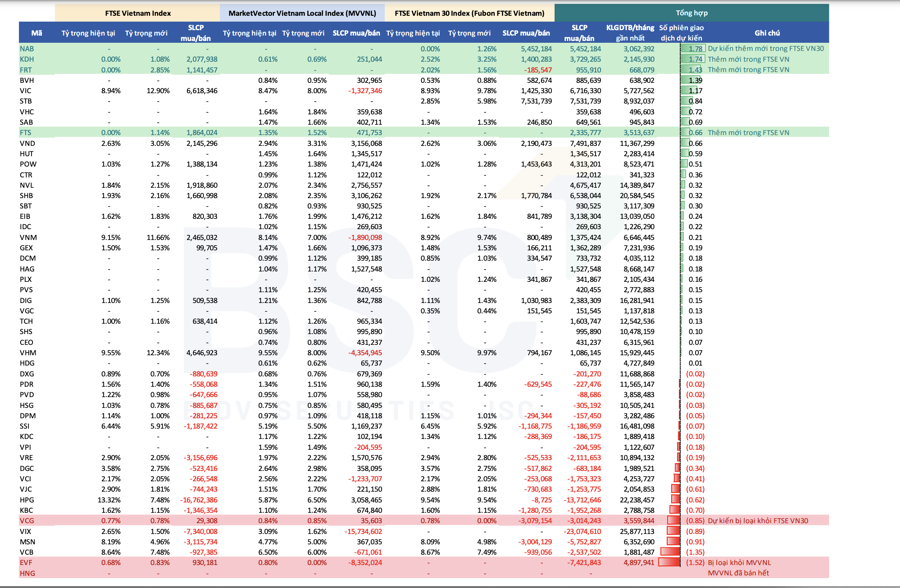

Profits Surge Primarily from Non-Core Business Activities

According to FiinGroup’s statistics, the market’s after-tax profit in Q3/2025 soared by 41.8% year-on-year, driven by the non-financial sector with a 50.4% increase, while the financial sector grew by only 34.1%, despite remarkable profit gains in Securities and Insurance.

