Central Government Budget Revenue Surpasses 1.2 Million Billion VND

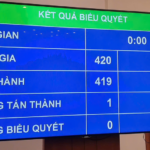

On the afternoon of November 14th, with unanimous approval from all present delegates, the National Assembly passed the Resolution on the Central Government Budget Allocation Plan for 2026.

The National Assembly resolved that the total central government budget revenue exceeds 1.2 million billion VND, while the total expenditure is over 1.8 million billion VND.

This includes nearly 240 trillion VND allocated to balance local budgets, more than 53.55 trillion VND to ensure a base salary of over 2.3 million VND per month for local governments, and over 187.1 trillion VND in targeted allocations for local budgets.

Minister of Finance Nguyen Van Thang delivers a report on feedback and explanations. Photo: Nhu Y

For central government agencies and administrative units previously under special financial and income mechanisms as per Resolutions 104/2023 and 142/2024 but without assigned civil servant quotas, the resolution allows for the allocation of funds for salaries, contributions, additional income, and regular expenses based on established norms.

The National Assembly also approved a 15 trillion VND reserve fund to ensure national financial security in case of economic fluctuations or budget shortfalls. The government is tasked with proactive management to minimize impacts on planned expenditures and maintain financial stability.

The resolution emphasizes allocating a minimum of 3% of the total state budget to science, technology, innovation, and digital transformation, with specific plans for central agencies and local governments.

Additionally, funds will be allocated to adjust salaries, pensions, social insurance benefits, monthly allowances, and other social policies as determined by competent authorities.

The National Assembly directs the government to implement budget allocation, revenue, and expenditure assignments in accordance with the State Budget Law and relevant resolutions.

The resolution highlights that securing resources for salary reform and social welfare policies is a top priority in the 2026 budget allocation. The total salary reform expenditure is 57.47 trillion VND, part of the 860.43 trillion VND in regular expenditures. An additional 53.554 trillion VND will support local budgets to ensure a base salary of 2.34 million VND per month throughout 2026.

Government Proactively Utilizes Accumulated Funds

In response to feedback on the surplus salary reform funds, the government reported that after implementing Decrees 178 and 67, the central government’s accumulated funds for salary reform total approximately 7 trillion VND.

Local governments have a surplus of around 375 trillion VND, though this varies significantly, with Hanoi and Ho Chi Minh City accounting for about 70% of the total surplus.

Total central government expenditure approved by the National Assembly.

The government confirmed that any budget surplus at the end of 2025 will be allocated to salary reform funds as stipulated (40% of central government surplus and 70% of local government surplus).

As per Resolution 27-NQ/TW and National Assembly resolutions, accumulated salary reform funds are exclusively for public sector salaries and allowances, except with parliamentary approval.

Given the numerous salary and income policies already in place, the government seeks parliamentary authorization to proactively use accumulated funds to ensure timely payments for eligible recipients, in line with Central Committee directives.

Latest Directive from Ho Chi Minh City on Safety Inspections for Aging Apartment Buildings

Ho Chi Minh City will allocate over VND 32 billion to inspect and evaluate the quality of 186 old apartment buildings comprising 223 blocks. If an apartment building is not deemed necessary for demolition, the inspection conclusion must clearly state the remaining usable period until it requires dismantling.

Upcoming Proposals for Salary Increases and Allowance Benefits

Following the preliminary review of Resolution No. 27, the Ministry of Home Affairs will take the lead in collaborating with relevant ministries and agencies to thoroughly assess the feasibility and propose updated salary structures, new allowance systems, and bonus schemes.