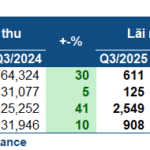

According to VietstockFinance data, the total revenue of 19 listed shipping companies reached over 10.7 trillion VND in Q3/2025, a 27% increase year-on-year. However, the majority of this growth came from low-margin commodity trading.

The industry’s net profit rose by 52% to approximately 1.3 trillion VND, primarily driven by non-recurring income.

Hai An Maintains Strong Growth

Hai An Transport and Logistics (HOSE: HAH) reported record-high revenue of 1.3 trillion VND, up 19% year-on-year. Net profit reached 304 billion VND, a 53% increase, second only to the record-breaking Q2 figure.

This impressive growth is attributed to the addition of two vessels in Q3 compared to the same period last year, along with improved transportation volume and freight rates.

| HAH’s Q3 profit was only lower than the previous quarter’s record |

Petroleum Transportation Sector Shows Improvement

The petroleum transportation sector also performed well. Petrolimex Hai Phong Transportation and Services (HNX: PTS) posted a sixfold increase in net profit to 6 billion VND, despite a slight revenue rise to 91 billion VND, marking its highest quarterly profit in years.

Vitaco Petroleum Transportation (HOSE: VTO) saw a 45% profit increase to 28 billion VND, thanks to reduced depreciation costs. VIPCO Petroleum Transportation (HOSE: VIP) reported higher gross profit, but a surge in management expenses led to a 25% drop in net profit to 16 billion VND.

Petrolimex Waterway Petroleum Transportation (HOSE: PJT) recorded an 8.2 billion VND profit, up 43%, mainly from other income sources.

Au Lac (ALC) turned a loss into a 70 billion VND profit, despite a slight revenue decline to 342 billion VND. Last year, the company incurred losses due to a sharp increase in depreciation expenses following adjustments to vessel lifespans.

|

Q3 profits of petroleum transportation companies improved compared to the same period last year (Unit: billion VND)

Source: Author’s compilation

|

Oil and Gas Transportation Profits Under Pressure from Input Costs

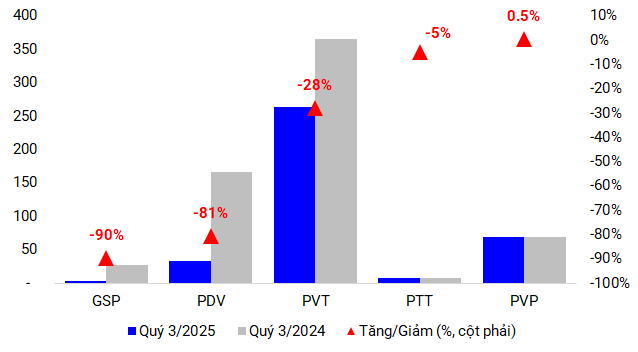

In contrast, oil and gas transportation companies reported profit declines due to rising input costs and the absence of vessel disposal income.

Notably, International Gas Products Transportation (HOSE: GSP) saw a 90% profit drop to less than 3 billion VND. Gross profit margin fell from 15.5% to 3.7%. The company attributed this to intense market competition, soaring operating costs, and a stronger USD, significantly impacting its financial performance.

Phuong Dong Viet Transportation and Logistics (PVT Logistics, HOSE: PDV) experienced a nearly 50% decline in gross profit to around 40 billion VND, with net profit plunging 80% to over 32 billion VND due to the absence of vessel disposal income.

PVTrans (HOSE: PVT), the parent company of several aforementioned entities, reported a 28% profit decrease to 263 billion VND. Gross profit margin narrowed from 24.8% to 18% due to higher depreciation expenses and reduced vessel operating efficiency.

|

Cost pressures weigh on oil and gas transportation companies’ profits (Unit: billion VND)

