With over 101.4 million outstanding shares, Coteccons plans to allocate more than 101 billion VND for dividend payments. The expected implementation date is December 22, 2025.

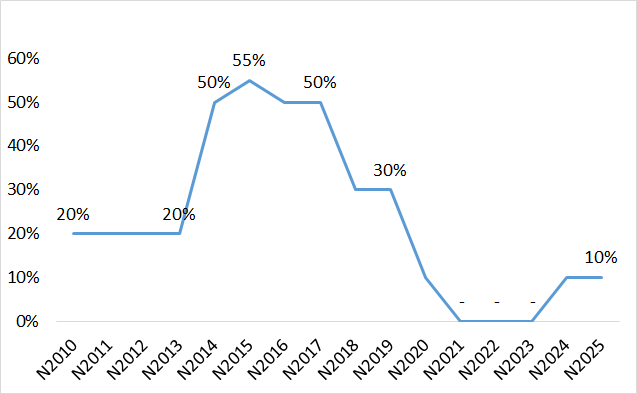

Listed on the Ho Chi Minh City Stock Exchange (HOSE) in 2010, Coteccons consistently paid cash dividends to shareholders until 2020, with rates ranging from 10% to 55%. The highest dividend rate was recorded in 2015, followed by 50% in the subsequent two years, and 30% in 2018. This period also marked the construction giant’s peak performance, with revenue reaching 28,560 billion VND in 2018.

Subsequently, during the transition and restructuring phase, it’s understandable that Coteccons did not pay dividends for three consecutive years from 2021 to 2023.

|

Cash dividend payout ratio of CTD from 2010 – 2025

Source: VietstockFinance

|

Additionally, Coteccons has approved a plan to issue approximately 5.1 million bonus shares to shareholders, with a rights ratio of 20:1. This means that shareholders holding 20 shares will receive 1 new share, aimed at increasing capital. The implementation will proceed upon receiving the issuance notification from the State Securities Commission (SSC).

If successful, Coteccons’ chartered capital will rise to over 1,087 billion VND, equivalent to more than 108.7 million shares.

Regarding capital raising, in October, Coteccons approved a plan to issue public bonds with a maximum value of 1.4 trillion VND, expected to be implemented from late this year to early next year. According to the plan, most of the proceeds will be used to settle debts with partners and employees.

Coteccons aims to raise 1.4 trillion VND through bond issuance to settle debts

In terms of personnel, CTD recently appointed Ms. Đinh Thị Hồng Thắm as Head of the Board of Directors’ Secretariat and the person in charge of corporate governance, replacing Mr. Nguyễn Văn Đua, effective November 17, 2025. Mr. Đua will focus on his role as Deputy General Director and Chief Financial Officer.

– 4:52 PM, November 17, 2025

Fastest Capital-Raising Real Estate Firm Set to List on HoSE

The Ho Chi Minh City Stock Exchange (HoSE) has recently received the listing application for 200 million RGG shares from Regal Group Joint Stock Company. Prior to this, Regal Group successfully offered 20 million shares to existing shareholders at a price of 10,000 VND per share, increasing its chartered capital from 1.8 trillion VND to 2 trillion VND.

Chairman Nguyen Dang Quang’s Wife Steps Down from Vinacafe Bien Hoa’s Board of Directors

Vinacafe Bien Hoa’s shareholders have approved the resignation of Ms. Nguyen Thi Hoang Yen from her position as a Board Member, effective prior to the end of her term.

New Major Shareholder Emerges for DSC Securities

On November 11th, prominent investor Le Ngoc Duc acquired 32.35 million shares of DSC, securing an 11.76% stake in the company’s charter capital and becoming a major shareholder.