VPS Securities Corporation (VPS) has announced a resolution regarding the handling of remaining shares from its initial public offering (IPO).

As of now, investors have subscribed and paid for 201.6 million out of the total 202.3 million IPO shares offered by VPS.

The remaining 690,285 shares, for which payment has not been fully settled, will be allocated to investor Vũ Cao Hoàng Hải Linh. The offering price remains at 60,000 VND per share, requiring a total payment of 41.4 billion VND. The payment deadline is set for 8 AM on November 17th. These shares will be subject to a one-year transfer restriction. Post-allocation, this individual is expected to own 0.046% of VPS’s charter capital.

Additionally, 12,859 fractional shares arising from rounding during allocation will be distributed to investor Nguyễn Trường Giang. The offering price is also 60,000 VND per share, totaling over 771 million VND. The payment deadline is 8 AM on November 17th. These shares are not subject to transfer restrictions. Post-allocation, this individual is expected to own 0.0009% of VPS’s charter capital.

According to VPS’s announcement, as of November 6, 2025, the IPO attracted 19,952 investors who registered to purchase a total of 220,420,400 shares, exceeding the 202.31 million shares offered. Notably, individual investors accounted for 98.11% of the total registered value.

Investors who placed orders at prices higher than the offering price will receive their full requested allocation. Those who ordered at the offering price will receive an allocation ratio of 83.73%. VPS will notify each investor of their share allocation results.

Upon successful completion of the IPO, VPS is expected to raise 12,138.6 billion VND. Of this amount, 10,976.8 billion VND will be allocated for margin lending; 900 billion VND for IT infrastructure investment; and 270 billion VND for human resource development. The disbursement period spans from 2025 to 2027.

Following the IPO, all shares will be registered and centrally depository at the Vietnam Securities Depository and Clearing Corporation (VSDC) and listed on the Ho Chi Minh City Stock Exchange (HoSE).

If VPS fails to meet the listing requirements post-IPO, the shares will be registered for trading on the Unlisted Public Company Market (UPCoM).

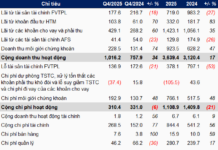

Prior to the IPO, VPS reported robust Q3 2025 results with pre-tax profit of 1,395 billion VND, up 70%; and post-tax profit of 1,126 billion VND, up 72%.

For the first nine months of 2025, VPS recorded operating revenue of 5,900 billion VND, nearly 20% higher year-on-year; pre-tax profit of 3,192 billion VND; and post-tax profit of 2,564 billion VND, both up 52%.

VPS’s Board of Directors recently adjusted its 2025 business plan upward. The company now targets annual revenue of 8,800 billion VND; pre-tax profit of 4,375 billion VND; and post-tax profit of 3,500 billion VND.

Compared to the plan approved at the 2025 Annual General Meeting, VPS increased its revenue target by 3.5% and profit target by 25%.

Thus, after nine months, VPS has achieved 67% of its revenue target and 73% of its pre- and post-tax profit goals.

CII Transfers 4.49 Million NBB Shares to Subsidiary

CII has registered to sell 4.49 million NBB shares of Nam Bay Bay to its subsidiary, CII Invest, during the period from November 19 to December 18, 2025.

Global Brokerages Caught in the Capital Increase Vortex

Amidst a market correction marked by liquidity tightening and index fluctuations, the race to raise capital within the securities sector has entered a new phase of heightened tension. After a period of relative inactivity, foreign investors are now re-emerging as key players in this competitive landscape. This resurgence signals a notable shift, particularly as the IPO trend is poised to extend its reach to foreign direct investment (FDI) enterprises, warranting close attention from market observers.