Shares of Pomina Steel (stock code: POM) have unexpectedly surged to their upper limit for two consecutive sessions, amidst a shortage of available stock. The stock closed the November 14th session with a buy surplus at the ceiling price, reaching nearly 12 million units, equivalent to over 4% of the total outstanding shares. Notably, the shares of this once-prominent steel giant have “rebounded” despite being restricted to trading only on Fridays.

Previously, Pomina was forcibly delisted from HoSE in May 2024 due to severe breaches in information disclosure obligations. The stock now trades on the UPCoM market, marking a significant decline for a company that was once a steel industry leader. This situation underscores the ongoing challenges facing the company.

Founded in 1999, Pomina operates three steel billet and construction steel rolling mills with a combined annual capacity of 1.1 million tons of construction steel and 1.5 million tons of billets. At its peak, Pomina was one of Vietnam’s largest construction steel producers, commanding nearly 30% market share. However, its market share has since dwindled in the face of fierce competition from Hoa Phat.

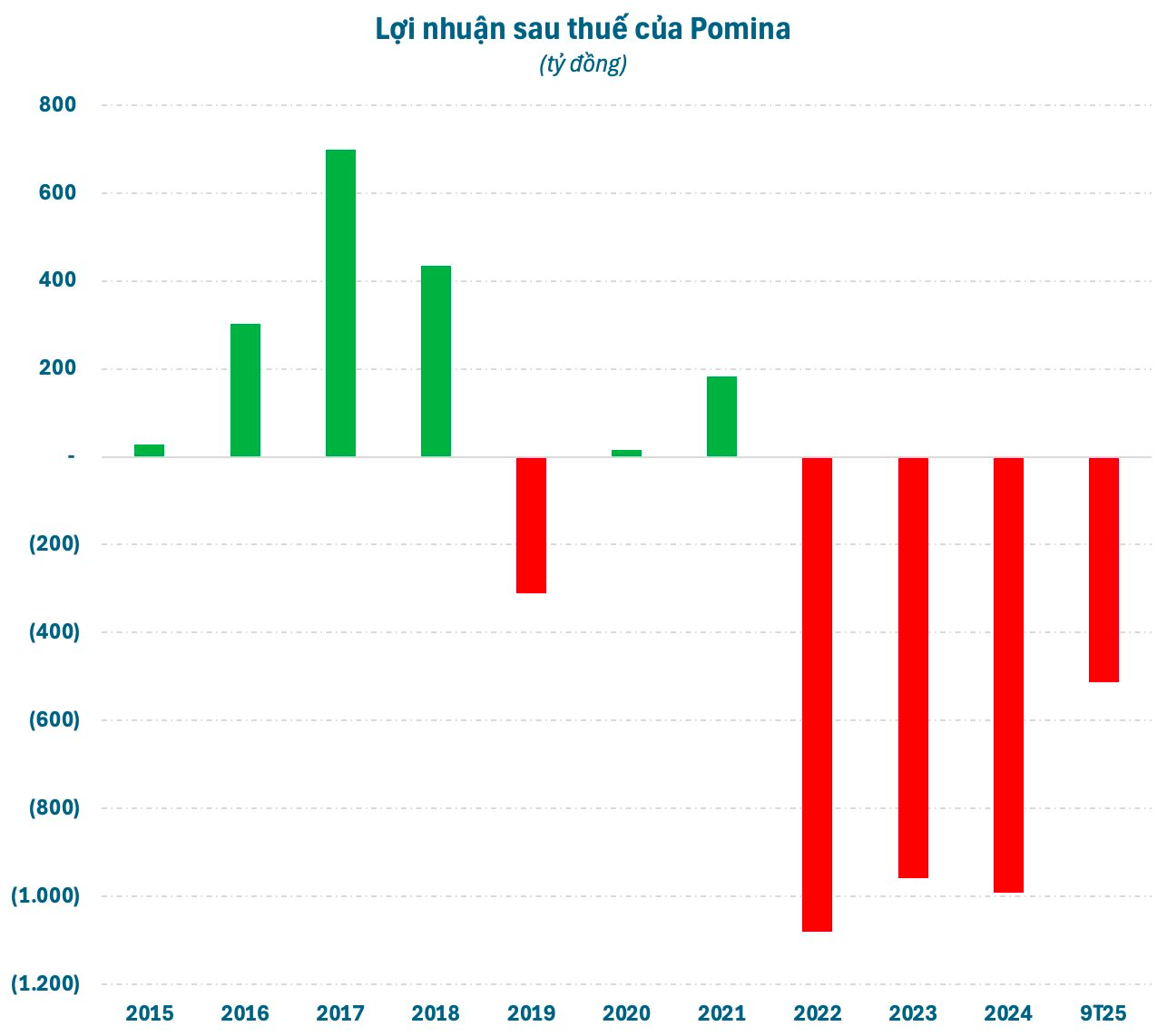

Given the highly cyclical nature of the steel industry, Pomina’s financial performance has been erratic. Historically, the company enjoyed periods of robust profitability, with earnings ranging from VND 400 billion to VND 700 billion. However, post-boom, profits declined sharply, even resulting in significant losses.

Over the past three years (2022-2024), Pomina has consistently reported annual losses of around VND 1 trillion. In the first nine months of 2025, the company incurred an additional loss of over VND 500 billion, pushing cumulative losses to over VND 3 trillion. This has officially driven Pomina into negative equity, prompting an emergency meeting to discuss restructuring plans.

Recently, Pomina’s Board of Directors called an extraordinary meeting scheduled for December. The agenda includes approving the 2025 nine-month financial report and a restructuring plan. Details of the restructuring remain undisclosed. This isn’t Pomina’s first attempt at revival.

