|

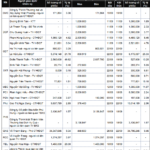

Ms. Trịnh Khánh Linh, daughter of Mr. Trịnh Văn Tuấn, Chairman of the Board of Directors of PC1 Group, has registered to purchase 4 million new PC1 shares between November 20 and December 18. Following the transaction, her ownership is expected to rise to 1.118%. Mr. Tuấn currently holds nearly 76.5 million shares, equivalent to 21.382% of the capital, making him the largest shareholder of PC1.

Based on the closing price of VND 22,550 per share on November 17, Ms. Linh’s new acquisition is valued at over VND 90 billion. PC1 shares recently experienced a positive trading week, with a 10% increase, pushing the one-year growth rate above 17% and average liquidity of nearly 3 million shares per session. However, the stock remains 17% below its peak of over VND 27,000 per share in mid-August.

| PC1 Share Price Trends Over the Past Year |

In a similar buying trend, Vice Chairman Phan Ngọc Hiếu increased his ownership from zero to 2.24% of the capital after purchasing 8 million PC1 shares via agreement in two sessions on September 16 and 18, with a minimum value of approximately VND 200 billion. Conversely, VIX Securities ceased to be a major shareholder after selling 3 million PC1 shares through an agreement, earning around VND 79 billion and reducing its ownership to 4.95% of the capital.

In terms of business results, PC1 recorded its highest quarterly performance since its establishment in Q3/2025. Revenue reached VND 3,278 billion, and net profit hit VND 301 billion, up 47% and 88% year-on-year, respectively. Strong growth in construction, electrical equipment supply, and industrial infrastructure development was driven by accelerated progress in major projects. The energy, mining sectors, and profits from the affiliated company Western Pacifics also improved.

For the first nine months of the year, PC1 reported revenue of VND 8,073 billion, a 7% increase year-on-year, and net profit of VND 498 billion, up 25%. This marks the highest nine-month profit in the past four years, even surpassing the full-year results of 2022-2024. The company has achieved 60% of its annual revenue and profit targets.

Previously, on November 12, PC1 set the ex-rights date for the issuance of over 53.6 million bonus shares at a 15% ratio. Post-issuance, the company’s chartered capital is expected to rise to VND 4,113 billion.

– 15:28 17/11/2025

Technical Analysis Afternoon Session 03/11: Long Lower Shadow Emerges

The VN-Index staged a modest recovery, forming a Long Lower Shadow candlestick pattern after retesting its August 2025 lows. Conversely, the HNX-Index extended its decline as the Stochastic Oscillator triggered a sell signal.

“Shareholders Receive First Dividend Payout After a 14-Year Wait”

Despite incurring losses of nearly VND 44 billion in the first half of the year, Vietnam Maritime Transport Joint Stock Company (stock code: VOS) distributed VND 154 billion in dividends to its shareholders. Notably, this marks the first time since 2011 that VOS shareholders have received dividends.