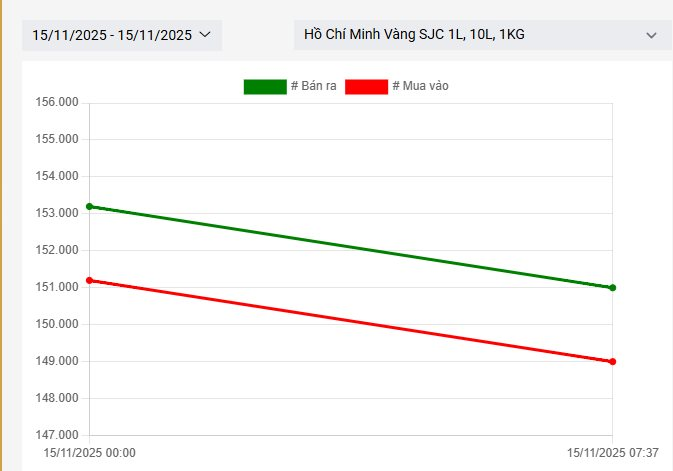

This morning, domestic gold markets continued to experience significant adjustments. PNJ gold ring prices dropped to VND 146.9 – 149.9 million per tael (buy – sell), a loss of VND 2.6 million compared to yesterday’s close. SJC also decreased to VND 146.5 – 149 million per tael, equivalent to a VND 2.2 million reduction.

Gold bar prices at these two brands currently stand at VND 149 – 151 million per tael, continuing to decline by approximately VND 2.2 million per tael.

Price fluctuations of gold bars listed at SJC.

In the international market, gold closed the week at USD 4,080 per ounce, losing over USD 90 compared to the previous session. Despite maintaining levels above USD 4,000 per ounce, experts suggest that failing to surpass the USD 4,200 per ounce threshold indicates the market needs more accumulation time before reaching historical highs again.

This tug-of-war occurs amid diminishing expectations of a Fed rate cut in December. The CME FedWatch tool shows the market now bets less than 50% on a rate cut, down sharply from over 90% a month ago.

The U.S. government’s conclusion of its 43-day shutdown, the longest in history, has left many economic data points missing or distorted. Some Fed officials express caution, stating they lack “sufficient quality data” to make decisions at the upcoming meeting.

This uncertainty is pressuring gold. Although global prices rose 2.4% for the week, they remain nearly 3.5% below Thursday’s peak.

Neil Welsh, Head of Metals at Britannia Global Markets, notes: “Gold’s upward momentum is being tested with a 3% drop in a single session. Short-term sentiment heavily depends on Fed policy signals. However, the long-term outlook remains positive due to prolonged macro risks and central bank demand.”

According to expert Hill, gold holding above USD 4,000 per ounce is positive but doesn’t guarantee a trend: “If it falls below USD 4,000, especially the USD 3,886 low from late October, the market could see heavy selling, pushing prices to USD 3,748. While the long-term trend favors buyers, short-term volatility persists.”

Christopher Vecchio (Tastylive.com) believes the lack of economic data due to the government shutdown won’t alter long-term policy direction. He views current adjustments as opportunities to increase gold holdings.

This view is shared by Phillip Streible, Chief Strategist at Blue Line Futures: “As long as gold stays above USD 3,900 per ounce, the upward trend remains strong. Investors now see gold as a strategic asset and should hold it long-term.”

While awaiting delayed data updates, the market will closely monitor preliminary reports on regional manufacturing and the housing market to gauge U.S. economic health.

“We Sold 3 Taels of Gold to Buy a Car – Now It’s Unused, and Gold Prices Have Doubled”

Selling three taels of wedding gold at the beginning of 2024 to buy a car felt like the right decision for my spouse and me. Now, with gold prices soaring to 150 million VND per tael, our car sits unused, gathering dust. Job loss, reduced income, and the burden of vehicle maintenance costs have turned our once-proud purchase into a costly regret.

Gold Ring and Gold Bar Prices Surge by VND 2.5 Million per Tael on November 13th, Reaching VND 154 Million per Tael

Gold ring and bullion prices at numerous enterprises continued to rise this afternoon, with further adjustments made to their rates.

Afternoon of November 13: Ring Gold and Gold Bar Prices Surge by 2.5 Million VND/tael, Returning to the 154 Million VND/tael Mark

The price of gold rings and gold bars at numerous enterprises continued to rise this afternoon, with further adjustments made to their rates.