I. MARKET DYNAMICS OF WARRANT CERTIFICATES

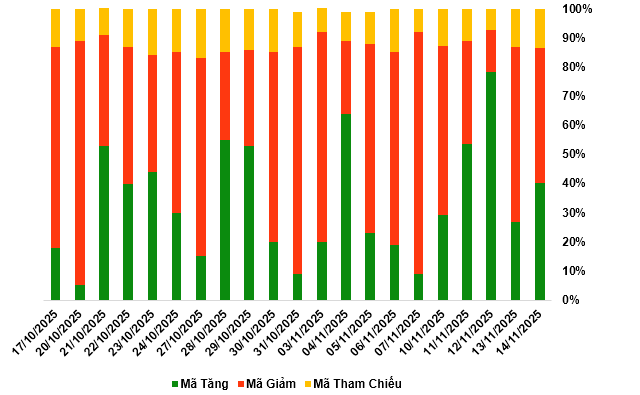

By the close of trading on November 14, 2025, the market recorded 121 gainers, 139 decliners, and 41 unchanged securities.

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

Source: VietstockFinance

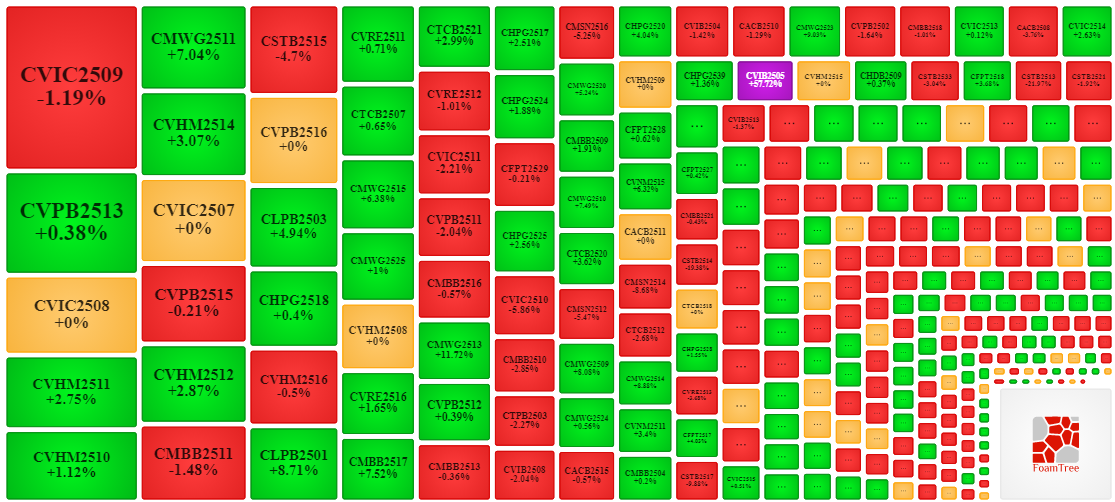

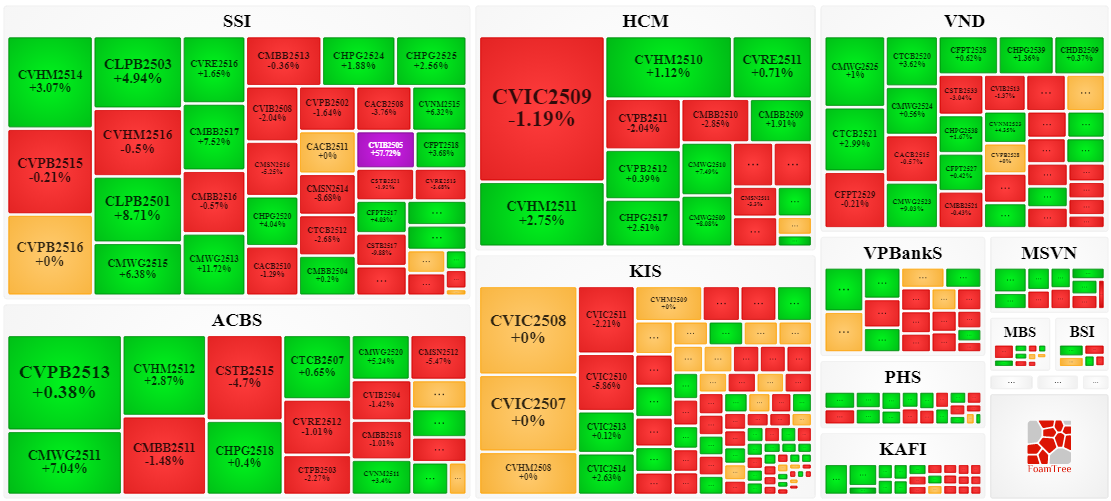

During the November 14, 2025 session, the market experienced significant divergence, with sellers maintaining control, leading to widespread declines in warrant prices. Notably, the top decliners included CVIC2509, CVPB2515, CMBB2511, and CSTB2515.

