At the consultation conference on draft documents submitted to the 14th National Party Congress, organized by the Party Committee of the Voice of Vietnam (VOV), Dr. Nguyen Tri Hieu, an economic expert, stated that Resolution 68 of the Politburo identifies the development of the private sector as the most crucial driving force in the economy.

Currently, private enterprises significantly contribute to GDP growth and account for a substantial portion of the workforce.

Dr. Nguyen Tri Hieu. (Photo: Minh Duc)

“However, small and medium-sized enterprises, a vital component of the private sector, face significant disadvantages in accessing loans and investment capital, making them vulnerable to interest rate fluctuations. The government lacks medium and long-term capital to support these businesses,” said Dr. Hieu.

Dr. Hieu highlighted that after the issuance of Decree 34/2018 (regarding the establishment, organization, and operation of the Credit Guarantee Fund for Small and Medium Enterprises), many credit guarantee funds were established to support SMEs in borrowing from banks. However, these funds have not operated effectively.

Credit guarantee funds are institutions widely used by many countries to support SMEs. For these funds to operate effectively, the government must inject new capital annually to ensure sufficient compensation for banks and guarantee more enterprises.

However, the expert noted a significant limitation in Vietnam: Decree 34/2018 mandates that credit guarantee funds adhere to the principle of capital preservation. This constraint prevents funds from actively guaranteeing loans for businesses, as the minimum charter capital for a local credit guarantee fund is 100 billion VND.

“This capital is too small for funds to guarantee multiple local businesses borrowing from banks. The ‘capital preservation’ principle is a paradox in Decree 34/2018 and needs to be reconsidered,” Dr. Hieu remarked.

Therefore, Dr. Hieu proposed that the operating regulations for credit guarantee funds should eliminate the “capital preservation” principle. Credit guarantee funds, essentially a form of insurance for banks, operate based on risk assessment and cannot function under such a principle.

“A Central Credit Guarantee Fund should be established with its headquarters in Hanoi and branches in major cities. This Central Fund should be equipped with a charter capital of up to 10,000 billion VND,” suggested economic expert Nguyen Tri Hieu.

Another issue Dr. Hieu addressed in his presentation was the problem of group interests in the banking sector.

Although the amended Law on Credit Institutions has restricted the shareholding ratio of shareholders and related individuals to limit cross-ownership and control group interests in banking, Dr. Hieu considers this a concerning issue.

Specifically, regulations on shareholding limits at a bank can be easily circumvented by secretly dividing shares among related individuals, evading scrutiny by the State Bank of Vietnam.

“Manipulation by interest groups in the banking sector often leads to the exploitation of banks for personal gain. In some cases, these groups have pushed banks to the brink of failure, and without intervention from the State Bank, these banks would have collapsed,” said Dr. Nguyen Tri Hieu.

According to the economic expert, in most cases, manipulation by interest groups results in capital being concentrated on projects of related companies and individuals. This creates a shortage of necessary capital for other businesses, particularly small and medium-sized enterprises.

In response to this situation, Dr. Hieu recommended that the State Bank enhance its inspection and supervision of decisions and activities by the board of directors and credit councils to trace signs of manipulation by interest groups.

“The State Bank must also implement strong sanctions to address manipulative activities by interest groups, including publicly disclosing violations and imposing deterrent measures,” added Dr. Hieu.

Surpassing 10% Growth: The Ultimate Test of Resilience and Innovation

With the National Assembly’s approval of a 10% or higher GDP growth target for 2026, Vietnam is not merely setting a statistical benchmark but igniting a transformative journey. This ambitious goal hinges on the intrinsic dynamism of businesses, the prowess of governance, and the spirit of innovation and creativity that will define its success.

