Surprising VND 750 Million Loan from ROX Key JSC to Thuan An Company

On July 7, 2025, the Board of Directors of ROX Key JSC (HOSE: TN1) issued a resolution approving a 15% dividend payout for the fiscal year 2024.

This includes a 10% stock dividend, meaning shareholders holding 100 shares will receive an additional 10 new shares. The total issuance amounts to over 5.4 million shares, valued at VND 54.63 billion at par.

The dividend will be sourced from the accumulated undistributed after-tax profits as of the end of 2024. Additionally, a 5% cash dividend, equivalent to VND 500 per share, will be distributed.

With over 54.63 million shares outstanding, the total cash dividend payout will reach nearly VND 27.32 billion. Dividends will be paid to shareholders registered as of the record date, July 22, 2025, with the cash dividend payment scheduled for August 13, 2025.

In its Q3 2025 financial report, ROX Key recorded a 7.06% decline in revenue compared to the same period last year, while the cost of goods sold decreased by 16.35%. Administrative expenses also dropped by 6.38%.

Conversely, selling expenses surged by 323.51%. Net profit reached VND 46.03 billion, a 167.13% increase year-over-year.

For the first nine months of the year, revenue totaled VND 661.86 billion, down 9.75% year-over-year, while cumulative profit reached VND 142.59 billion, up 205.73%.

Financially, in Q3 2025, financial expenses rose by 168.65%, with interest expenses increasing by 44.04%. Investment-wise, the company continued to invest in fixed assets, reaching VND 144.47 billion by the end of Q3 2025. The company’s chartered capital increased to VND 600.95 billion.

As of November 14, 2025, TN1 shares traded at VND 15.2 per share. Notably, TN1’s share price has surged from VND 10,000 in June 2025 to nearly VND 17,000 in early September 2025.

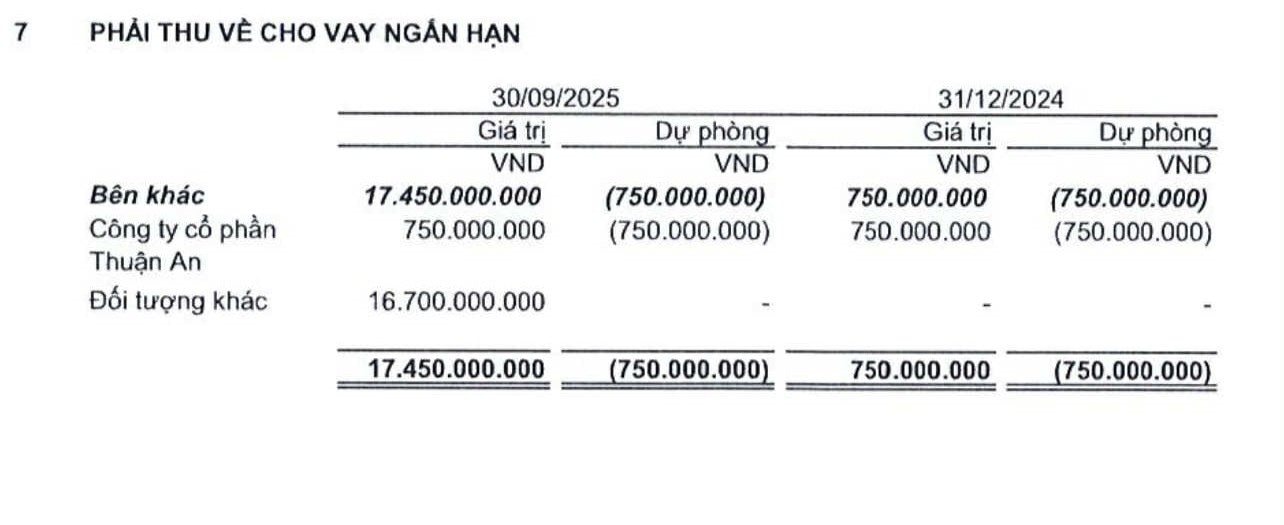

In the Q2 2025 financial report, ROX Key had short-term receivables from loans totaling VND 55.95 billion, including a VND 750 million loan to Thuan An Company (provisioned), with the remaining VND 55.2 billion lent to other entities.

