Sectors Trading Below Their 5-Year Average Valuations

In a newly released report, FiinGroup notes that the market-wide P/E ratio currently stands at 14.2 times, a 13.7% decline from its three-year peak of 16.5 times recorded in October 2025, when the VN-Index reached its historical high. This reduction is primarily due to a 10.3% drop in stock prices, while corporate profits rose by 7%. The banking sector, accounting for nearly 40% of the market’s total profits, is trading at a P/E of 9.8 times, significantly influencing overall valuation levels.

Meanwhile, the non-financial sector’s P/E ratio is at 19.2 times, nearing historical highs. However, excluding Vingroup and Gelex—two groups that have seen significant price increases—the remaining non-financial sector’s P/E drops to approximately 14.2 times, approaching the five-year low of 12.3 times, a level rarely seen since 2020.

This indicates that the non-financial sector only appears expensive before adjusting for these two stocks. Many other sectors remain attractively valued, particularly given their strong fundamentals and positive profit outlooks.

Compared to the five-year average, current valuations highlight a clear divergence among sectors. Real Estate, Food, and Information Technology (IT) are trading at P/E ratios above their five-year averages, despite limited short-term profit growth potential, increasing adjustment risks.

Banking and Securities sectors have P/E and P/B ratios near their five-year averages. However, banks are entering a profit plateau after peaking, while securities firms, being high beta, struggle to attract capital during market corrections.

In contrast, FiinGroup identifies cyclical sectors such as Construction, Oil & Gas Equipment, Textiles, Seafood, Chemicals, and Insurance as trading below their five-year averages. These sectors reported strong core profit growth in Q3, offering attractive potential for investors. The Steel sector, though trading above its five-year average P/E, is expected to improve valuations due to promising profit growth prospects.

Banking and Real Estate Valuations No Longer Undervalued

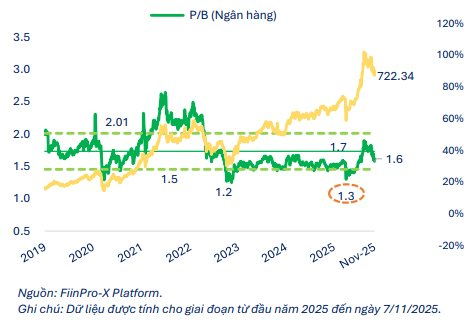

Focusing on the banking sector, the current P/B ratio is 1.6 times, down 20% from its three-year peak of 2.0 times in October 2025, returning to levels seen between late 2023 and mid-2025. Leading private banks (VPB, TCB, MBB) and smaller institutions (LPB, SHB, ABB) have seen significant P/B increases since the year’s start, driving substantial price gains.

Conversely, state-owned banks (BID, VCB, CTG) have experienced lower or declining valuations, resulting in less favorable stock performance despite rising book values. Unclear short-term profit prospects increase adjustment risks, especially for overheated stocks.

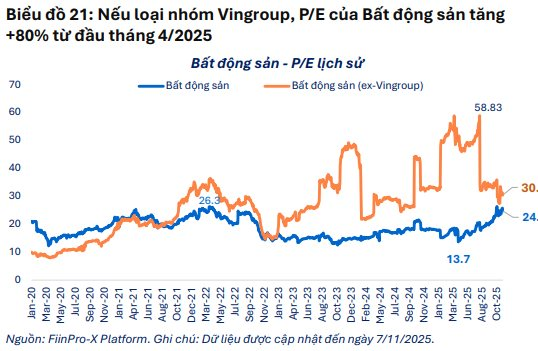

In the Real Estate sector, FiinGroup suggests that excluding Vingroup (VIC, VHM, VRE, VEF) provides a more accurate reflection of the industry’s actual profit landscape. The sector’s P/E has surged 80% since early April 2025, driving a remarkable 106.63% year-to-date price increase. Currently, the P/E for non-Vingroup real estate firms is 30.4 times, higher than the sector average of 24.7 times, largely due to low base profits and strong stock price recoveries.

This indicates that real estate valuations are no longer undervalued, despite anticipated profit recoveries in upcoming quarters. Short-term adjustment risks may rise as profits and cash flows remain unclear, while P/B ratios (1.7–2.4 times) approach two-year highs. Real estate stocks, highly volatile due to cash flow cycles and project progress, attract significant speculative capital, increasing risks during market liquidity downturns.