State Regulation Needed for Land Pricing

Multiple localities are rushing to finalize new land price tables, set to take effect from January 1, 2026, with proposed rates soaring significantly. In Hanoi, for instance, land pricing zones have shifted from district-based boundaries to 17 distinct areas. Central districts now boast a maximum rate of over 702 million VND/m², a 2% increase from current levels. The most substantial hikes, ranging from 16% to 26%, are projected for suburban areas. Similarly, Dong Nai’s new land price table is expected to surge by up to ninefold.

Speaking with VietNamNet, Dr. Pham Viet Thuan, Director of the Institute of Natural Resources and Environment Economics in Ho Chi Minh City, emphasized the need for state intervention in the 2026 land pricing framework. He advocates for a base land price multiplied by a coefficient (K) to mitigate market risks associated with soaring land costs, which could trigger macroeconomic repercussions.

Localities, when drafting land price tables, must recognize that land is not merely a special production resource but a critical driver of socio-economic development. Dr. Thuan stressed that market-based land valuation does not equate to unchecked price fluctuations. Instead, state regulation is essential during the formulation process to prevent implementation challenges witnessed in recent years.

“When land prices escalate rapidly and exceed citizens’ living standards, all societal costs rise in tandem. Investment, housing, and infrastructure expenses surge, hindering development. Controlling land prices at sustainable levels would channel more capital into production and services, fostering industrial growth, infrastructure, and affordable housing—key pillars for macroeconomic expansion, which the government is actively pursuing,” Dr. Thuan noted.

Experts emphasize aligning land prices with real market value. Photo: Thach Thao |

For Ho Chi Minh City, Dr. Thuan advised against relying on valuation consultants to set prices. Instead, the city should base its framework on Decision 02/2020, multiplying the base price by coefficient K to ensure increases remain within threefold of the previous table. The People’s Council would then approve K adjustments for specific cases, as land values and coefficients vary even within the same street.

For projects fulfilling financial obligations, applying coefficient K would determine land rental or allocation fees, reducing reliance on unverifiable valuation certificates and ensuring alignment with investment incentives.

Dr. Thuan warned that higher land prices equate to greater capital locked in real estate, underscoring the urgency of state intervention. “Skyrocketing property prices stem from unbridled land price hikes, driven by subjective market forces rather than tangible factors. This destabilizes the economy and labor welfare. Land prices must reflect reality, free from speculation or policy exploitation. Excessive pricing invites severe consequences,” he cautioned.

Central Framework, Local Calibration

The Vietnam Real Estate Market Research and Assessment Institute (VARS IRE) highlights land price tables as vital state tools for land management, budget collection, financial obligations, and legal compensation frameworks. Their development demands rigor, scientific methodology, and phased implementation to mirror market realities while avoiding financial strain on citizens and businesses.

VARS IRE clarifies that land price tables are regulatory and tax instruments, not market supply-demand levers. Policy stability should prioritize long-term transparency, equity, and sustainability.

Responsibilities should be delineated between central and local authorities. The state should establish technical standards and unified valuation methods, leaving localities to operationalize and fine-tune adjustments. Local governments should be empowered to introduce flexible coefficients based on area, timing, land use, and development goals.

Differentiated fees for land use, rentals, taxes, and charges should align with purposes (residential, commercial, agricultural) and regional infrastructure development.

VARS IRE experts urge a gradual adjustment roadmap to prevent market shocks, particularly as many localities transition to two-tier urban governance models.

By Nguyen Le

– 05:45 16/11/2025

Big Group Holdings: Unlocking 2025 Profits with Three Revolutionary Business Strategies to Boost Stock Valuation

By the end of 2025, Big Group Holdings JSC (UPCoM: BIG) is set to expand its three strategic pillars through its subsidiaries: Big Expo, Big Hotel, and Big Bro. This growth trajectory is projected to drive consolidated revenue above 500 billion VND and post-tax profit exceeding 20 billion VND. These positive developments have fueled a steady rise in BIG’s stock price over recent weeks.

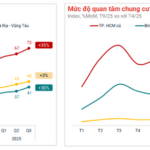

Expert Analysis: Assessing the Current Appeal of Gold, Stocks, Real Estate, and Digital Assets as Investment Channels

On the morning of November 13th, the seminar “The Allure of Asset Classes,” hosted by the Financial and Investment Newspaper, garnered significant attention from experts and investors alike.

Aqua City by Novaland: Over 2,400 Units Eligible for Transfer

The Department of Construction of Dong Nai Province has confirmed that the residential units within the Aqua City project fully comply with legal requirements, land regulations, technical infrastructure standards, and the adjusted 1/500 detailed planning. As of October 2025, nearly 2,400 properties at Novaland’s Aqua City are authorized for sales contract signing.

Unlocking the Secrets: Why East Saigon Apartments Consistently Boast High Liquidity and Buyer Benefits

The strategic development of a financial hub, coupled with robust infrastructure, high-quality supply, and significant price appreciation potential, positions Eastern Ho Chi Minh City as the leading investment destination in the region, attracting substantial capital inflows.