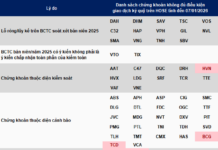

I. FUTURE CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

On November 17, 2025, VN30 futures contracts saw a unanimous rise. Specifically, 41I1FB000 (I1FB000) increased by 1.36%, closing at 1,895.2 points; VN30F2512 (F2512) rose by 1.4%, reaching 1,891.1 points; 41I1G3000 (G3000) gained 0.86%, closing at 1,881 points; and 41I1G6000 (I1G6000) climbed 1.48%, ending at 1,880 points. The underlying index, VN30-Index, closed at 1,893.54 points.

Additionally, VN100 futures contracts also experienced a collective uptrend on the same day. Notably, 41I2FB000 (I2FB000) surged by 1.46%, closing at 1,806 points; 41I2FC000 (I2FC000) increased by 0.82%, reaching 1,793.4 points; 41I2G3000 (I2G3000) rose by 0.49%, closing at 1,776.1 points; and 41I2G6000 (I2G6000) gained 1.4%, ending at 1,785.1 points. The underlying VN100-Index closed at 1,804.18 points.

During the November 17, 2025 session, 41I1FB000 witnessed a strong surge from the opening bell, with long positions dominating throughout the morning session, sustaining its upward momentum. In the afternoon, the contract entered a fierce tug-of-war but buyers maintained control until the close. Consequently, I1FB000 closed at 1,895.2 points, up 25.5 points from the previous Friday’s session.

Intraday Chart of 41I1FB000

Source: https://stockchart.vietstock.vn/

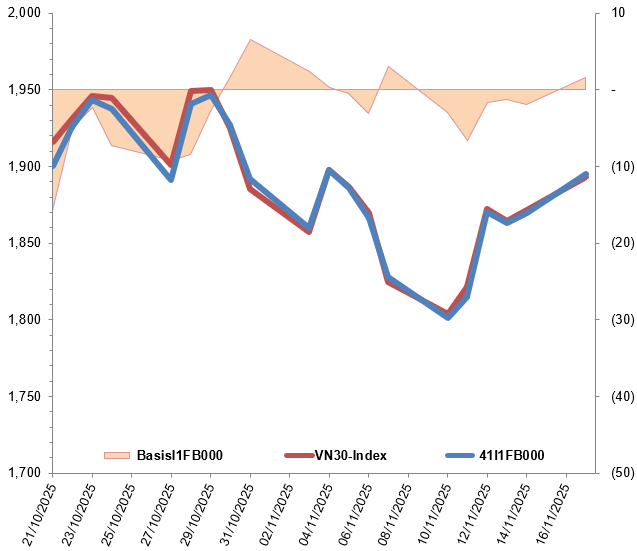

At the close, the basis of the 41I1FB000 contract reversed from the previous session, reaching 1.66 points. This reversal indicates a renewed optimism among investors.

Fluctuations of 41I1FB000 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated using the formula: Basis = Futures Contract Price – VN30-Index

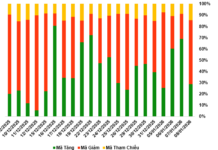

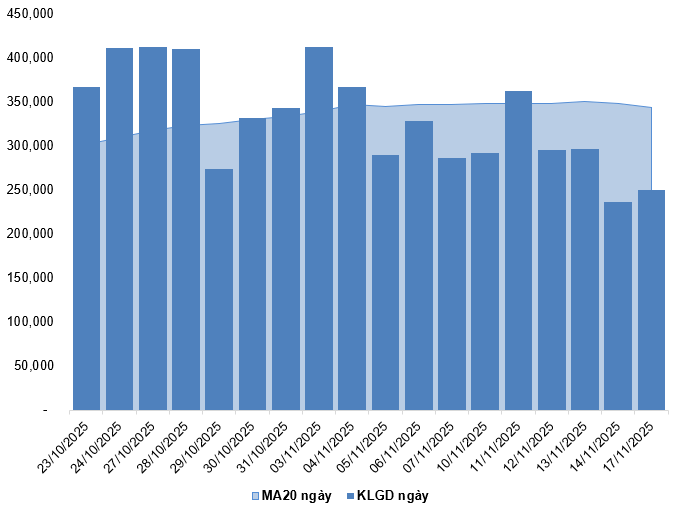

Trading volume and value in the derivatives market increased by 5.6% and 6.95%, respectively, compared to the November 14, 2025 session. Specifically, I1FB000 trading volume rose by 4.88%, with 247,434 contracts matched. I2FB000 trading volume reached 62 contracts, a 34.78% increase.