By Q3 2025, short-term receivables from loans decreased to VND 17.45 billion, with VND 750 million still lent to Thuan An Company (provisioned) and VND 16.7 billion to other entities.

Thus, in Q3, loans to other entities decreased by VND 38.5 billion from Q2, from VND 55.2 billion to VND 16.7 billion.

Q3 2025 Financial Report shows ROX Key’s loans to other entities decreased to VND 16.7 billion, with VND 750 million to Thuan An Company.

In the Q1 2025 financial report, ROX Key only had a VND 750 million short-term loan to Thuan An Company. Thus, the VND 55.2 billion loan to other entities was executed after Q1 2025.

Previously, on May 20, 2025, ROX Key announced the appointment of Mr. Nguyen Van Hiep as the new legal representative, effective May 16, 2025, replacing Mr. Tran Xuan Quang.

On December 27, 2024, ROX Key completed the issuance of TN1H2427001 bonds worth VND 200 billion. The bonds have a 36-month term, maturing on December 27, 2027, with a fixed interest rate of 9.8% per annum. The bonds are secured by 39 million shares of Maritime Bank (HOSE: MSB) and other assets owned by TN1, totaling VND 460.2 billion, based on the valuation report issued by Vietnam Asset Appraisal and Valuation JSC on December 20, 2024.

According to the issuance plan, TN1 will use the entire VND 200 billion to repay the principal of a loan from Tam Trinh Construction Investment Joint Venture. This loan, with an interest rate of 11% per annum, was used to settle payables and fund other business activities. The loan agreement was signed in late September 2024 with a 36-month term.

Subsequently, on April 18, 2025, the Hanoi Stock Exchange announced that ROX Key’s TN1H2427001 bonds would be traded on the private placement trading system.

ROX Key (formerly TNS Holdings) provides comprehensive solutions in the following areas: Residential Management (low-rise and high-rise), Office Management, Shopping Center Management, Industrial Zone Management, Security Services, Cleaning Services, Information Technology, and Human Resource Management.

ROX Key is part of the Rox Group ecosystem, founded by entrepreneur Nguyen Thi Nguyet Huong. Formerly known as TNG Holdings Vietnam, the group has been operating since 1996. Its predecessor was the Vietnam Investment and Development Group (VID Group).

Under the leadership of Tran Anh Tuan and Nguyen Thi Nguyet Huong, the group expanded into financial investment in 2007, becoming a partner of Maritime Bank (MSB). Real estate is the core business of Rox Group, with Rox Living as the primary entity, engaged in urban development, resorts, and industrial services.

Cumulative Losses Exceed 3 Trillion, Negative Equity: Former Steel Industry Leader Unveils Restructuring Plan

Pomina’s Q3/2025 financial report reveals a 58% year-over-year decline in net revenue, totaling 203 billion VND. The company posted a post-tax loss of nearly 183 billion VND, an improvement from the 286 billion VND loss in the same quarter last year. This marks Pomina’s 14th consecutive quarter of losses.

Vietnam’s Aviation Titan Reports Surging Q3 Profits, Brokerages Forecast Near 9,000 Billion VND for the Year Driven by a Unique Factor

In the first nine months of the year, the company achieved a net revenue of 19,167 billion VND, with post-tax profit reaching 8,936 billion VND, marking a 14% and 5% increase, respectively, compared to the same period last year.

Cash Kings of the Stock Market: Vingroup Reigns Supreme, MWG Quadruples Since Start of Year, 5 Companies Surpass 40 Trillion VND Mark

The Q3/2025 financial reports reveal a remarkable trend: 13 non-financial enterprises listed on the stock exchange hold a staggering cash reserve exceeding 20,000 billion VND, comprising cash, cash equivalents, and short-term deposits. Notably, several of these companies have experienced a significant surge in their cash holdings during this period.

Vinaconex (VCG) Reports Q3 Net Profit Surge of Over 2,000% to VND 3.3 Trillion, Driven by Successful Sale of 107 Million VCR Shares

Cumulative net revenue for the first nine months of 2025 reached 11,413 billion VND, a 40% increase compared to the same period in 2024. Fueled by a 20-fold surge in financial revenue, after-tax profit for the first nine months soared to 3,783 billion VND, a fivefold increase year-over-year.