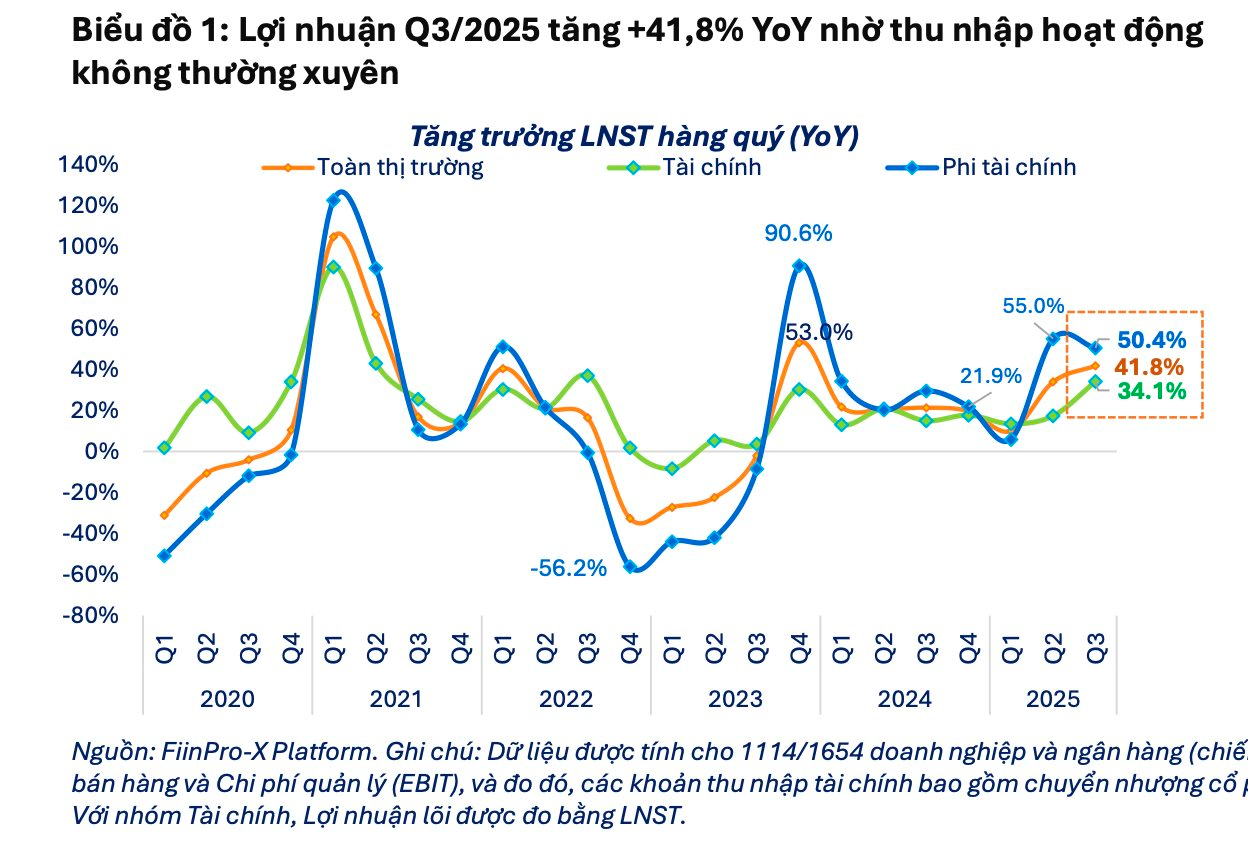

Notably, the significant growth was primarily attributed to non-operating income, such as asset sales, foreign exchange gains, and provision reversals, rather than core business operations.

Specifically, core profit increased by only 16.7% YoY, marking the fourth consecutive quarter of deceleration since the peak in Q4/2024. These non-operating income streams were concentrated among leading enterprises like VIC, VCG, GEE, GEX, VGI, and MWG.

