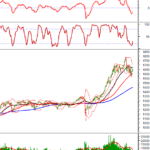

The stock market witnessed a volatile week of trading. The VN-Index opened the week with a sharp decline of nearly 20 points, hovering around 1,580 points, continuing the previous week’s correction. However, the market swiftly rebounded in subsequent sessions.

At one point, the VN-Index breached the psychological barrier of 1,600 points early in the week, quickly reclaimed it, and closed the week at approximately 1,635 points, marking a 36.36-point (+2.27%) increase.

Most experts remain cautious about the market’s trend, advising investors to observe carefully before making decisions and maintain a moderate stock allocation in their portfolios.

The VN-Index’s ability to break free from the downtrend soon is low

According to Mr. Nguyễn Anh Khoa, Director of Securities Analysis at Agribank (Agriseco), the VN-Index showed a positive performance by recovering over 36 points. However, the recent rebound may be technically driven, with weakening momentum as the index approaches the upper channel of the downtrend, corresponding to the 1,630–1,635 resistance zone.

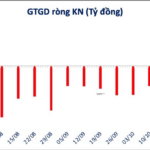

In terms of liquidity, trading volume gradually recovered, while value remained flat and slightly decreased toward the end of the week. Proactive selling pressure also dominated, indicating the VN-Index’s limited potential to break free from the downtrend soon. The liquidity contribution of VN30 stocks to the market slightly decreased, replaced by VNMid stocks, reflecting a shift in capital flow from large-cap to mid-cap stocks.

For the week of November 17–21, Mr. Khoa anticipates the VN-Index will fluctuate within the downtrend channel, retesting the 1,610 support level in early sessions to stimulate proactive buying interest. A positive scenario would see the VN-Index trading around the reference level in the first session or even rising toward the 1,650 resistance, offering an opportunity to exit the downtrend.

Given the short-term downtrend and low liquidity, investors should limit margin usage to preserve purchasing power. Nonetheless, many fundamentally strong stocks have become attractively priced and can be accumulated for the medium to long term. Currently, the VN-Index’s P/E ratio stands at 14.26 times, averaging the past three years. Several sectors and stocks are now priced quite attractively.

Agriseco experts recommend maintaining a 50–60% stock allocation in portfolios, increasing exposure to stocks with positive growth prospects and reasonable valuations.

The market needs a breakout session to confirm a new uptrend

According to Mr. Đinh Việt Bách, Securities Analyst at Pinetree, the VN-Index had a positive week with low liquidity. Reduced selling pressure, as many stocks had already fallen 20–30%, facilitated the recovery. The rebound was driven by news of potential market upgrades, including the National Assembly’s 10% GDP growth target for 2026 and positive developments from FTSE Russell and Vanguard regarding investment in Vietnam’s stock market post-upgrade.

Notably, capital rotated from large-cap stocks to previously dormant mid-cap sectors like Oil & Gas, Chemicals, Fertilizers, and Industrial Zones. Conversely, previously leading sectors like Vin Group, Banking, and Securities underperformed.

Despite continued foreign net selling, market sentiment stabilized as the VN-Index recorded four consecutive recovery sessions, closing the week above the 20-week MA at 1,635 points.

For the upcoming week, Mr. Bách advises investors to await a breakout session confirming the bottom. After finding equilibrium last week, low liquidity signals reduced supply pressure, while short-term profit-taking, especially in Banking and Securities, indicates no new lows. The market remains in a technical recovery phase, requiring a Follow-Through Day (FTD) to confirm a new uptrend. If successful, mid-cap stocks, with less supply pressure, are likely to lead rather than large-caps.

Initially, the VN-Index may retest the 1,600 support zone. Holding this level and a subsequent FTD would confirm an uptrend. However, losing the 1,600 zone could lead to deeper support levels around 1,500–1,550 points.

Will the Stock Market Shift Gears Next Week?

The VN-Index continued its recovery last week, though investor sentiment remained cautious with subdued trading volumes. Despite this, positive signals emerged in select stock groups, attracting bottom-fishing demand. Analysts advise investors to position for a potential trend reversal once recovery signals are confirmed, while maintaining a cash reserve to capitalize on emerging opportunities.

Thai Tycoon Reaps Windfall Dividends from Vietnamese Enterprises

After 13 years, Nawaplastic Industries Co., Ltd. has reaped over VND 2.824 trillion in dividends from Binh Minh Plastics, equivalent to their initial investment in shares. Meanwhile, Vietnam Beverage has garnered approximately VND 15.4 trillion in dividends from Sabeco, and F&N Dairy Investments has collected more than VND 15 trillion in dividends from Vinamilk.

Technical Analysis for the Afternoon Session of November 17: Maintaining a Positive Outlook

The VN-Index continues its upward trajectory, decisively breaking above the Bollinger Bands’ Middle line. Meanwhile, the HNX-Index demonstrates even greater momentum, extending its winning streak to a fifth consecutive session.