According to Vietstock Finance, out of 36 oil, gas, and energy companies that reported Q3 earnings, 23 saw profit growth, with 4 turning losses into gains. Only 12 companies experienced declines, and 1 reported a loss.

A Strong Quarter for Industry Leaders

|

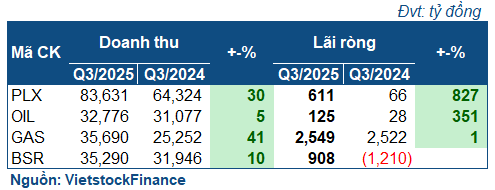

Q3 2025 Performance of Top Oil, Gas, and Energy Companies

|

Leading companies in the sector reported positive results compared to the same period last year. Petrolimex (HOSE: PLX) led the way with revenue exceeding 83.6 trillion VND, a 30% increase, and a net profit of 611 billion VND, 9.3 times higher than the previous year. The company attributed this growth to its core fuel business, which had previously been unprofitable. The primary reason was the stability in oil prices during Q3 2025, which decreased slightly from $68 per barrel to $62-$65 per barrel, compared to the sharp decline from $83 per barrel to $66-$68 per barrel in the same period last year.

| Petrolimex’s Q3 2025 Performance |

Stable oil prices also benefited OIL, with profits increasing 4.5 times to 125 billion VND and a slight 5% revenue growth. Additionally, the parent company’s financial income (revenue minus expenses) rose by 65%, primarily due to the reversal of financial investment provisions and increased interest income from deposits.

PV GAS maintained a slight profit increase, reaching over 2.5 trillion VND in net profit. While revenue grew significantly by 41% to nearly 35.7 trillion VND, gross profit declined due to higher production costs. However, by reducing expenses, particularly financial and administrative costs, GAS managed to increase profits. Furthermore, GAS‘s 2025 outlook is positive, having already surpassed its annual target after just 9 months, with profits nearly matching the entire year of 2024.

| GAS’s 9-Month Profit Matches 2024 Full-Year Earnings |

BSR made a strong recovery with a profit of 908 billion VND, compared to a loss of over 1.2 trillion VND in the same period last year. This turnaround was due to more stable oil prices, a better crack spread (the difference between crude oil and refined product prices), and increased sales volume.

Segmentation and Diversification

The remaining companies showed varied results across the upstream (exploration and production services), midstream (resource gathering and transportation), and downstream (refining, retail, and related services) sectors.

|

Q3 2025 Earnings of Oil, Gas, and Energy Companies

|

In the upstream sector, PVS reported a significant profit of 324 billion VND, 2.4 times higher than the previous year, mainly due to increased financial revenue and reduced financial expenses related to exchange rate differences.

| PVS’s Business Performance |

PVD also saw substantial profits, with a net profit of 278 billion VND, a 53% increase, thanks to revenue from the PV Drilling VIII rig starting September 1, 2025, and increased workload boosting revenue in related drilling services.

PVB, a PVN subsidiary specializing in oil pipeline coating, turned a loss into a 27 billion VND profit. PVB attributed this to higher revenue and profits from service contracts in Q3.

The midstream sector showed significant diversification. VTO, PJT, and PVP all experienced profit growth due to improved transportation volumes, increased workload, or reduced depreciation costs. Conversely, PV Trans (HOSE: PVT) saw a 51% revenue increase but a 28% drop in net profit to 263 billion VND. The company explained that this was primarily due to lower non-operating income from the sale of ships in the same period last year. However, an 8% decrease in gross profit indicates that core business operations were also less favorable.

| PV Trans’s Profit Decline Due to Absence of Ship Sale Income |

GSP (Gas Shipping) saw a 90% profit decline to 2.9 billion VND, one of the largest drops in the oil, gas, and energy sector in Q3. The company cited a volatile and competitive shipping market, leading to operational challenges and increased costs. Additionally, exchange rate fluctuations increased financial expenses, negatively impacting the final results.

The downstream sector also showed diversification. In Q3, many companies in this segment experienced strong growth. PMS, a service provider, saw a sixfold profit increase to 8 billion VND in net profit, driven by growth in various product lines and strategic raw material reserves at its subsidiary.

CCI increased profits by 88% to 10 billion VND. Although revenue decreased by 10% due to lower average fuel prices, the company improved profits through enhanced income. Other notable profit increases were seen in companies like PJC, PSC, and PPT.

Conversely, several companies, mostly in the gas sector, reported profit declines. TDG saw a 65% drop in profits to approximately 310 million VND due to a decrease in customers. PVG experienced a 45% profit decline to 2.5 billion VND, as the LPG gas market faced challenges and global prices fell unpredictably. Even CNG, a major player in compressed natural gas under PVN, reported a slight profit decrease.

The only company reporting a loss in the entire sector was PSH, a major fuel company in the Western region, with a loss of 143 billion VND (down from a 172 billion VND loss in the same period last year). PSH‘s situation is unique, as the company remains under a tax debt enforcement order, preventing operations and resulting in zero revenue.

– 09:00 16/11/2025

Seafood Industry Profits Surge to New Heights

Despite facing tariff pressures and a slowdown in export markets, the seafood industry group reported remarkable profit growth in Q3 2025. Several companies achieved their highest earnings in three years, with bank deposits reaching unprecedented levels.

Pig Price Plunge: What’s in Store for the Pork Industry in Q3?

Unlike the explosive growth in the first two quarters, the third quarter of 2025 saw a significant drop in live hog prices compared to the same period last year, defying earlier predictions of price increases. However, businesses in the livestock industry reported mixed results during this period.