Source: VietstockFinance

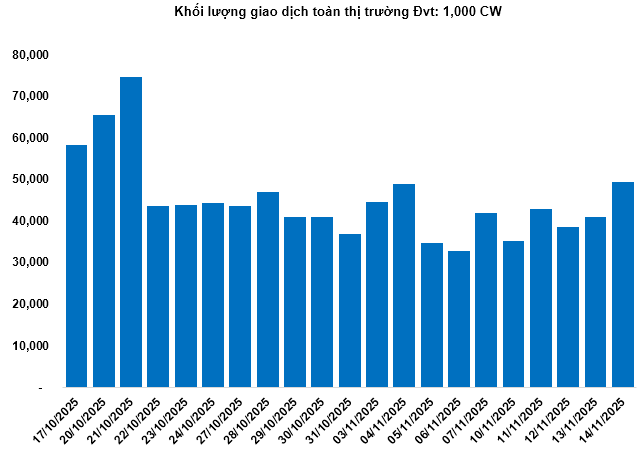

Total market volume on November 14 reached 49.41 million CW, up 20.33%; trading value hit 85.87 billion VND, a 23.61% increase from November 13. CSTB2528 led in volume with 2.92 million CW, while CVNM2511 topped trading value at 5.62 billion VND.

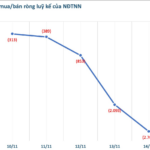

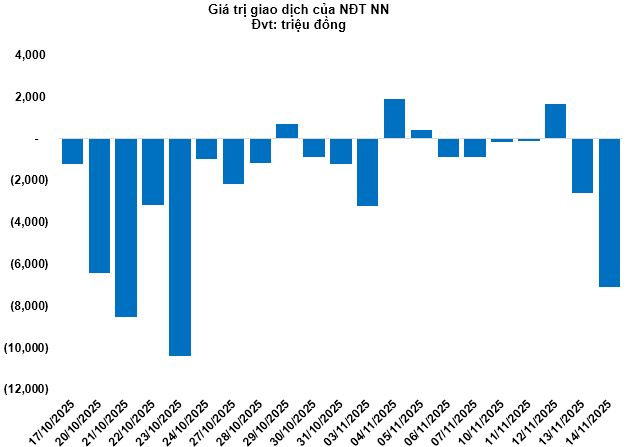

Foreign investors continued net selling on November 14, totaling 7.08 billion VND. CVNM2511 and CHPG2517 saw the highest net outflows. For the week, foreign net selling exceeded 8.33 billion VND.

Securities firms SSI, ACBS, KIS, and HCM are the leading issuers of warrant certificates in the market.

Source: VietstockFinance

II. MARKET STATISTICS

Source: VietstockFinance

III. WARRANT VALUATION

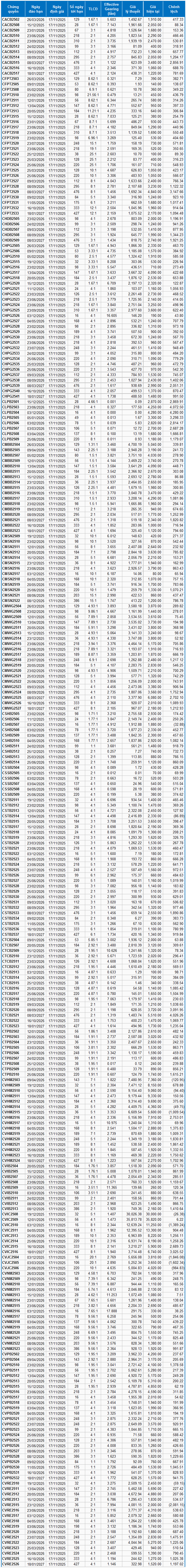

Based on the valuation method applicable from November 17, 2025, the fair prices of warrants currently trading are as follows:

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted for the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, adjusted for warrant maturity.

According to the valuation, CVRE2515 and CVJC2504 are the most attractively priced warrants.

Warrants with higher effective gearing exhibit greater volatility relative to their underlying securities. Currently, CVNM2516 and CHPG2526 have the highest effective gearing ratios in the market.

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 18:58 16/11/2025

Foreign Investors Continue Net Selling Streak, Offloading Nearly 700 Billion VND in Session 14/11, with Heavy Focus on a Banking Stock

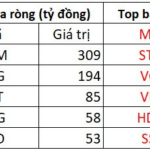

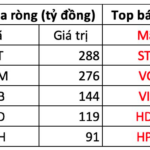

In the afternoon trading session, foreign investors aggressively accumulated VNM shares, making it the most heavily bought stock on the market with a total value of 309 billion VND.

Stock Market Week 10-14/11/2025: Balanced Supply and Demand, Market Polarization Persists

The VN-Index edged higher in the final session of the week, capping a notably positive recovery week following an extended period of adjustment. Amid balanced supply and demand dynamics, with investor participation remaining subdued, the market’s low-liquidity divergence is likely to persist. Next week, the VN-Index faces a critical test at the Middle line of the Bollinger Bands.