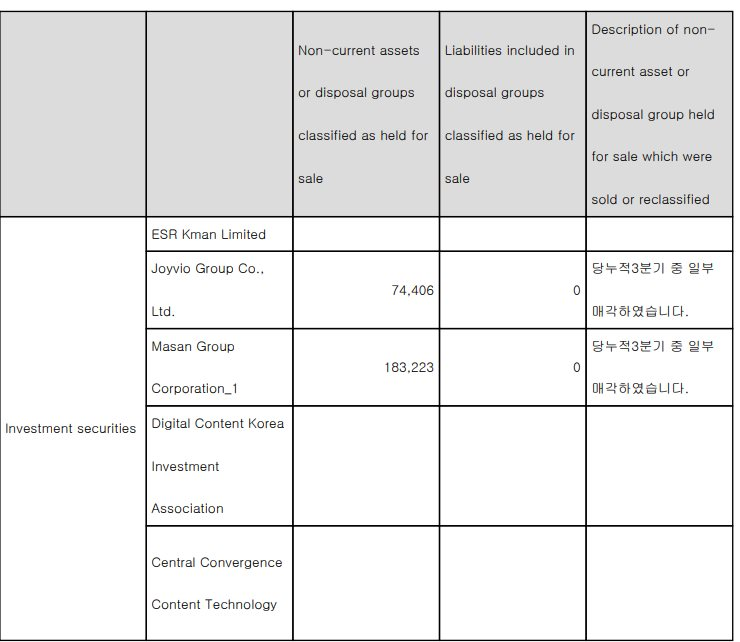

SK’s Q3 2025 activity report reveals that its investment in Masan is classified under assets held for sale, with a slight variation from the beginning of the year.