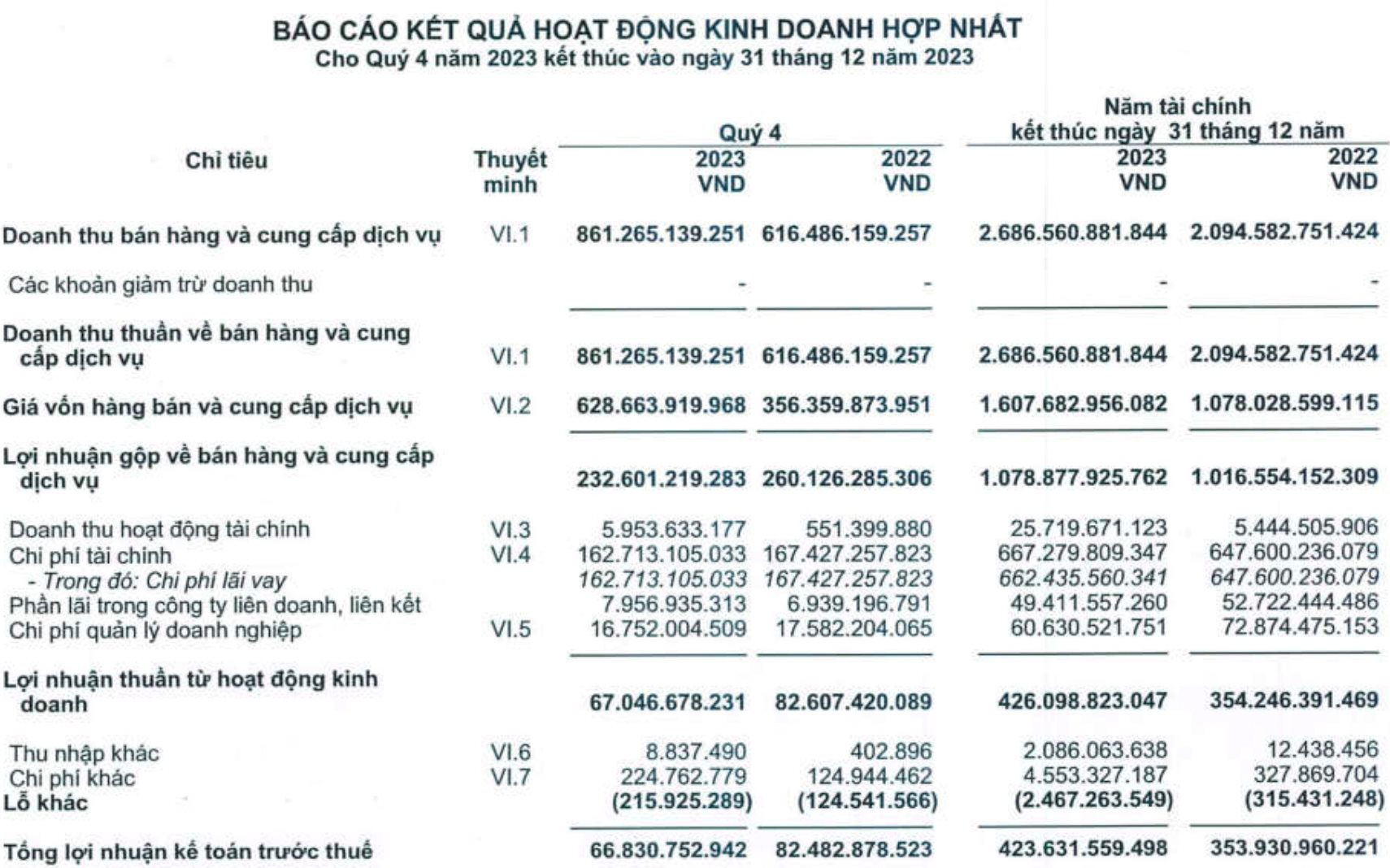

Retail Banking Sector Leads Credit Growth Surge in First Nine Months of 2025

Credit growth is projected to reach a robust 20% this year, signaling a positive outlook for the entire banking sector. However, Q3 financial reports reveal a more nuanced narrative: it’s not just about the pace of growth, but the shifting dynamics of credit flows and emerging challenges that will shape the future trajectory of individual banks in the coming period.

The 2025 Q3 Layoff Wave: 14 Banks Cut Nearly 7,300 Jobs, While Two FPT Subsidiaries Ramp Up Hiring Despite Parent Group’s Reduction

Among companies disclosing workforce figures, FPT Retail (FRT) leads with the highest personnel growth, adding 1,983 employees. FPT Telecom (FOX) follows closely in second place, with an increase of 986 employees.