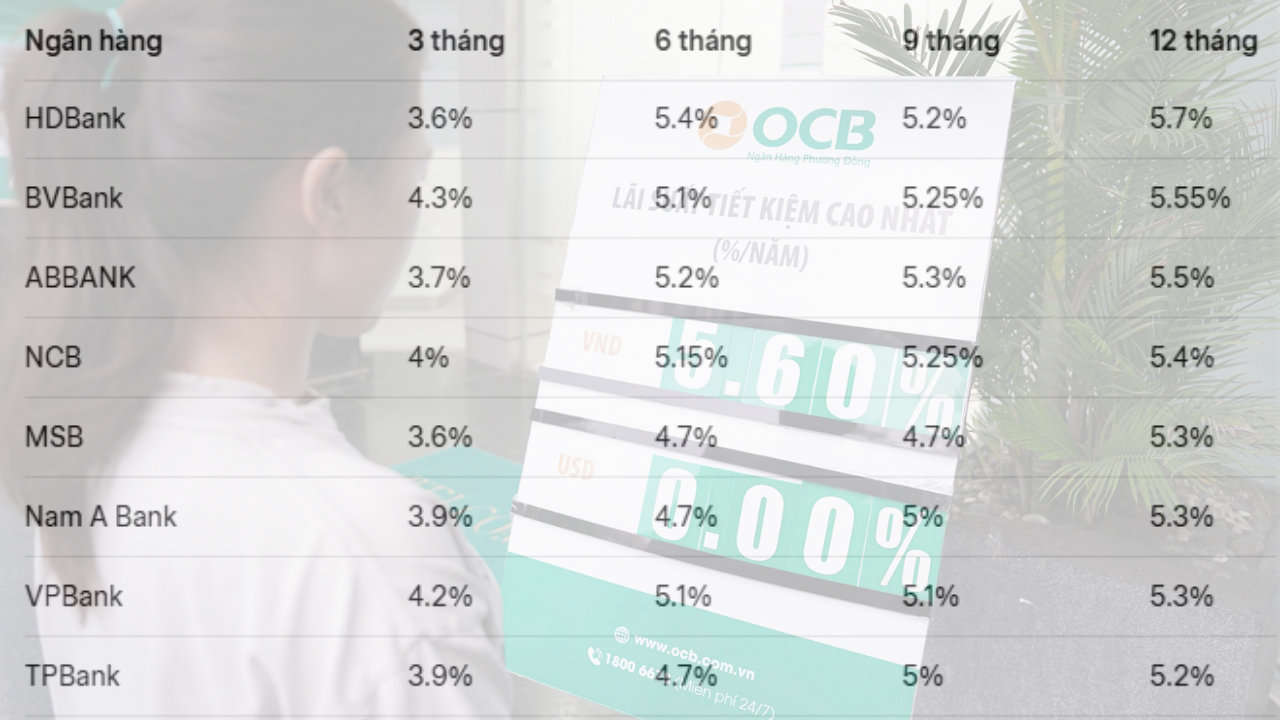

Latest interest rate schedules at several commercial banks. Photo: DUY PHU – THAI PHUONG

No Immediate Concerns About Rising Lending Rates

According to Vu Minh Truong, Director of the Capital and Financial Market Division at VPBank, the increase in deposit interest rates is lower than the credit growth rate of the banking system. In the first nine months of 2025, capital mobilization grew by approximately 16%, while credit growth reached 19%. Capital demand for the year-end period will continue to rise, making the increase in deposit interest rates understandable.

Nguyen Hung, CEO of Tien Phong Bank (TPBank), provided a similar explanation, noting that year-end is typically a sprint period with strong economic capital demand. This requires banks to supplement mobilized capital to meet credit growth targets. While deposit interest rates are trending upward, the increase remains modest. At TPBank, deposit interest rates have risen by only about 0.1%.

“Although input interest rates are rising, lending rates must remain stable as required by the Government and the State Bank to support businesses and the economy. Therefore, banks must diversify revenue streams from service fees alongside net interest income from credit. Banks’ net profit margins will likely narrow compared to previous periods,” Hung commented.

Dr. Can Van Luc believes that from now until year-end, lending rates are unlikely to increase further, as the Prime Minister and the State Bank have directed credit institutions to maintain stable output interest rates. If deposit interest rates continue to rise, banks’ profit margins may narrow slightly.

Looking at the international context, Associate Professor Dr. Pham The Anh analyzed that maintaining low interest rates in Vietnam is challenging given the high global interest rates, particularly U.S. government bond yields and interbank rates. Despite average inflation of 3.27% in the first nine months of 2025, living costs are trending upward, especially for essential goods and services, putting pressure on people’s livelihoods, particularly low-income earners.

“Rising exchange rates are feeding back into inflation. Housing prices in Vietnam are also increasing, making it unsuitable to maintain low interest rates. In this context, monetary policy management requires a long-term vision, meaning credit growth should not be overly rapid to avoid potential risks to the economy in the future,” analyzed Associate Professor Dr. Pham The Anh.

Previously, at the Government’s regular meeting in September 2025, Deputy Governor of the State Bank Doan Thai Son stated that to achieve the 2025 credit growth target of approximately 16% and support the economy, the State Bank will continue implementing synchronized solutions. Credit institutions are required to ensure safe and effective credit growth, focusing on priority production and business sectors and economic growth drivers, while tightly controlling credit in high-risk areas.

The Prime Minister has directed the State Bank to submit a decree in November 2025 guiding the policy of supporting a 2% interest rate for businesses borrowing capital to implement green, circular projects, and applying environmental, social, and governance (ESG) standards through commercial banks.

This was announced in the conclusion of the Prime Minister, Head of the National Steering Committee for Implementing Resolution 68/2025 of the Politburo on private economic development, at the committee’s second meeting.

Vietnam: Asia’s Rising Star

Over the past five years, Vietnam’s economy has demonstrated remarkable resilience in the face of global shocks, consistently maintaining one of the highest growth rates in the world.

Projected Bond Market Capital Mobilization to Surpass 730 Trillion VND by 2025

The head of the Financial Institutions Department (Ministry of Finance) revealed that the total capital mobilized through the bond market in 2025 surpassed 730 trillion VND, accounting for approximately 27% of the total social investment. By year-end, the market size is projected to reach around 3.83 quadrillion VND, equivalent to 33.3% of the 2024 GDP.