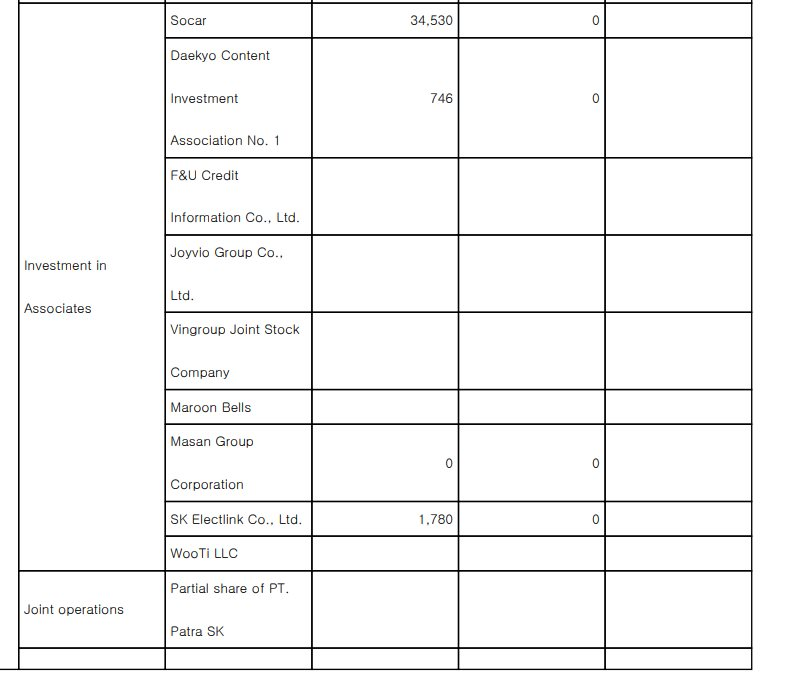

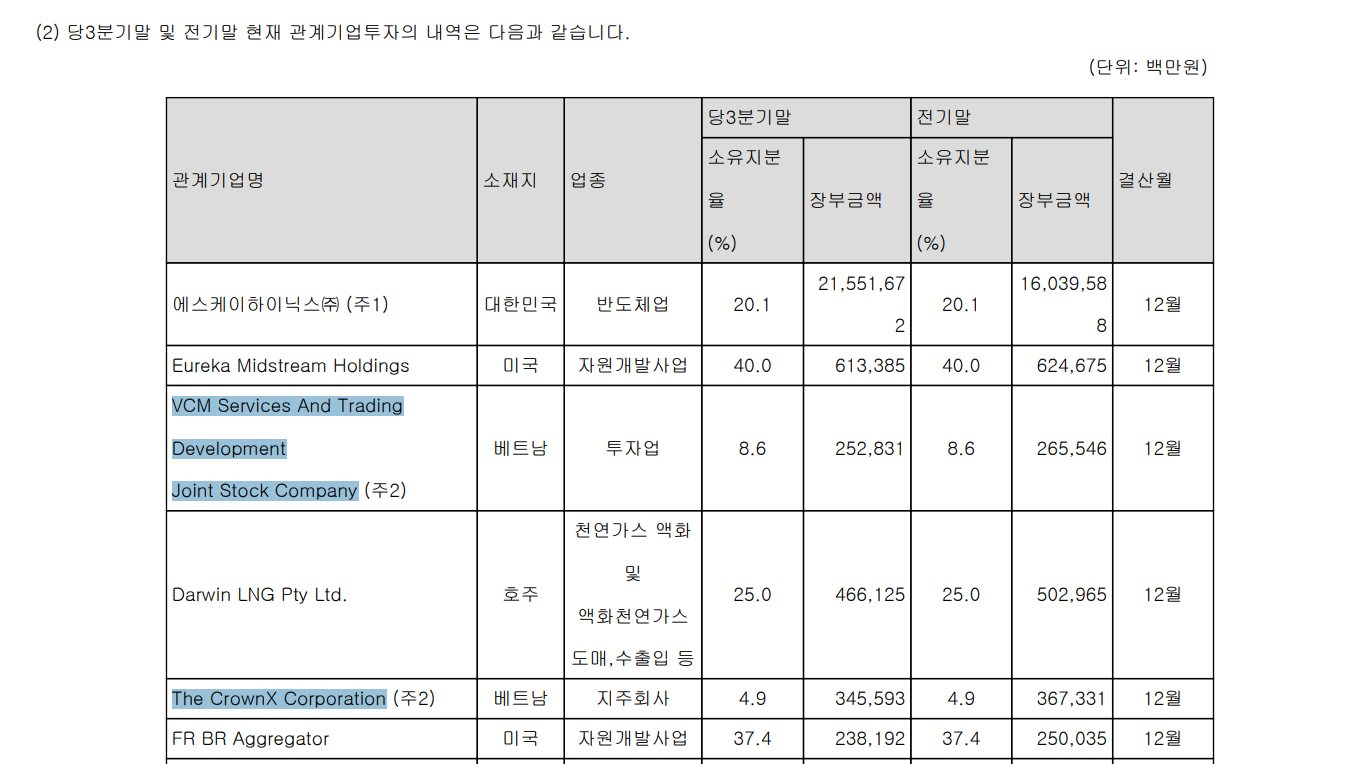

According to the report, SK’s investment in its associate, Masan (HoSE: MSN), has been reduced to zero, now listed as Masan Group Corporation. At the end of 2024, this figure stood at 112.1 billion won (approximately $76.9 million).

However, the report introduces a new entry under investment securities: Masan Group Corporation_1, valued at 182.2 billion won. This aligns with October’s news that SK Invest VINA II Pte. Ltd. offered approximately 42.6 million MSN shares (worth around $127 million) for sale via a negotiated deal.

Additionally, SK’s report indicates that the company retains 4.9% and 8.6% stakes in CrowdX and WinCommerce, respectively.

Regarding other investments, SK’s report confirms that its stake in Vingroup has been fully divested, consistent with the mid-2025 report stating that SK Investment Vina II Pte. Ltd. sold all Vingroup shares on August 5, 2025.

SK Group became a major shareholder of Masan in 2018 after investing 530 billion won (nearly $470 million) to acquire a 9.5% stake and securing a put option for MSN shares in 2024.

In early September 2024, SK Group and Masan Group agreed to extend SK Group’s put option for MSN shares by up to five years. Simultaneously, Ms. Chae Rhan Chun, representing SK Investment Vina I, resigned from Masan Group’s board.

SK Group’s divestment from Masan was not unexpected, as it had been signaled earlier. In the 2024 consolidated financial report, the South Korean conglomerate reclassified its Masan investment as “assets held for sale.”

Da Nang Chairman Pham Duc An Addresses the $16 Billion Reclamation Project

On November 13th, during a conference focused on studying and implementing the resolutions and action plans from the 1st Congress of the Da Nang City Party Committee (term 2025-2030), as well as centralizing new documents from the Central Committee and the City Party Committee, Mr. Pham Duc An, Chairman of the Da Nang People’s Committee, shared insights regarding the proposed land reclamation project in Da Nang.

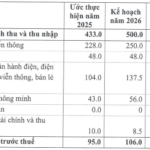

VNPT Proceeds with Capital Withdrawal Registration from VNTT

Vietnam Posts and Telecommunications Group (VNPT) has announced its intention to sell its entire stake in Vietnam Technology and Communication Joint Stock Company (VNTT, UPCoM: TTN). The offering comprises 2 million TTN shares, scheduled for sale outside the trading system from November 12 to December 11.