In 2024, Pomina announced a strategic partnership with Japan’s Nansei Steel, planning to sell a 51% stake for restructuring. However, legal restrictions on foreign ownership at the time prevented the deal from closing. Pomina also explored domestic partnerships, such as with Thaco Industries, but to no avail.

This latest restructuring effort has garnered attention due to Pomina’s unexpected ties with VinMetal, a Vingroup subsidiary. Established in early October, VinMetal recently increased its charter capital to VND 15 trillion.

Notably, prior to the capital increase, VinMetal appointed Mr. Do Tien Si as CEO and legal representative. Born in 1967, Mr. Si currently serves as CEO and Vice Chairman of Pomina’s Board, boasting over 30 years of experience in steel production, corporate management, and investment.

VinMetal will focus on civil construction steel, hot-rolled steel, high-strength steel, and specialty alloys for electric vehicles and high-speed infrastructure. According to Vingroup, the company aims to supply materials for its core sectors, including Vinhomes real estate and VinFast electric vehicles.

Additionally, Vingroup seeks to secure high-quality steel for industrial, energy, and transportation projects under consideration, such as the North-South high-speed railway and routes connecting Ho Chi Minh City to Can Gio and Hanoi to Quang Ninh.

Vinmetal in Motion: Billionaire Pham Nhat Vuong Appoints Top Executives from Pomina Steel and The Gioi Di Dong to Key Leadership Roles

Do Tien Si has been appointed as the CEO and Legal Representative of Vinmetal Production and Business Joint Stock Company, a member of Vingroup (HOSE: VIC).

Cumulative Losses Exceed 3 Trillion, Negative Equity: Former Steel Industry Leader Unveils Restructuring Plan

Pomina’s Q3 2025 financial report reveals a net revenue of VND 203 billion, marking a 58% decline compared to the same period last year. The company incurred an after-tax loss of nearly VND 183 billion, an improvement from the VND 286 billion loss recorded in the corresponding quarter of the previous year. This marks Pomina’s 14th consecutive quarter of losses.