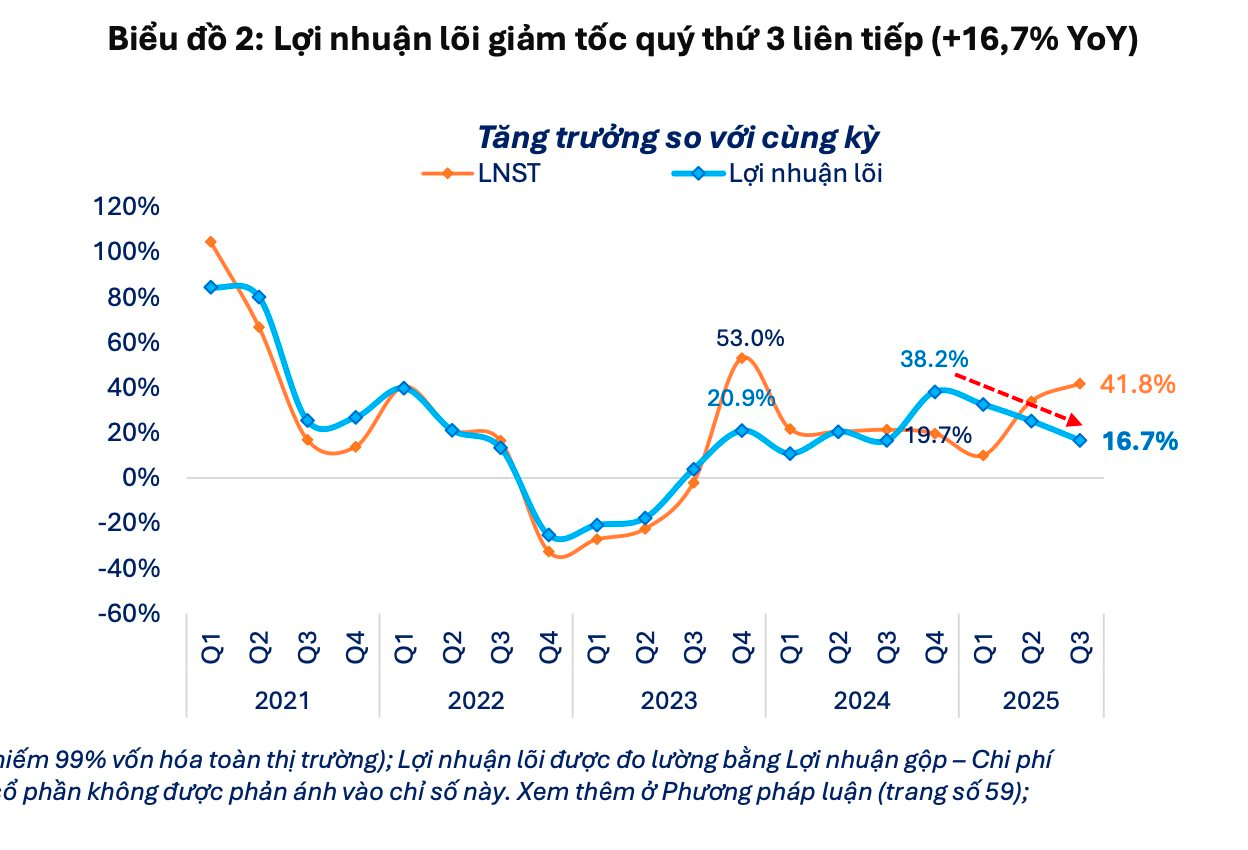

In Q3/2025, the core profit of the large-cap VN30 group—which outperformed the VN-INDEX in terms of stock price—declined slightly by 2.4% YoY due to underwhelming results from leading sectors like Banking and Real Estate.

Conversely, the core profit of mid-cap (VNMID) and small-cap (VNSML) groups surged by 62.4% and 44.2% YoY, respectively, driven by the recovery of sectors such as Retail, Steel, Construction, Building Materials, Seafood, Oil & Gas Exploration, and Fertilizers. However, these two groups account for less than 30% of the core profit structure on HOSE, thus having a negligible impact on overall growth.

Which Sectors Outperformed?

