Illustrative image

A new crisis is brewing in the rare earths market as the supply of yttrium, a critical element in aerospace, energy, and semiconductor industries, faces severe shortages. Export restrictions from China have driven prices sharply higher, raising concerns about supply chain disruptions in the U.S. and other high-tech economies.

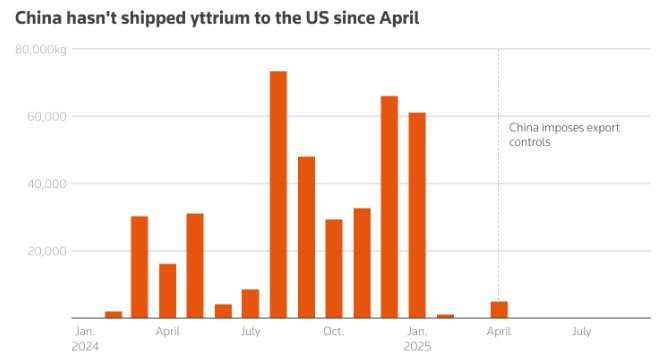

China, the world’s largest supplier of yttrium, tightened export controls on this element and six other rare earths in April, retaliating against U.S. tariffs. Despite hopes for easing tensions following the meeting between Donald Trump and Xi Jinping last month, the dispute remains unresolved.

China’s yttrium exports to the U.S. have been halted since April and remain suspended. Source: Reuters

According to rare earths traders and analyst Ellie Saklatvla of Argus, exporters now require permits from Beijing to ship yttrium out of China. These permits are issued sparingly, often for small quantities, and delays in delivery persist.

“China’s export controls have sparked a months-long scramble for yttrium,” Saklatvla noted.

Argus data reveals that the price of yttrium oxide, used in thermal barrier coatings in Europe, has surged 4,400% since the start of the year, reaching $270 per kilogram. In contrast, domestic prices in China have risen 16% to approximately $7 per kilogram and are showing signs of cooling.

Yttrium is essential for specialized alloys in jet engines, gas turbine coatings, and critical semiconductor components. The Aerospace Industries Association (AIA) warns that heavy reliance on Chinese imports is increasing costs and risks for supply chains.

“This dependence leaves us vulnerable in a tight supply environment,” said Dak Hardwick, AIA’s Vice President of International Affairs.

Semiconductor firms rate the severity of the yttrium shortage at “9 out of 10.” Richard Thurston, CEO of Great Lakes Semiconductor, stated that the shortage will prolong production times, raise costs, and reduce device efficiency, though it won’t halt operations immediately.

“This is becoming a significant bottleneck for the industry,” he added.

Major gas turbine manufacturers like Mitsubishi Heavy and Siemens Energy report no immediate supply chain impacts. Siemens Energy is working to diversify its sources, though reducing reliance on China will take time.

U.S. Gulfstream Aerospace, a commercial aircraft manufacturer, notes limited effects on deliveries so far.

Customs data through September shows China drastically reduced yttrium exports to the U.S. earlier this year before halting them entirely in April. Exports to other countries have also dropped by approximately 30%.

Some traders fear China may further restrict supply if re-exports to the U.S. are detected. Inventory levels vary widely among businesses: some have only a few months’ supply, while others report stocks plummeting from 200 tons to just 5 tons, or even running out entirely.

Despite soaring prices, two aerospace industry sources indicate the shortage has not yet caused production disruptions.

According to the U.S. Geological Survey (USGS), the U.S. imports all its yttrium, with 93% coming directly from China. This may soon change as ReElement Technologies in Indiana prepares to produce 200 tons of yttrium oxide annually starting in December, scaling up to 400 tons by March next year.

The U.S. is estimated to have imported 470 tons of yttrium in 2024, highlighting that domestic production will initially meet only a fraction of demand.

Source: Reuters