Foreign investors returned to net buying, with a total net purchase volume of 454 contracts on November 17, 2025.

Daily Trading Volume Fluctuations in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

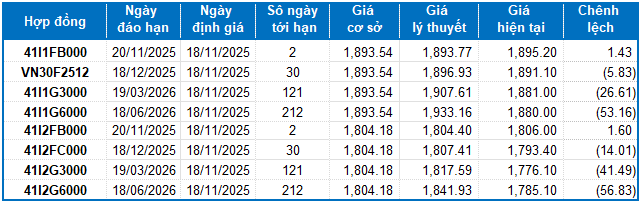

I.2. Futures Contract Valuation

Based on the fair pricing method as of November 18, 2025, the fair price range for actively traded futures contracts is as follows:

Summary Table of Derivatives Valuation for VN30-Index and VN100-Index

Source: VietstockFinance

Note: The opportunity cost in the valuation model has been adjusted to align with the Vietnamese market. Specifically, the risk-free rate (government treasury bills) has been replaced by the average deposit rate of major banks, with maturity adjustments tailored to each futures contract.

I.3. Technical Analysis of VN30-Index

On November 17, 2025, the VN30-Index continued its upward trend, forming a small-bodied candlestick pattern with trading volume remaining below the 20-session average, reflecting investor hesitation.

Currently, the index is retesting the Middle Band of the Bollinger Bands, while the Stochastic Oscillator continues to rise after generating a buy signal.

Meanwhile, the MACD indicator is narrowing its gap with the Signal line after previously issuing a sell signal. If a buy signal reemerges, the prospects for a recovery in the near term will be further supported.

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

II. FUTURE CONTRACTS OF THE BOND MARKET

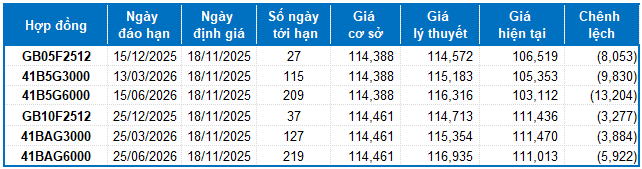

Based on the fair pricing method as of November 18, 2025, the fair price range for actively traded bond futures contracts is as follows:

Summary Table of Government Bond Futures Valuation

Source: VietstockFinance

Note: The opportunity cost in the valuation model has been adjusted to align with the Vietnamese market. Specifically, the risk-free rate (government treasury bills) has been replaced by the average deposit rate of major banks, with maturity adjustments tailored to each futures contract.

According to the above valuation, contracts GB05F2512, 41B5G3000, 41B5G6000, GB10F2512, 41BAG3000, and 41BAG6000 are currently attractively priced. Investors should focus on and consider buying these futures contracts in the coming period, as they present a compelling value proposition in the market.

Economic Analysis & Market Strategy Department, Vietstock Consulting Division

– 18:28 17/11/2025

Derivatives Market Outlook for Week 17-21/11/2025: Short-Term Risks Persist

On November 14, 2025, most VN30 and VN100 futures contracts closed higher. While the VN30-Index edged up, a small-bodied candlestick pattern emerged alongside trading volume remaining below the 20-session average, indicating investor hesitation.

Derivatives Market on November 14, 2025: Mixed Signals Emerge

On November 13, 2025, the VN30 and VN100 futures contracts diverged in their performance. The VN30-Index exhibited a tug-of-war pattern, forming a small-bodied candlestick accompanied by declining trading volume, which remained below the 20-session average. This suggests a cautious sentiment among investors.

Technical Analysis Afternoon Session 13/11: Stochastic Oscillator Signals a Buy Opportunity

The VN-Index staged a modest recovery, forming a small-bodied candle, while the Stochastic Oscillator signaled a return to buying momentum. Meanwhile, the HNX-Index extended its upward trajectory, decisively breaching the Middle line of the Bollinger Bands.

Derivatives Market Outlook on November 13, 2025: Has Pessimism Subsided?

On November 12, 2025, both the VN30 and VN100 futures contracts rallied during the trading session. The VN30-Index extended its winning streak to a second consecutive session, forming a White Marubozu candlestick pattern. This bullish signal was further reinforced by a notable increase in trading volume compared to the previous session, indicating a shift in investor sentiment from pessimism to cautious optimism.