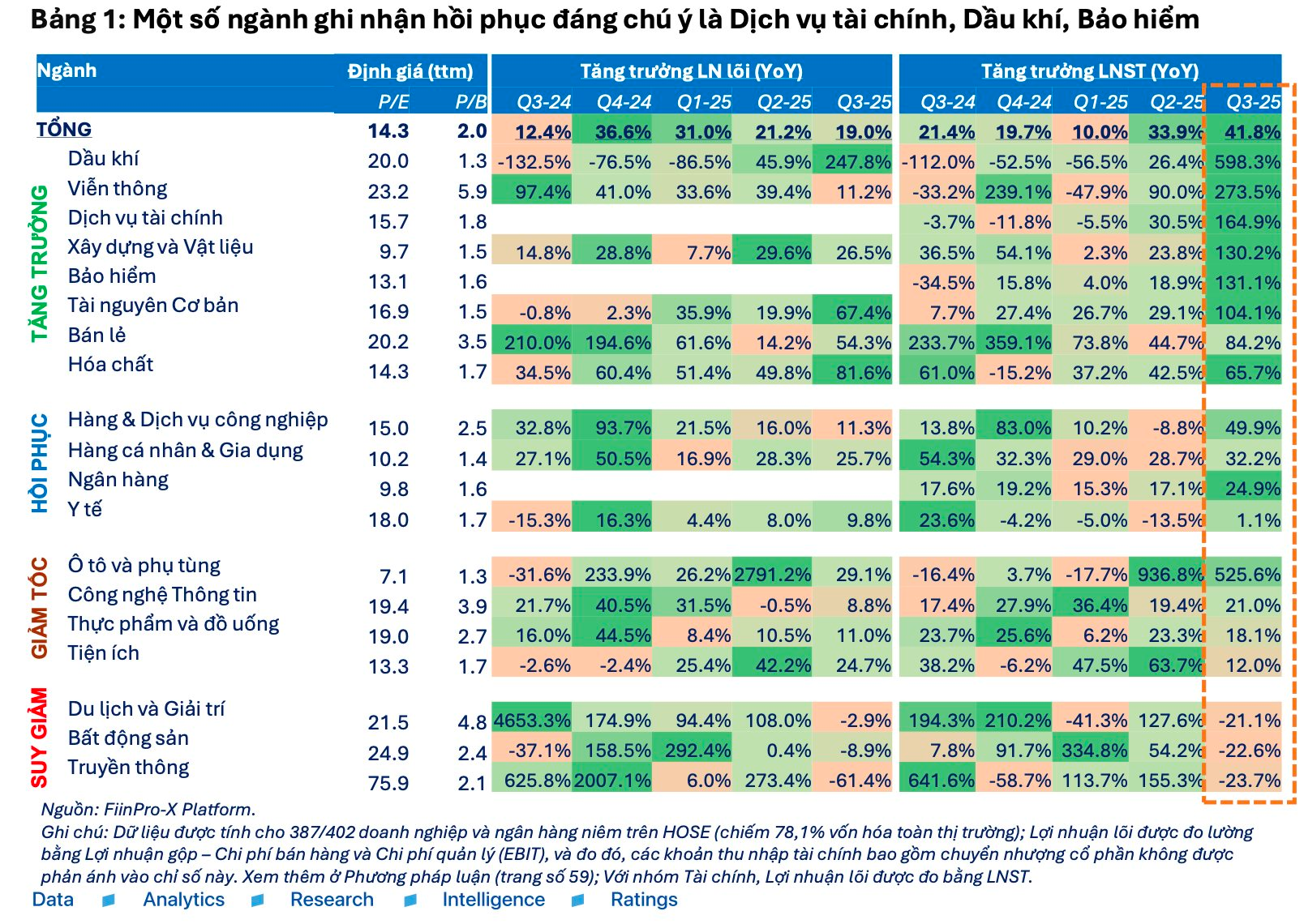

By sector, growth was lackluster in key groups but robust in smaller sectors.

In the growth group, momentum stemmed from both core operations and non-operating income. Notable performers included Oil & Gas companies like PVS, PVD, TOS, Telecommunications with VGI, and Materials & Construction firms such as VCG, SJG, BMP, PC1, and CTD. The Telecommunications sector saw the most significant core profit growth, surging 247% year-on-year.

The Insurance sector also recorded strong growth, with BVH, PVI, and MIG standing out due to a low base effect from Typhoon Yagi’s impact in the previous year. However, compensation risks from post-September storms have yet to be reflected in Q3 results, potentially slowing profit growth in Q4/2025.

The Retail sector, led by MWG and FRT, grew due to improved operational efficiency and a recovery in ICT product demand. In the Chemicals sector, DGC’s profit recovered slowly, while Rubber (DPR), Plastics (AAA), and Fertilizers (DCM, DPM, DDV) saw notable growth.

In the recovery group, Personal Goods stood out with PNJ, as profit margins improved significantly due to rising gold prices. The Industrial Goods & Services sector also achieved high growth, with Airports (ACV), Water Transportation, and Electronics & Electrical Equipment (GEX, GEE) leading the way.

The slowdown group witnessed significant divergence in Food & Beverages, with declines in Dairy and Sugar, deceleration in Livestock (HAG, DBC), and recovery in Seafood and Beer. The Utilities sector saw profit deceleration in Electricity and stagnation in Gas Distribution (GAS).

Meanwhile, the decline group was headlined by Real Estate, where profits unexpectedly reversed after several quarters of growth. The primary cause was insufficient non-operating income to offset the decline in core business revenue, largely driven by a sharp drop in project handovers.

As of the end of 9M/2025, most sectors have achieved over 85% of their annual profit targets, indicating that business results are closely aligned with goals. Sectors like Media, Telecommunications, Oil & Gas, and Chemicals have significantly exceeded plans due to a low base in the previous year and improved profit margins.

In contrast, Banking and Real Estate remain the sectors with the lowest completion rates, at approximately 74.6% and 52.5%, respectively. Conversely, Retail, Insurance, Utilities, and Construction & Materials have maintained steady growth, laying the foundation to meet or even exceed annual profit targets in the final quarter.

Market Pulse 14/11: Divergent Trends as Foreign Investors Net Sell VN30 Stocks

At the close of trading, the VN-Index rose 4.02 points (+0.25%) to 1,635.46, while the HNX-Index gained 1.32 points (+0.5%) to 267.61. Market breadth favored the bulls, with 357 advancing stocks versus 342 decliners. Similarly, the VN30 basket saw a slight green tilt, with 11 gainers, 13 losers, and 6 unchanged.

Stock Market Week 10-14/11/2025: Balanced Supply and Demand, Market Polarization Persists

The VN-Index edged higher in the final session of the week, capping a notably positive recovery week following an extended period of adjustment. Amid balanced supply and demand dynamics, with investor participation remaining subdued, the market’s low-liquidity divergence is likely to persist. Next week, the VN-Index faces a critical test at the Middle line of the Bollinger Bands.

Where is the Money Flowing as Real Estate Prices Surge?

Capital flows are noticeably shifting away from the outskirts of Hanoi and Ho Chi Minh City, as apartment prices in the central areas of these two cities remain high and continue to surge.

Market Pressures Mount: What Lies Ahead for Stocks Next Week?

Last week, the VN-Index fell below the 1,600-point mark amid mounting pressure from a strengthening USD/VND exchange rate and heavy net selling by foreign investors. Despite positive macroeconomic data and third-quarter corporate earnings, analysts predict that the stock market may shift toward a consolidation phase next week, testing the support range of 1,550–1,580 points in the short term.