MARKET ANALYSIS FOR THE WEEK OF NOVEMBER 10-14, 2025

During the week of November 10-14, 2025, the VN-Index rebounded after four consecutive weeks of adjustments, indicating that bottom-fishing demand has re-emerged around the 1,580-1,600 point support zone. However, the recovery momentum needs to be solidified by a significant improvement in liquidity in the coming period.

Additionally, the risk of volatility is likely to persist, given that the Stochastic Oscillator and MACD indicators continue to weaken after issuing sell signals.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – Stochastic Oscillator Has Issued a Buy Signal

In the trading session on November 14, 2025, the VN-Index saw a slight increase, accompanied by a small-bodied candlestick pattern and trading volume remaining below the 20-session average, reflecting investor hesitation. Currently, the index is well-supported by the 100-day SMA, while the Stochastic Oscillator has issued a buy signal and moved out of the oversold region, favoring a short-term recovery.

However, trading volume consistently below the 20-session average and the MACD remaining below zero after a sell signal suggest that these technical factors need improvement for a more sustainable recovery.

HNX-Index – Bollinger Bands Are Narrowing

In the November 14, 2025 trading session, the HNX-Index rose for the fourth consecutive session and is trading above the 100-day SMA, indicating reduced pessimism among investors. Furthermore, the MACD and Stochastic Oscillator continue to rise after issuing buy signals, reinforcing the short-term upward trend.

Currently, the Bollinger Bands are narrowing (Bollinger Band Squeeze) amid below-average 20-session trading volume. Without improvement in liquidity, a sideways trend with alternating up and down sessions is likely to continue.

Liquidity Analysis

Smart Money Flow Dynamics: The Negative Volume Index for the VN-Index is below the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will increase.

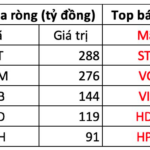

Foreign Investor Flow Dynamics: Foreign investors continued to net sell in the November 14, 2025 session. If this trend continues in upcoming sessions, the outlook will become more pessimistic.

Technical Analysis Department, Vietstock Advisory Division

– 16:58 November 15, 2025

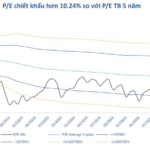

VN-Index Valuation Remains Attractive for Mid to Long-Term Investors, but Beware of These 4 Key Risks

The P/E ratio is poised to expand its range to 13.5–15.x in an optimistic scenario, as the VN-Index fluctuates between 1,550 and 1,770, sustaining its upward trajectory in both the medium and long term.

Market Pulse 14/11: Divergent Trends as Foreign Investors Net Sell VN30 Stocks

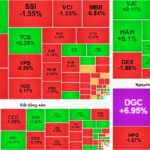

At the close of trading, the VN-Index rose 4.02 points (+0.25%) to 1,635.46, while the HNX-Index gained 1.32 points (+0.5%) to 267.61. Market breadth favored the bulls, with 357 advancing stocks versus 342 decliners. Similarly, the VN30 basket saw a slight green tilt, with 11 gainers, 13 losers, and 6 unchanged.

Stock Market Week 10-14/11/2025: Balanced Supply and Demand, Market Polarization Persists

The VN-Index edged higher in the final session of the week, capping a notably positive recovery week following an extended period of adjustment. Amid balanced supply and demand dynamics, with investor participation remaining subdued, the market’s low-liquidity divergence is likely to persist. Next week, the VN-Index faces a critical test at the Middle line of the Bollinger Bands.