Source: Author’s compilation

|

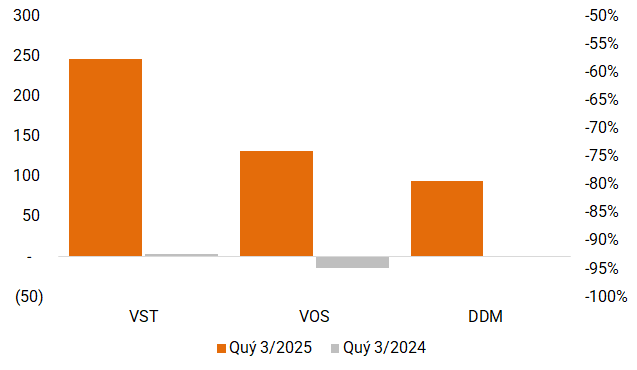

Dry Bulk Companies Profit from Non-Operating Income

Several dry bulk companies had a strong quarter, but their profit growth was largely driven by vessel sales or debt write-offs.

Vietnam Ocean Shipping Company (Vosco, HOSE: VOS) reported a 131 billion VND profit, the highest in a year, thanks to nearly 100 billion VND from selling the Vosco Star vessel. While revenue improved due to a more active dry bulk market, the primary driver was this non-recurring income.

Dong Do Shipping (UPCoM: DDM) posted a 94 billion VND profit, hundreds of times higher year-on-year, due to over 105 billion VND in other income. Vietnam Shipping and Chartering (UPCoM: VST) saw profits soar to 247 billion VND after a nearly 250 billion VND debt write-off.

Phuong Dong Shipping and Trading (UPCoM: NOS) turned a profit for the first time since 2021, earning nearly 10 billion VND from selling the Phuong Dong 5 vessel, although its core operations remained unprofitable.

Meanwhile, Vinaship Ocean Shipping (UPCoM: VNA) continued to incur a 9 billion VND loss due to below-cost operations and the absence of non-recurring income. Global Pacific Shipping (HNX: PCT) saw a 77% profit decline to over 5 billion VND, despite revenue growth from new vessel additions, primarily due to higher depreciation expenses.

|

Non-operating income boosts profits for some companies (Unit: billion VND)

Source: Author’s compilation

|

Vessel Transactions Surge

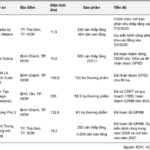

In Q3, many shipping companies seized opportunities to dispose of and acquire vessels.

DDM recorded 106 billion VND in other income from vessel sales, achieving a record net profit and reducing accumulated losses to 851 billion VND. NOS gained 47 billion VND from selling the Phuong Dong 5, reducing its fleet to four vessels.

VOS earned nearly 100 billion VND from selling the Vosco Star, while also taking delivery of the Vosco Jubilant and planning to sell the Vosco Unity. Since the beginning of the year, the company has added three Supramax bulk carriers, increasing its vessel value by approximately 1.3 trillion VND.

Vosco takes delivery of the Vosco Jubilant in Q3 – Photo: VOS

|

VST added the HD Sun vessel with a 30,000 DWT capacity, increasing its value by 281 billion VND. Within the PVT system, PTT and PDV took delivery of the Handysize PVT Fortune (36,000 DWT) and PVT Emerald (34,000 DWT) vessels in Q3, increasing fixed assets by 311 billion VND and 289 billion VND, respectively. GSP added the LPG Phoenix Gas vessel, worth 328 billion VND.

Although HAH did not add new vessels in the quarter, it began operating the HAIAN IRIS container ship with a 29,300 TEU capacity in early Q4. PVP announced plans to acquire a 45,000-55,000 DWT oil/chemical tanker, less than 15 years old.

PTT takes delivery of the PVT Fortune in July at UAE – Photo: PVT

|

– 13:00 16/11/2025

Oil Giants Report Massive Wins in Q3 2025

With gasoline and oil prices stabilizing significantly compared to the same period last year, many companies in the petroleum and gas sector have achieved positive results in Q3 2025.

A Top Global Destination in Northwest Vietnam, Famous Since the 1920s, Set to Launch a $100 Million Eco-Urban Complex

Anticipated to break ground in Q1 2026, the Ô Quý Hồ Tea Hill Eco-Urban Area in Sa Pa ward promises to redefine sustainable living.