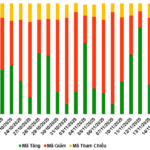

Last week, the VN-Index surged by 36.36 points to reach 1,635.46. However, trading volume on the HoSE averaged 713 million shares per session, a 17% decline compared to the previous week. The average transaction value stood at VND 21,183 billion per session, down by over 16%. Similarly, the HNX-Index rose by 7.5 points to 267.61.

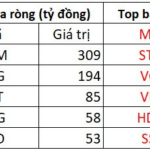

On the HoSE, foreign investors net-sold for five consecutive sessions, offloading 90.5 million units with a net value of over VND 2,289 billion. On the HNX, foreign investors net-sold more than 7.5 million units, valued at over VND 163 billion.

On the Upcom market, foreign investors net-sold 2.7 million units, with a net value of over VND 299 billion. Overall, during the trading week from November 10 to 14, foreign investors net-sold 100.88 million units across the market, totaling VND 2,752 billion.

Listing of 200 Million Shares

HoSE has received the listing application for 200 million RGG shares from Regal Group Joint Stock Company. Previously, Regal Group was approved for trading on Upcom starting October 30, with a reference price of VND 13,300 per share. Notably, despite a strong market price increase, the liquidity of RGG shares remains low, averaging less than 3,000 shares per session.

HoSE receives the listing application for 200 million RGG shares from Regal Group Joint Stock Company. Photo: RGG.

Before trading on Upcom, Regal Group completed the sale of 20 million shares to existing shareholders at VND 10,000 per share, increasing its charter capital from VND 1,800 billion to VND 2,000 billion.

Post-capital increase, Regal Group’s major shareholders include Dat Xanh Real Estate Service Joint Stock Company (stock code: DXS) with 55% ownership, Mr. Tran Ngoc Thanh holding 15%, Mr. Luong Tri Thin with 5.17%, and the remaining 24.83% held by minority shareholders.

Regal Group, originally Dat Xanh Mien Trung Joint Stock Company, was established in 2011 and rebranded as Regal Group in March 2023. Starting with a charter capital of VND 6 billion, Regal Group has undergone 15 consecutive capital increases over 14 years, reaching VND 2,000 billion—a 332-fold increase. This growth rate is among the fastest in the private real estate sector.

Dragon Capital funds recently sold an additional 1.35 million DXG shares of Dat Xanh Group Joint Stock Company (stock code: DXG), reducing their ownership to 9.88%. Specifically, Amersham Industries Limited sold 1 million shares, Vietnam Enterprise Investments Limited sold 1 million shares, Norges Bank purchased 500,000 shares, and Samsung Vietnam Securities Master Investment Trust (Equity) bought 150,000 shares.

Previously, on August 25, Dragon Capital sold 3.9 million DXG shares. On August 29, Dragon Capital-related funds sold 3.75 million DXG shares. On September 22, Dragon Capital sold 1.25 million DXG shares. On September 25, Dragon Capital sold an additional 2.2 million DXG shares. On October 14, Dragon Capital sold 1.3 million DXG shares. On October 17, Dragon Capital sold 6,058,634 DXG shares. On October 29, Dragon Capital sold another 1.8 million DXG shares.

Similarly, Dragon Capital funds sold 200,000 DGC shares of Duc Giang Chemicals Group Joint Stock Company (stock code: DGC), reducing their ownership to 4.98% and ceasing to be a major shareholder. Amersham Industries Limited sold 300,000 shares, while Norges Bank purchased 100,000 shares.

Masan Consumer Issues 238 Million Bonus Shares

Masan Consumer Joint Stock Company (stock code: MCH) has approved a written shareholder vote to issue shares from equity. Masan Consumer will issue bonus shares at a ratio of 1,000:225, meaning shareholders holding 1,000 shares on the record date will receive 225 new shares.

Masan Consumer will issue nearly 238 million bonus shares. Photo: MCH.

With over 1 billion outstanding shares, Masan Consumer plans to issue nearly 238 million bonus shares, increasing its post-issuance charter capital to VND 12,945 billion. The funding will come from undistributed profits of over VND 3,835 billion.

On November 5, HoSE announced receiving Masan Consumer’s initial listing application. With a charter capital of over VND 10,676 billion, Masan Consumer will list over 1 billion shares on HoSE. Vietcap Securities Joint Stock Company is the listing advisor.

Ms. Le Thi Vi Na sold 1,391,000 RYG shares of Royal Invest Joint Stock Company (stock code: RYG), reducing her ownership to 2.22%. Post-transaction, Ms. Vi Na is no longer a major shareholder of Royal Invest JSC.

Market Warrants Overview for the Week of November 17-21, 2025: A Mixed Performance

As the trading session closed on November 14, 2025, the market witnessed 121 stocks advancing, 139 declining, and 41 remaining unchanged. Foreign investors continued their net selling streak, offloading a total of 7.08 billion VND.

Surprise Powerhouse Injects Nearly $52 Million to Scoop Up Vietnamese Stocks in Final Week’s Session

Proprietary trading desks at securities companies unexpectedly turned net buyers on the Ho Chi Minh Stock Exchange (HOSE), scooping up a staggering VND 1.195 trillion worth of shares.