Vietnam’s stock market, after a deep decline, is transitioning to a state of supply-demand equilibrium, setting the stage for a new cycle amidst lingering uncertainties. Macroeconomic stability is maintained, with a targeted GDP growth of 10% or higher by 2026. However, investor sentiment remains weighed down by high-interest rates, prolonged net selling by foreign investors, and increasing disparities in business performance across sectors.

According to Mr. Bùi Văn Huy, Deputy General Director of FIDT, instead of attempting to predict the exact bottom or chase short-term waves, investors should view the critical support zone of 1,580–1,600 points as a preparation area for the new year 2026. Portfolio restructuring, improving stock quality, reducing leverage, and patiently focusing on beneficiary sectors are recommended strategies.

For portfolio structure, experts advise a three-tier approach with distinct roles. The core layer (30–40%) should focus on leading companies with healthy balance sheets, benefiting from mid-term growth (2025–2026), including select banks, essential consumer goods, utilities, and digital infrastructure. These sectors are deemed to have reasonable upside potential, with the VN-Index trading at a P/E ratio of ~14 times, which is not cheap but acceptable if profit growth is sustained.

The second layer (10–20%) can be allocated to themes benefiting from public investment, FDI, logistics, and exports, with strict stop-loss discipline.

The remaining portion should be held in cash to cushion against unexpected market volatility.

Which sectors are attracting capital flow?

For short-term investors, Mr. Huy suggests a strategy of selective stock picking rather than index chasing. Current data indicates capital rotation into specific stocks with clear narratives, such as VNM, FPT, NVL, HAG, rather than broad market exposure. Instead of predicting the VN-Index’s daily movements, investors should closely monitor individual stocks in their portfolios, prioritizing those with strong accumulation, improved liquidity, and clear supportive information (e.g., earnings, projects, dividends, capital increases). Stocks breaking support levels or lacking positive fundamentals should be reduced or cut.

Notably, the recent rebound has seen relatively healthy capital rotation across sectors, not concentrated in a single group. Last week, real estate, select steel, and food & beverage stocks performed well, alongside banks as key market supports. However, liquidity remains insufficient to confirm a sector-wide rally. Mr. Huy identifies three key sectors for potential capital inflows in the next 1–2 quarters:

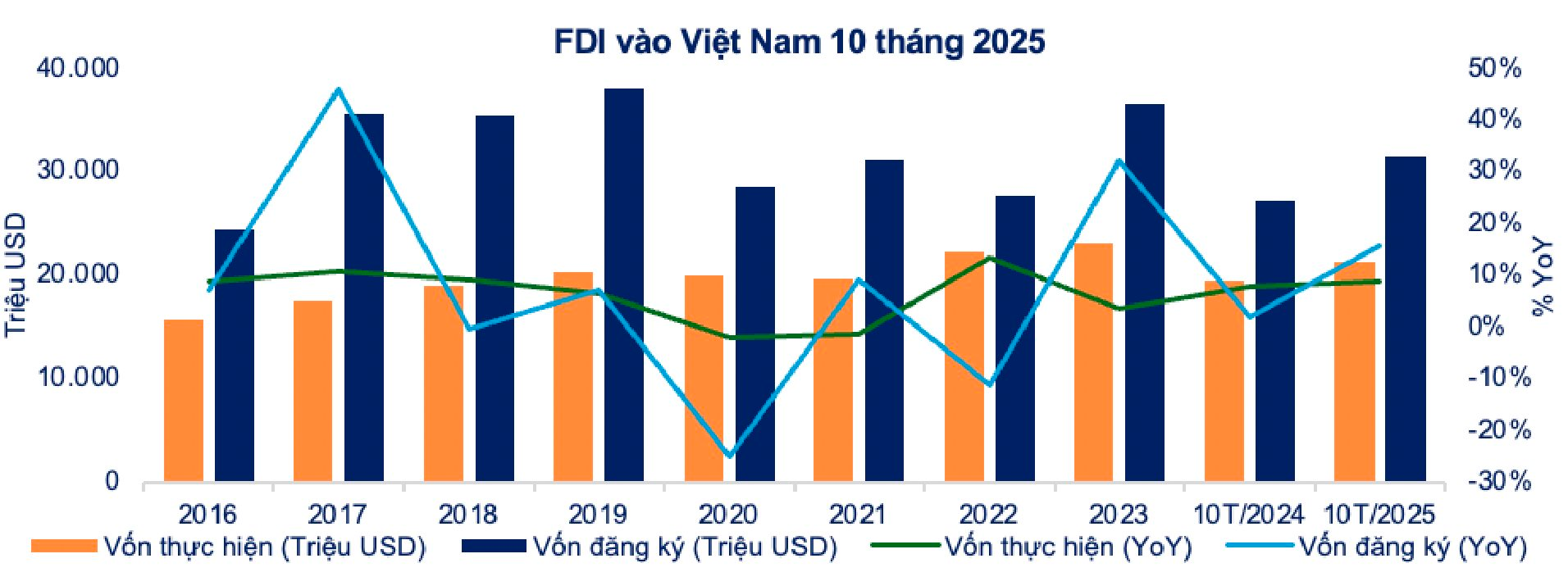

First, beneficiaries of public investment and supply chain restructuring: construction, industrial zones, logistics, and infrastructure. The National Assembly’s approval of a 9% increase in 2026 public investment, with ample debt capacity, supports continued infrastructure disbursement. Strong FDI and manufacturing shifts into Vietnam, particularly with new free trade zones and deep-sea ports, bolster prospects for maritime transport, logistics, and industrial zones. While this sector offers mid-term potential, stock selection should prioritize companies with clean land banks, healthy financials, and capacity expansion potential.

Second, real estate and banking: these sectors remain in focus but require high selectivity. Last week’s real estate rally was driven by positive project legal updates, debt restructuring, or strategic partnerships, while the sector overall is still “detoxifying” balance sheets. Experts predict highly polarized real estate performance, favoring developers with strong delivery records, existing project cash flows, and clear land titles. Despite heavy foreign selling, banks remain market pillars, trading at P/B ratios of 1.3–1.5 times, which is reasonable given stable asset quality and profit growth. However, a gradual recovery is expected, demanding patience.

Third, consumer-export and technology sectors: trade data shows rebounding exports to ASEAN and key markets, with agricultural, processed food, and wood products poised for margin improvements as input costs ease. Simultaneously, technology firms are benefiting from global investment in data infrastructure, AI, and data centers. Leading Vietnamese tech stocks demonstrate steady earnings growth, making them suitable for long-term investors seeking reasonable entry points rather than quick gains.

Gold Trading Floors Are Not Overnight Magic Wands for All Financial Equations

The State Bank is exploring the establishment of a gold trading platform in the near future. Experts anticipate this move will create a new marketplace, enabling businesses and individuals to trade gold more conveniently while narrowing the price gap between domestic and international gold markets.

Vietnam’s National Assembly Targets Over 10% GDP Growth in 2026, Aims for Per Capita GDP of $5,400–$5,500

This morning, during the 10th Session of the 15th National Assembly, the National Assembly voted to adopt the Resolution on the Socio-Economic Development Plan for 2026. With 429 out of 433 participating delegates (90.51%) voting in favor, the National Assembly officially approved the Resolution on the Socio-Economic Development Plan for 2026.

Vietnam: Asia’s Rising Star

Over the past five years, Vietnam’s economy has demonstrated remarkable resilience in the face of global shocks, consistently maintaining one of the highest growth rates in the world.