Valuation Returns to Reasonable Range

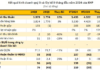

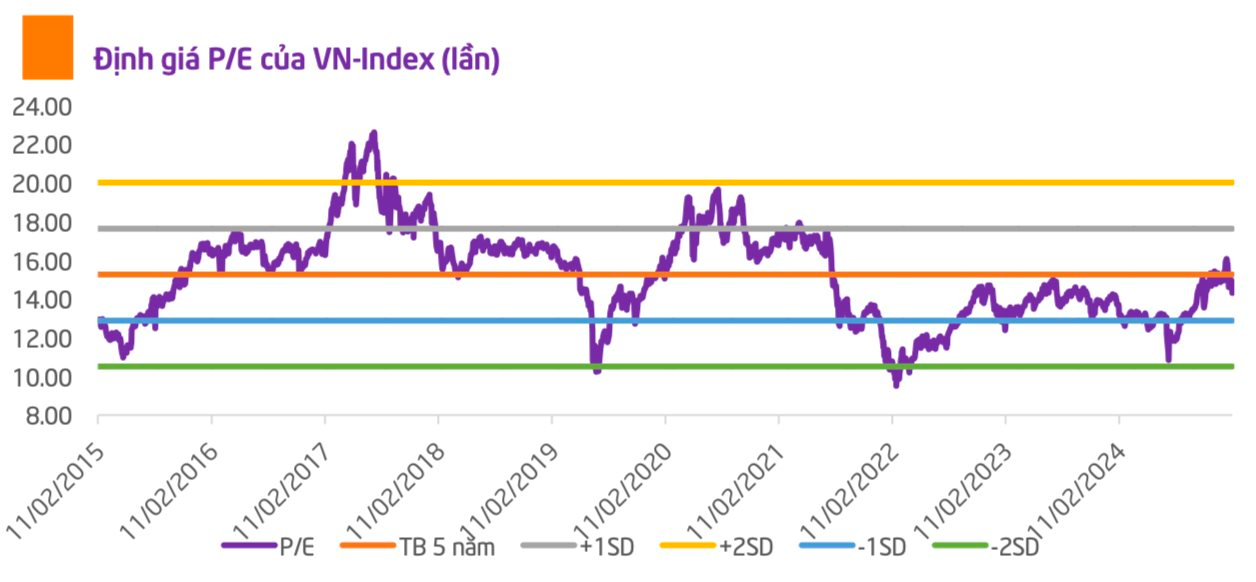

According to TPS Securities’ report, as of October 31, 2025, the VN-Index adjusted to 1,639.65 points (-1.3% month-on-month), corresponding to a P/E TTM valuation of 14.3 times. This is 0.4 standard deviations below the 10-year average and close to the 5-year average (14.5 times). Across sectors, 8 out of 11 are trading below their 5-year average P/E, while Pharmaceuticals, Consumer Services, and Finance are above.

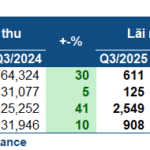

TPS assesses that the market’s valuation is returning to a reasonable range and becoming increasingly attractive, as most sectors have fallen below their 5-year averages. With Q4/2025 and 2026 profit growth expected to exceed 20% year-on-year, the current P/E level is entering an attractive zone.

On the macro front, TPS expects the U.S. Federal Reserve to continue cutting rates in Q4, while the State Bank of Vietnam maintains a loose monetary policy to support growth. Q4 GDP growth is forecast at 8.4%, with the government targeting 10% growth for 2026. FTSE Russell’s official announcement of Vietnam’s stock market upgrade, effective September 2026, is expected to expand the market’s P/E, similar to the 2017–2018 and 2020–2021 rallies.

Listed companies’ profits are projected to grow over 20% in the final two quarters, particularly in manufacturing and exports, which show recovery signs. Stock prices remain low year-to-date, keeping P/E valuations attractive relative to the 5-year average.

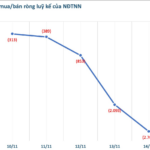

Foreign investors sold a net total of VND 120.754 trillion in the first 10 months of 2025, surpassing 2024’s record (-VND 90 trillion). Key reasons include: (1) VND depreciation against the USD and other currencies, with a 3% spread between black market and bank rates; (2) profit-taking after the market’s rapid rise.

While foreign investors account for only 10–15% of daily trading value, their trend is noteworthy, especially as many sectors are no longer undervalued.

However, with FTSE’s upgrade and positive economic outlook, TPS expects foreign investors to return or reduce selling pressure in late 2025 as currency pressures ease.

Three Key Market Supports

Technically, the VN-Index has breached most short-term moving averages (MAs), retaining only the MA200, indicating a positive long-term trend but short-term correction pressure.

TPS assigns a 70% probability to a technical correction. Current signals suggest the market needs time to rebalance supply and demand before establishing a new trend. Absent new negatives, the index may sideways-down in the short term, with 1,600 points as key resistance. Investors should reduce equity exposure if the VN-Index retests 1,600.

Long-term, TPS identifies three positive factors: (1) Expected 0.25% Fed rate cut on December 10, 2025; (2) U.S.-Vietnam tariff negotiations may boost exports; (3) Q4/2025 GDP growth of 8.4%+, with manufacturing and export orders rebounding after 12 months.

TPS views the market as correcting to an attractive valuation range. However, recovery will be selective, favoring sectors with strong Q4/2025 and 2026 profit growth. Investors should focus on undervalued stocks with positive fundamentals.

Foreign Investors Continue Net Selling Streak, Offloading Nearly 700 Billion VND in Session 14/11, with Heavy Focus on a Banking Stock

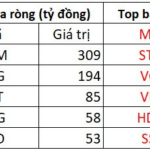

In the afternoon trading session, foreign investors aggressively accumulated VNM shares, making it the most heavily bought stock on the market with a total value of 309 billion VND.

Foreign Investors Net Sell VND 1.5 Trillion in Two Bank Stocks During November 10-14, While Steel Shares See Strong Accumulation

Foreign investors continued their net selling streak, with pressure intensifying towards the end of the week.